Region:Global

Author(s):Dev

Product Code:KRAA1631

Pages:84

Published On:August 2025

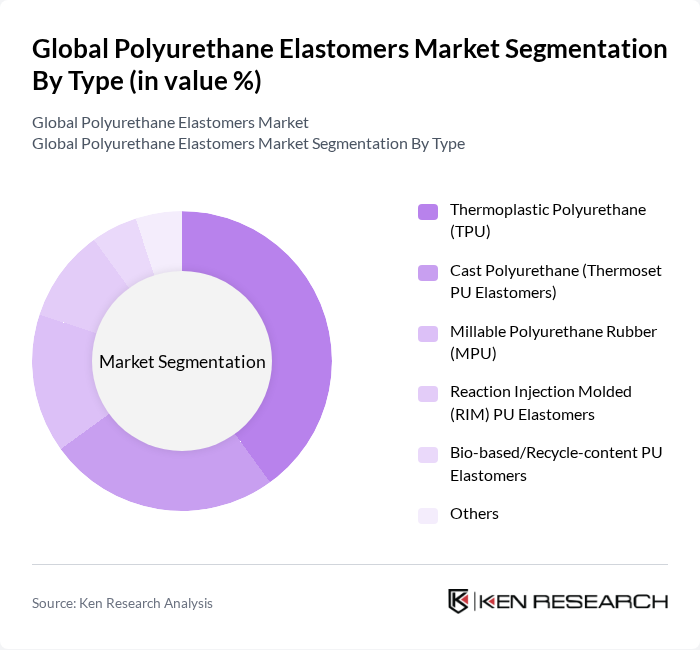

By Type:The polyurethane elastomers market is segmented into various types, including Thermoplastic Polyurethane (TPU), Cast Polyurethane (Thermoset PU Elastomers), Millable Polyurethane Rubber (MPU), Reaction Injection Molded (RIM) PU Elastomers, Bio-based/Recycle-content PU Elastomers, and Others. Among these, Thermoplastic Polyurethane (TPU) is the leading subsegment due to its excellent elasticity, durability, and abrasion resistance, with widespread use in automotive components, industrial wheels/rollers, footwear, and consumer goods; TPU has been cited as holding a leading share/value within PU elastomers in recent assessments .

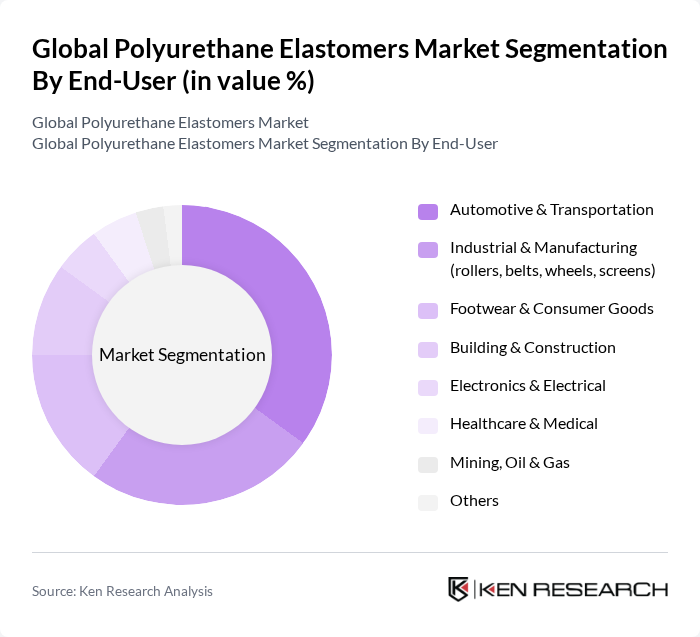

By End-User:The end-user segmentation of the polyurethane elastomers market includes Automotive & Transportation, Industrial & Manufacturing, Footwear & Consumer Goods, Building & Construction, Electronics & Electrical, Healthcare & Medical, Mining, Oil & Gas, and Others. The Automotive & Transportation sector is a leading end-user, supported by needs for lightweight, high-performance, and durable parts that improve efficiency and extend service life; EV and advanced mobility trends further increase demand for elastomeric components like bushings, seals, cable sheathing, and protective parts .

The Global Polyurethane Elastomers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Wanhua Chemical Group Co., Ltd., Mitsui Chemicals, Inc., Tosoh Corporation, The Lubrizol Corporation, LANXESS AG, Kuraray Co., Ltd., Coim Group (Coim S.p.A.), Carpenter Co., CoorsTek, Inc., Reckli GmbH, Coating & Converting Resources, Inc. (C.C.R.) contribute to innovation, geographic expansion, and service delivery in this space .

Notes on updates and validation

The future of the polyurethane elastomers market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in bio-based materials are expected to gain traction, aligning with global sustainability goals. Additionally, the integration of smart materials into products will enhance functionality and performance. As manufacturers adapt to changing consumer preferences and regulatory landscapes, the market is likely to witness significant growth opportunities, particularly in emerging economies where demand for advanced materials is rising.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermoplastic Polyurethane (TPU) Cast Polyurethane (Thermoset PU Elastomers) Millable Polyurethane Rubber (MPU) Reaction Injection Molded (RIM) PU Elastomers Bio-based/Recycle-content PU Elastomers Others |

| By End-User | Automotive & Transportation Industrial & Manufacturing (rollers, belts, wheels, screens) Footwear & Consumer Goods Building & Construction Electronics & Electrical Healthcare & Medical Mining, Oil & Gas Others |

| By Application | Wheels, Rollers, and Cast Parts Footwear Midsoles/Outsoles Automotive Components (bushings, suspension, NVH parts) Industrial Components (screens, liners, belts, seals) Adhesives, Sealants, and Coatings (PU elastomeric systems) Medical Tubing and Devices Wire & Cable Sheathing Others |

| By Processing Method | Injection Molding Extrusion Compression/Transfer Molding Casting D Printing/Additive Manufacturing Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Hardness/Performance Class | Soft (Shore A) Medium (Shore A–D) Hard (Shore D) High-performance (abrasion/tear/chemical resistant grades) |

| By Product Form | Pellets/Granules (TPU) Prepolymers/Systems (cast PU) Sheets/Rods/Profiles Finished Wheels/Rollers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Engineers, Procurement Managers |

| Footwear Manufacturing | 80 | Design Managers, Production Supervisors |

| Industrial Equipment | 70 | Maintenance Managers, Operations Directors |

| Construction Materials | 90 | Project Managers, Materials Engineers |

| Consumer Goods Applications | 75 | Product Development Managers, Marketing Directors |

The Global Polyurethane Elastomers Market is valued at approximately USD 20 billion, based on a five-year historical analysis. Recent studies indicate the market value aligns within the high teens to about twenty billion range, reflecting consistent industry assessments.