Region:Global

Author(s):Shubham

Product Code:KRAA1773

Pages:99

Published On:August 2025

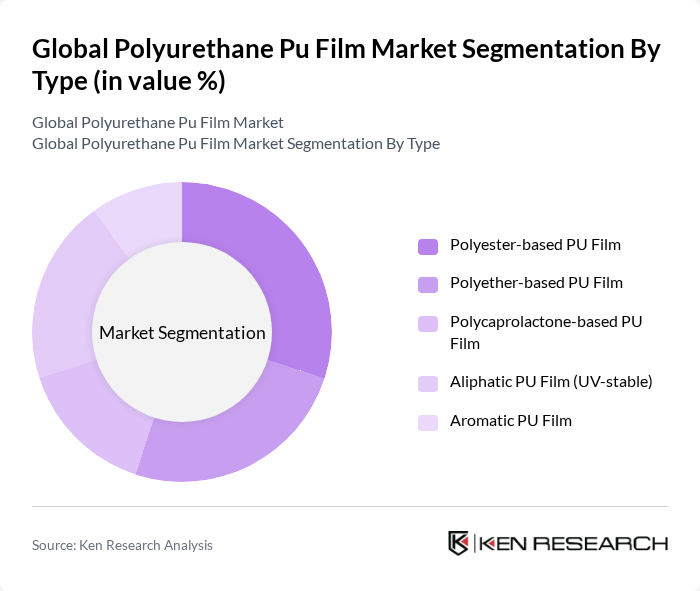

By Type:The market is segmented into various types of PU films, including polyester-based, polyether-based, polycaprolactone-based, aliphatic (UV-stable), and aromatic PU films. Each type serves different applications and industries, catering to specific performance requirements.

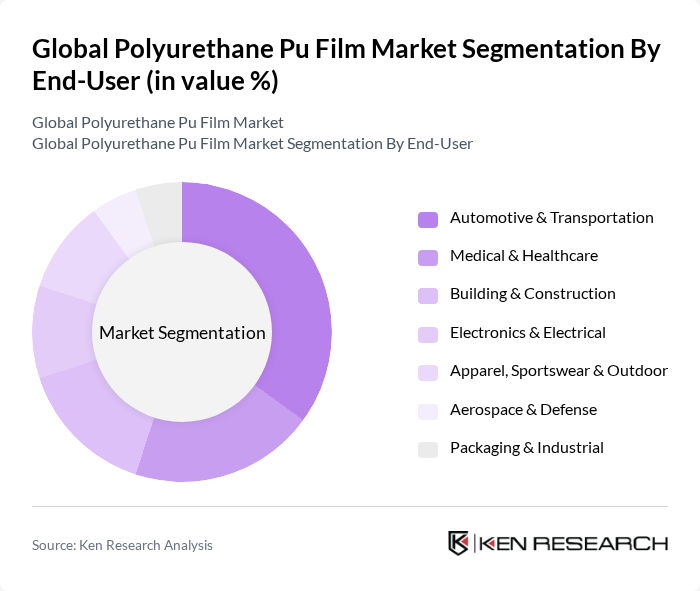

By End-User:The end-user segmentation includes automotive & transportation, medical & healthcare, building & construction, electronics & electrical, apparel, sportswear & outdoor, aerospace & defense, and packaging & industrial. Each sector utilizes PU films for their unique properties and applications, such as high abrasion resistance, optical clarity for PPF, biocompatibility and breathability for medical barriers, and hydrolysis resistance for outdoor gear.

The Global Polyurethane Pu Film Market is characterized by a dynamic mix of regional and international players. Leading participants such as Covestro AG, SWM International (a Scapa Healthcare company), DingZing Advanced Materials Inc., 3M Company, Avery Dennison Corporation, XPEL, Inc., BASF SE, Huntsman Corporation, Wanhua Chemical Group Co., Ltd., Mitsubishi Chemical Group Corporation, Lubrizol Corporation, Gerlinger Industries GmbH, Okura Industrial Co., Ltd., Permali Gloucester Ltd., American Polyfilm, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polyurethane film market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly prioritize eco-friendly materials, the demand for biodegradable polyurethane films is expected to rise. Additionally, the expansion of e-commerce is likely to enhance distribution channels, making these films more accessible. Companies that invest in innovative production techniques and sustainable materials will likely gain a competitive edge in this evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyester-based PU Film Polyether-based PU Film Polycaprolactone-based PU Film Aliphatic PU Film (UV-stable) Aromatic PU Film |

| By End-User | Automotive & Transportation Medical & Healthcare Building & Construction Electronics & Electrical Apparel, Sportswear & Outdoor Aerospace & Defense Packaging & Industrial |

| By Application | Paint Protection Film (PPF) and Surface Protection Medical Barrier & Wound Care Films Breathable Waterproof Membranes (lamination/garments) Adhesive/Transfer Films Inflatable & Sealing Films Electrical Insulation & Flexible Circuit Films Specialty Coating/Graphics and Industrial Films |

| By Distribution Channel | Direct Sales (OEMs and Tier-1s) Distributors/Converters Online/Inside Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Commodity-grade Mid-range Premium/High-performance |

| By Product Form | Cast Films Blown Films Laminates & Multilayer Rolls Sheets Custom Converted Shapes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive PU Film Applications | 120 | Product Engineers, Procurement Managers |

| Construction Industry Usage | 80 | Project Managers, Material Suppliers |

| Packaging Sector Insights | 90 | Packaging Designers, Operations Directors |

| Textile Industry Applications | 70 | Textile Engineers, Quality Control Managers |

| Consumer Goods Sector | 85 | Brand Managers, Supply Chain Analysts |

The Global Polyurethane PU Film Market is valued at approximately USD 1.8 billion, reflecting a significant growth trend driven by the demand for lightweight and durable materials across various industries, including automotive, healthcare, and construction.