Region:Global

Author(s):Geetanshi

Product Code:KRAA1292

Pages:96

Published On:August 2025

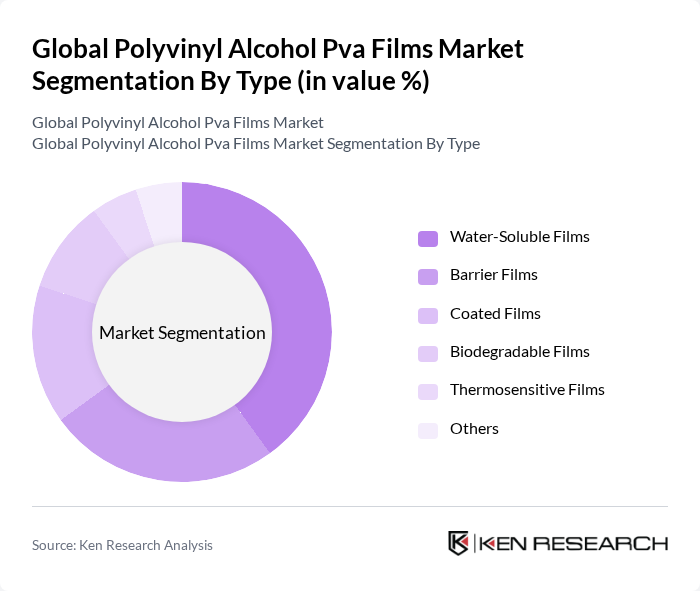

By Type:The PVA films market is segmented into Water-Soluble Films, Barrier Films, Coated Films, Biodegradable Films, Thermosensitive Films, and Others. Water-Soluble Films are gaining significant traction due to their extensive use in packaging applications, particularly for detergent pods and agricultural products. The demand for these films is driven by their convenience, water solubility, and environmental benefits, making them a preferred choice for manufacturers and consumers. PVA-based water-soluble films are especially dominant due to their superior performance and biodegradability in packaging and agricultural applications .

By Application:The applications of PVA films are diverse, including Packaging (Detergent Pods, Food Packaging, Agrochemical Packaging), Agriculture (Water-Soluble Pouches, Seed Tapes), Textile (Sizing Agents, Embroidery Films), Medical & Pharmaceutical (Unit Dose Packaging, Wound Dressings), Industrial (Construction, Electronics, Paper Processing), and Others. The Packaging segment is particularly dominant, driven by the increasing demand for convenient and sustainable packaging solutions in the consumer goods sector. Packaging applications account for the largest share, supported by the shift towards single-use and unit-dose packaging formats in household and industrial settings .

The Global Polyvinyl Alcohol Pva Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuraray Co., Ltd., Sekisui Chemical Co., Ltd., Mitsubishi Chemical Corporation, Chang Chun Petrochemical Co., Ltd., Anhui Wanwei Group Co., Ltd., Jilin Petrochemical Company (CNPC), Zhejiang Jianye Chemical Co., Ltd., Huzhou Shuanglin Hengxing Chemical Co., Ltd., Aicello Corporation, Kuraray Europe GmbH, Nippon Gohsei (The Nippon Synthetic Chemical Industry Co., Ltd.), Solvay S.A., Toppan Inc., Innovia Films Ltd., Bischof + Klein SE & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PVA films market appears promising, driven by increasing consumer awareness regarding sustainability and the need for innovative packaging solutions. As e-commerce continues to expand, the demand for eco-friendly packaging will likely rise, creating new opportunities for PVA films. Additionally, advancements in biodegradable film technologies are expected to enhance product offerings, making PVA films more competitive against traditional materials. The collaboration between manufacturers and research institutions will further accelerate innovation in this sector, ensuring a robust market presence.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-Soluble Films Barrier Films Coated Films Biodegradable Films Thermosensitive Films Others |

| By Application | Packaging (Detergent Pods, Food Packaging, Agrochemical Packaging) Agriculture (Water-Soluble Pouches, Seed Tapes) Textile (Sizing Agents, Embroidery Films) Medical & Pharmaceutical (Unit Dose Packaging, Wound Dressings) Industrial (Construction, Electronics, Paper Processing) Others |

| By End-User | Food and Beverage Pharmaceuticals & Healthcare Consumer Goods Agriculture Industrial & Manufacturing Others |

| By Sales Channel | Direct Sales Distributors/Wholesalers Online Retail Others |

| By Distribution Mode | B2B B2C Others |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| PVA Films in Packaging | 100 | Packaging Engineers, Product Managers |

| PVA Films in Textiles | 60 | Textile Manufacturers, R&D Specialists |

| PVA Films in Medical Applications | 40 | Medical Device Developers, Quality Assurance Managers |

| PVA Films in Agriculture | 50 | Agricultural Product Managers, Crop Scientists |

| PVA Films in Electronics | 50 | Electronics Engineers, Supply Chain Managers |

The Global Polyvinyl Alcohol (PVA) Films Market is valued at approximately USD 429 million, reflecting a significant growth trend driven by the demand for eco-friendly packaging solutions and diverse applications across various industries.