Region:Global

Author(s):Rebecca

Product Code:KRAD0185

Pages:80

Published On:August 2025

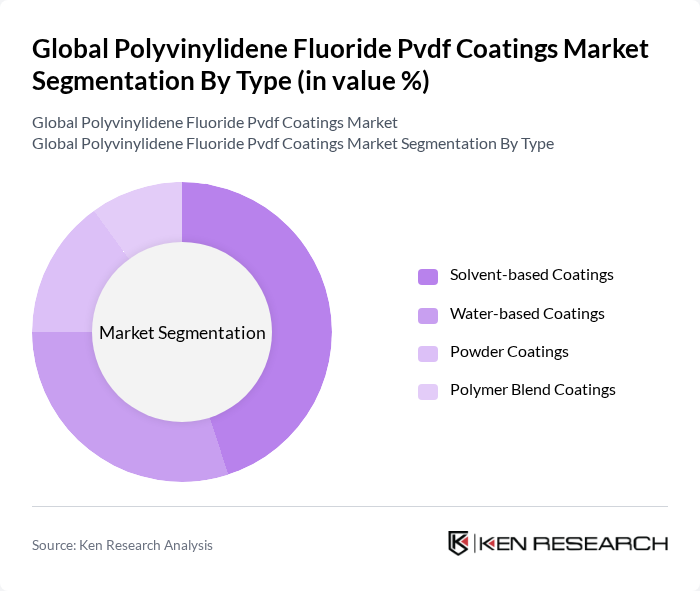

By Type:The market is segmented into four main types of coatings: Solvent-based Coatings, Water-based Coatings, Powder Coatings, and Polymer Blend Coatings. Solvent-based coatings have traditionally dominated the market due to their superior performance characteristics and ease of application. However, water-based coatings are gaining traction, driven by regulatory pressure for lower emissions and increasing demand for sustainable solutions. The powder coatings segment is also experiencing growth, supported by technological advancements and the push for eco-friendly alternatives in industrial and architectural applications.

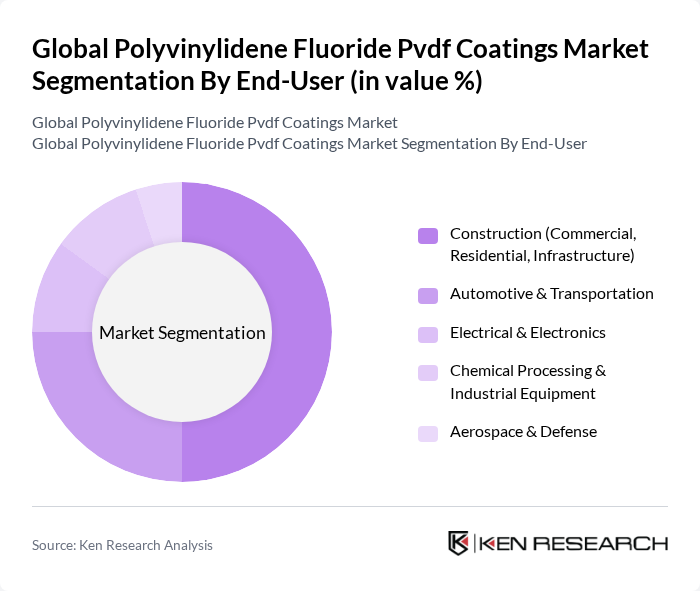

By End-User:The end-user segmentation includes Construction (Commercial, Residential, Infrastructure), Automotive & Transportation, Electrical & Electronics, Chemical Processing & Industrial Equipment, and Aerospace & Defense. The construction sector remains the largest end-user of PVDF coatings, driven by demand for durable, weather-resistant, and aesthetically appealing building materials. Automotive & transportation is a significant segment, with manufacturers seeking coatings that enhance vehicle longevity and performance. Electrical & electronics and chemical processing industries are also key users, leveraging PVDF’s chemical resistance and thermal stability for advanced applications.

The Global Polyvinylidene Fluoride Pvdf Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arkema S.A., Solvay S.A., 3M Company, The Chemours Company, Daikin Industries, Ltd., Dongyue Group Ltd., PPG Industries, Inc., Sherwin-Williams Company, BASF SE, AkzoNobel N.V., Nippon Paint Holdings Co., Ltd., RPM International Inc., Hempel A/S, Jotun A/S, Tnemec Company, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for PVDF coatings in None appears promising, driven by increasing investments in infrastructure and renewable energy projects. As governments prioritize sustainable practices, the demand for eco-friendly coatings is expected to rise. Additionally, the integration of smart technologies in coatings will likely enhance performance and functionality, attracting new customers. Overall, the market is poised for growth, with innovations and regulatory support playing crucial roles in shaping its trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Solvent-based Coatings Water-based Coatings Powder Coatings Polymer Blend Coatings |

| By End-User | Construction (Commercial, Residential, Infrastructure) Automotive & Transportation Electrical & Electronics Chemical Processing & Industrial Equipment Aerospace & Defense |

| By Application | Architectural Components (Roofs, Cladding, Facades) Protective Coatings (Pipes, Tanks, Valves) Wire & Cable Insulation Battery Components (Binders, Separators) Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Architectural Coatings | 60 | Architects, Project Managers |

| Automotive Applications | 50 | Manufacturing Engineers, Quality Control Managers |

| Aerospace Coatings | 40 | Materials Scientists, Aerospace Engineers |

| Industrial Coatings | 55 | Production Managers, Supply Chain Analysts |

| Consumer Goods Coatings | 45 | Product Development Managers, Marketing Directors |

The Global Polyvinylidene Fluoride (PVDF) Coatings Market is valued at approximately USD 1.8 billion, reflecting a significant demand for high-performance coatings across various industries, including construction, automotive, and electronics.