Region:Global

Author(s):Shubham

Product Code:KRAD0750

Pages:80

Published On:August 2025

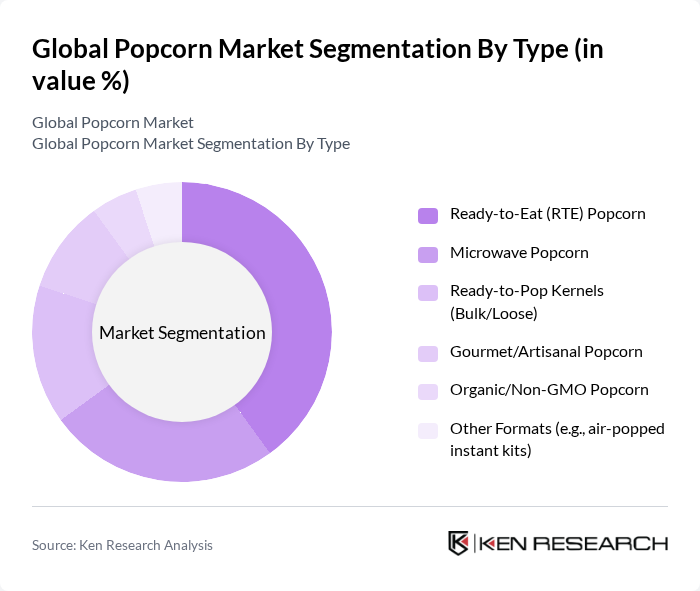

By Type:The popcorn market is segmented into various types, including Ready-to-Eat (RTE) Popcorn, Microwave Popcorn, Ready-to-Pop Kernels (Bulk/Loose), Gourmet/Artisanal Popcorn, Organic/Non-GMO Popcorn, and Other Formats (e.g., air-popped instant kits). Among these, Ready-to-Eat (RTE) Popcorn is the leading subsegment, driven by its convenience and the growing trend of on-the-go snacking. Consumers are increasingly opting for RTE popcorn due to its availability in various flavors and packaging options, making it a popular choice for both casual and formal occasions.

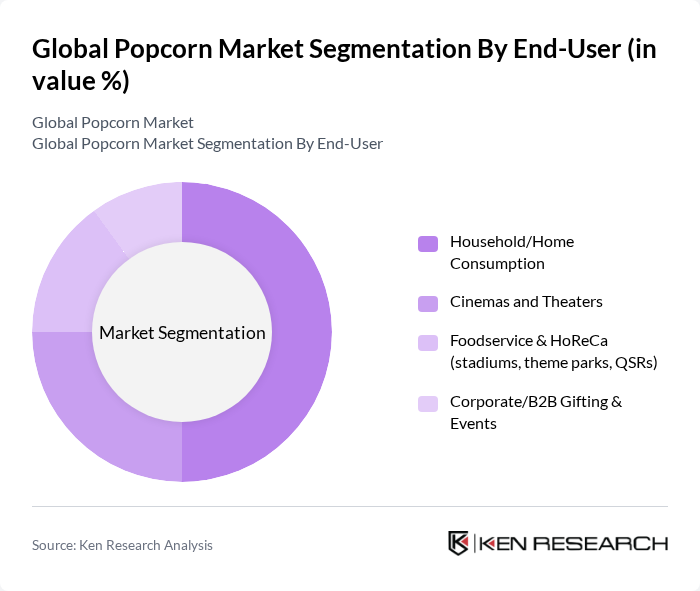

By End-User:The market is segmented by end-user into Household/Home Consumption, Cinemas and Theaters, Foodservice & HoReCa (stadiums, theme parks, QSRs), and Corporate/B2B Gifting & Events. The Household/Home Consumption segment is the largest, as more consumers are choosing to enjoy popcorn at home during movie nights or as a snack. This trend was accelerated by the COVID-19 period’s boost to at-home snacking, with sustained interest in convenient RTE products thereafter.

The Global Popcorn Market is characterized by a dynamic mix of regional and international players. Leading participants such as Conagra Brands, Inc. (Orville Redenbacher’s, ACT II), PepsiCo, Inc. (Smartfood, PopCorners), Weaver Popcorn Company, Inc., Amplify Snack Brands (Angie’s Boom Chicka Pop), Snyder’s-Lance, Inc. (Pop Secret), JOLLY TIME Pop Corn (American Pop Corn Company), The Popcorn Factory (1-800-FLOWERS.COM, Inc.), Garrett Popcorn Shops, LLC, Black Jewell Popcorn, Quinn Snacks, Inc., Proper Snacks Ltd. (PROPER Popcorn), Joe & Seph’s Gourmet Popcorn, Popcornopolis, LLC, Popcorn, Indiana, LLC, 4700BC Gourmet Popcorn (Instant Vending Machine Pvt. Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the popcorn market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to rise, brands are likely to focus on developing organic and non-GMO popcorn options. Additionally, the integration of gourmet flavors and unique culinary applications will attract a broader audience. The expansion into emerging markets, particularly in Asia-Pacific, will further enhance growth opportunities, as these regions increasingly adopt Western snacking habits and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Ready-to-Eat (RTE) Popcorn Microwave Popcorn Ready-to-Pop Kernels (Bulk/Loose) Gourmet/Artisanal Popcorn Organic/Non-GMO Popcorn Other Formats (e.g., air-popped instant kits) |

| By End-User | Household/Home Consumption Cinemas and Theaters Foodservice & HoReCa (stadiums, theme parks, QSRs) Corporate/B2B Gifting & Events |

| By Sales Channel | Supermarkets/Hypermarkets Convenience Stores Online (E-commerce & D2C) Specialty Stores & Gourmet Boutiques Other B2B (distributors, wholesalers) |

| By Packaging Type | Bags/Pouches Boxes/Cartons Tubs/Buckets Sachets/Multi-packs |

| By Flavor | Savory (butter, cheese, salted, spicy) Sweet (caramel, kettle corn, chocolate) Mixed/Combo (sweet & savory) |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Popcorn Sales | 120 | Store Managers, Category Buyers |

| Consumer Preferences for Flavors | 150 | Popcorn Consumers, Snack Enthusiasts |

| Distribution Channel Insights | 100 | Distributors, Wholesalers |

| Market Trends in Gourmet Popcorn | 80 | Product Developers, Marketing Managers |

| Health-Conscious Consumer Insights | 100 | Health-Conscious Consumers, Nutritionists |

The Global Popcorn Market is valued at approximately USD 33 billion, reflecting strong demand for snacks across various segments, including Ready-to-Eat (RTE), microwave, and kernels. This valuation is based on a five-year historical analysis of market trends.