Region:Global

Author(s):Shubham

Product Code:KRAC0661

Pages:81

Published On:August 2025

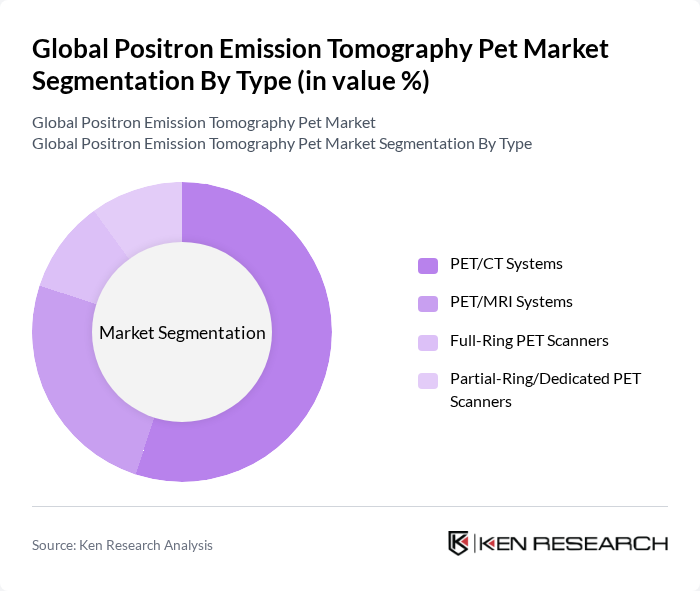

By Type:

The PET market is segmented into various types, including PET/CT Systems, PET/MRI Systems, Full-Ring PET Scanners, and Partial-Ring/Dedicated PET Scanners. Among these, PET/CT Systems dominate the market due to their widespread use in oncology for tumor detection and staging. The combination of anatomical and functional imaging provided by PET/CT enhances diagnostic accuracy, making it the preferred choice for healthcare providers. The increasing incidence of cancer and the need for precise imaging techniques further bolster the demand for PET/CT Systems .

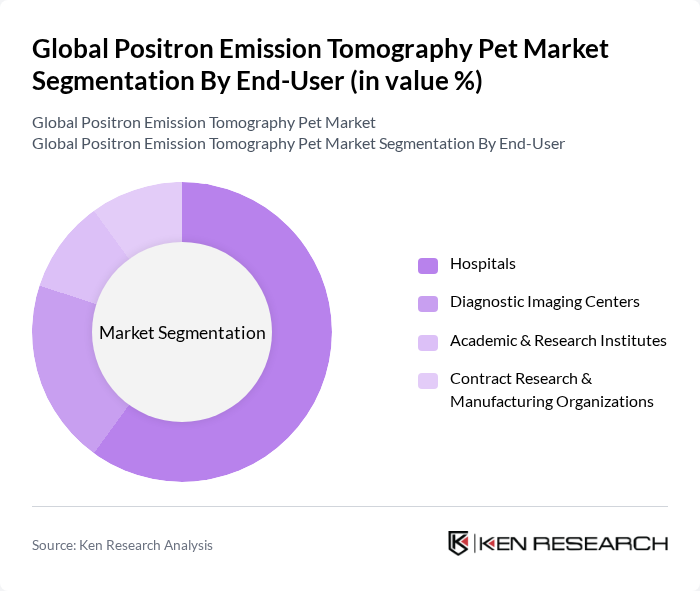

By End-User:

The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Academic & Research Institutes, and Contract Research & Manufacturing Organizations. Hospitals are the leading end-users, primarily due to their comprehensive healthcare services and the increasing number of patients requiring diagnostic imaging. The integration of PET technology in hospital settings facilitates timely diagnosis and treatment planning, which is crucial for patient outcomes. Additionally, the growing trend of outpatient services in hospitals is driving the demand for advanced imaging technologies .

The Global Positron Emission Tomography Pet Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE HealthCare, Philips, Canon Medical Systems, United Imaging Healthcare, Bracco Imaging, Lantheus Holdings, Cardinal Health, Eczac?ba??-Monrol, IBA (Ion Beam Applications), Advanced Accelerator Applications (AAA), a Novartis company, Avid Radiopharmaceuticals (Eli Lilly), SOFIE, Triad Isotopes, Curium contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PET market appears promising, driven by technological innovations and an increasing focus on personalized medicine. As healthcare systems evolve, the integration of artificial intelligence in imaging analysis is expected to enhance diagnostic accuracy and efficiency. Furthermore, the expansion of PET services in emerging markets will likely create new growth avenues, enabling broader access to advanced imaging technologies and improving patient outcomes across diverse populations.

| Segment | Sub-Segments |

|---|---|

| By Type | PET/CT Systems PET/MRI Systems Full-Ring PET Scanners Partial-Ring/Dedicated PET Scanners |

| By End-User | Hospitals Diagnostic Imaging Centers Academic & Research Institutes Contract Research & Manufacturing Organizations |

| By Application | Oncology Neurology Cardiology Infectious & Inflammatory Diseases |

| By Component | PET Scanners & Detectors Radiopharmaceuticals (FDG, Non-FDG, Novel Theranostics) Imaging & Reconstruction Software Services (Installation, Maintenance, Training) |

| By Sales Channel | Direct Sales (OEMs) Distributors/Value-Added Resellers Group Purchasing Organizations Online/Indirect |

| By Distribution Mode | Onsite Cyclotron & Radiopharmacy Centralized Radiopharmacy Networks Third-Party Logistics (Cold Chain) Hybrid Models |

| By Price Range | PET/CT (Entry to Mid-Tier) PET/CT (Premium) PET/MRI (Premium) Dedicated/Partial-Ring PET (Value) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology PET Imaging | 140 | Oncologists, Radiologists |

| Cardiology PET Applications | 100 | Cardiologists, Nuclear Medicine Technologists |

| Neurology PET Utilization | 80 | Neurologists, Clinical Researchers |

| Healthcare Facility Procurement | 120 | Procurement Managers, Hospital Administrators |

| Medical Imaging Equipment Manufacturers | 90 | Product Managers, Sales Directors |

The Global Positron Emission Tomography (PET) market is valued at approximately USD 1.3 billion, driven by advancements in imaging technology and the increasing prevalence of cancer and neurological disorders, which necessitate early diagnosis and treatment monitoring.