Region:Global

Author(s):Dev

Product Code:KRAD0545

Pages:96

Published On:August 2025

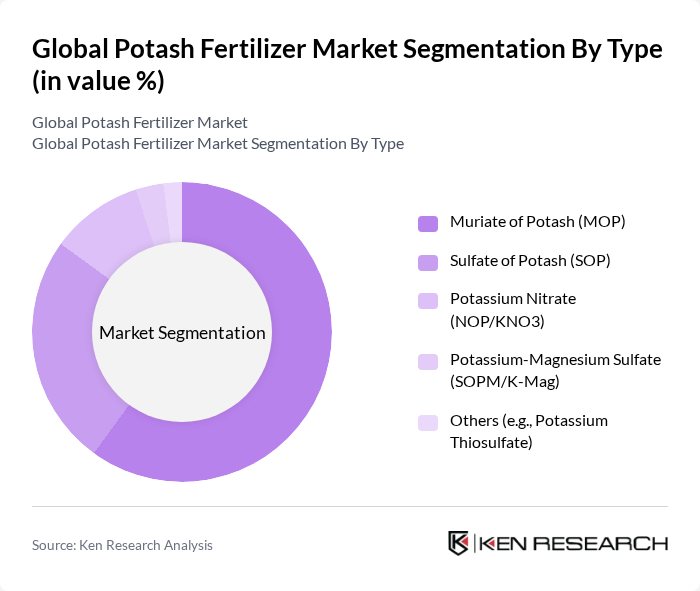

By Type:The potash fertilizer market is segmented into various types, including Muriate of Potash (MOP), Sulfate of Potash (SOP), Potassium Nitrate (NOP/KNO3), Potassium-Magnesium Sulfate (SOPM/K-Mag), and others such as Potassium Thiosulfate. Among these, MOP is the most widely used due to its high potassium content and cost-effectiveness, making it a preferred choice for many farmers. SOP is gaining traction for its additional sulfate benefits, particularly in chloride-sensitive and specialty crops.

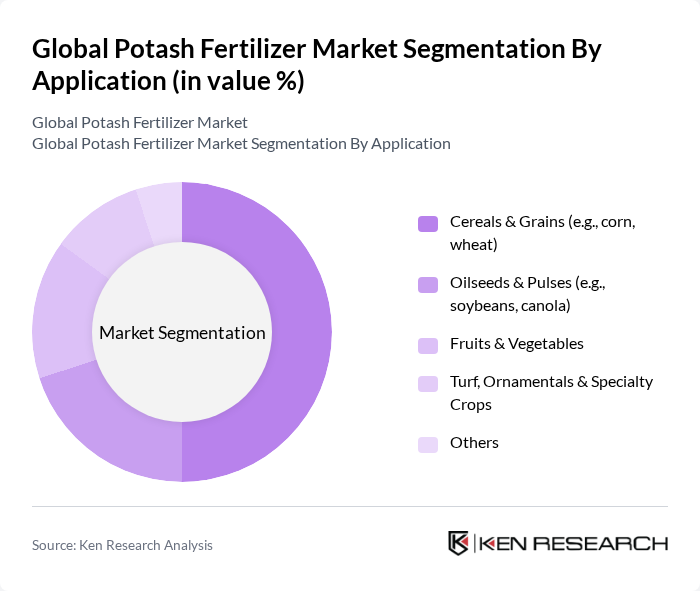

By Application:The applications of potash fertilizers are diverse, including cereals & grains, oilseeds & pulses, fruits & vegetables, turf, ornamentals & specialty crops, and others. The cereals & grains segment dominates due to the large planted area and high potassium requirements for crops like wheat, corn, and rice, with agriculture representing the vast majority of potash consumption globally.

The Global Potash Fertilizer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutrien Ltd., The Mosaic Company, K+S Aktiengesellschaft (K+S AG), ICL Group Ltd. (Israel Chemicals Ltd.), Uralkali PJSC, Belarusian Potash Company (BPC), EuroChem Group AG, Yara International ASA, Arab Potash Company, SQM S.A. (Sociedad Química y Minera de Chile), Intrepid Potash, Inc., Qinghai Salt Lake Industry Co., Ltd., Acron Group (JSC Acron), K+S Potash Canada, Sinofert Holdings Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the potash fertilizer market appears promising, driven by the increasing emphasis on sustainable agricultural practices and technological innovations. As farmers adopt precision agriculture techniques, the demand for controlled-release fertilizers is expected to rise significantly. Additionally, the expansion of organic farming will create new avenues for potash applications. With strategic partnerships and collaborations among industry players, the market is poised for growth, addressing both environmental concerns and the need for enhanced crop productivity.

| Segment | Sub-Segments |

|---|---|

| By Type | Muriate of Potash (MOP) Sulfate of Potash (SOP) Potassium Nitrate (NOP/KNO3) Potassium-Magnesium Sulfate (SOPM/K-Mag) Others (e.g., Potassium Thiosulfate) |

| By Application | Cereals & Grains (e.g., corn, wheat) Oilseeds & Pulses (e.g., soybeans, canola) Fruits & Vegetables Turf, Ornamentals & Specialty Crops Others |

| By End-User | Smallholder Farmers Large-Scale Commercial Farms & Plantations Agricultural Cooperatives & Farmer Producer Organizations Distributors & Blenders Others |

| By Distribution Channel | Direct Sales (Producers to Key Accounts) Dealer/Distributor Networks Retail/Agri-Input Stores Online/Marketplace Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Packaging Type | Bulk (Railcar, Truckload, Big Bags) Bagged (25–50 kg) Others (Specialty, Retail Packs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Nutrient Management | 120 | Agronomists, Crop Consultants |

| Fertilizer Distribution Channels | 90 | Distributors, Retail Managers |

| Farm-Level Potash Usage | 100 | Farmers, Agricultural Technicians |

| Regulatory Impact Assessment | 60 | Policy Makers, Agricultural Economists |

| Market Trends and Innovations | 80 | Industry Analysts, Research Scientists |

The Global Potash Fertilizer Market is valued at approximately USD 32 billion, driven by increasing food demand and the need for balanced nutrient application in agriculture, particularly potassium, which is essential for crop quality and yield.