Region:Global

Author(s):Dev

Product Code:KRAB0432

Pages:89

Published On:August 2025

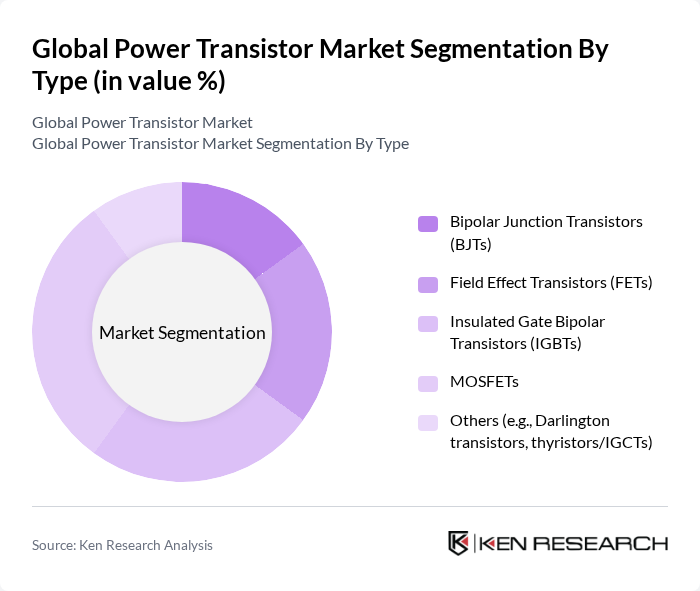

By Type:The power transistor market is segmented into various types, including Bipolar Junction Transistors (BJTs), Field Effect Transistors (FETs), Insulated Gate Bipolar Transistors (IGBTs), MOSFETs, and others such as Darlington transistors and thyristors. Among these, MOSFETs are the most dominant in high-volume switching applications due to their efficiency and switching speed across consumer, computing, and automotive electronics, while IGBTs and SiC MOSFETs are favored for high-voltage traction inverters and industrial drives.

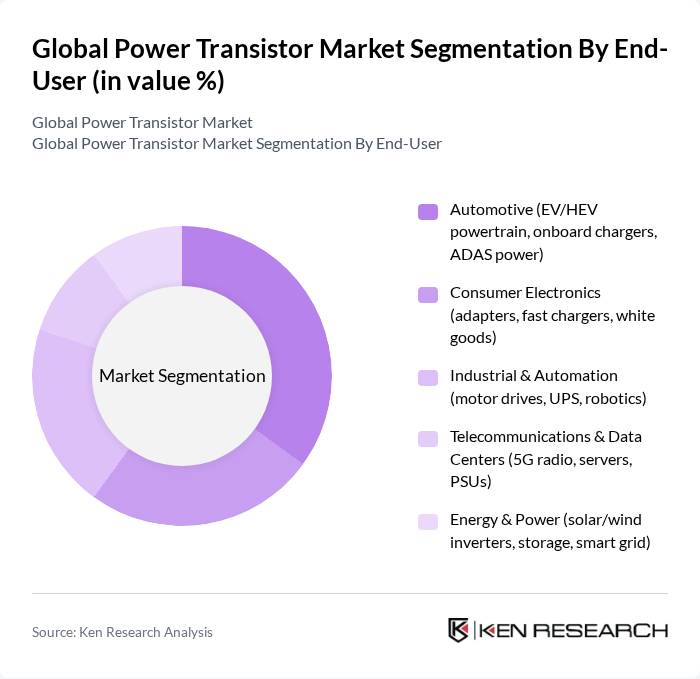

By End-User:The market is also segmented by end-user applications, including automotive, consumer electronics, industrial & automation, telecommunications & data centers, and energy & power. The automotive sector is currently the leading end-user, driven by the rapid growth of electric vehicles and the need for advanced power management systems. The increasing integration of power transistors in electric vehicle powertrains and onboard chargers is significantly contributing to the market's expansion in this segment.

The Global Power Transistor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Infineon Technologies AG, Texas Instruments Incorporated, onsemi (ON Semiconductor Corporation), STMicroelectronics N.V., NXP Semiconductors N.V., Mitsubishi Electric Corporation, Renesas Electronics Corporation, Analog Devices, Inc., Vishay Intertechnology, Inc., Broadcom Inc., Microchip Technology Incorporated, Wolfspeed, Inc. (formerly Cree, Inc.), ROHM Co., Ltd., Toshiba Electronic Devices & Storage Corporation, Fuji Electric Co., Ltd., Nexperia B.V., Power Integrations, Inc., Skyworks Solutions, Inc., Qorvo, Inc., Littelfuse, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the power transistor market appears promising, driven by technological advancements and increasing demand for energy-efficient solutions. As industries transition towards sustainable practices, the integration of smart technologies and renewable energy sources will further enhance the role of power transistors. Additionally, the ongoing development of electric vehicles and smart grids will create new applications, fostering innovation and growth in the sector. Companies that adapt to these trends will likely gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Bipolar Junction Transistors (BJTs) Field Effect Transistors (FETs) Insulated Gate Bipolar Transistors (IGBTs) MOSFETs Others (e.g., Darlington transistors, thyristors/IGCTs) |

| By End-User | Automotive (EV/HEV powertrain, onboard chargers, ADAS power) Consumer Electronics (adapters, fast chargers, white goods) Industrial & Automation (motor drives, UPS, robotics) Telecommunications & Data Centers (5G radio, servers, PSUs) Energy & Power (solar/wind inverters, storage, smart grid) |

| By Application | Power Conversion & Supply (AC-DC, DC-DC, inverters) Motor Control & Drives Renewable Energy & Energy Storage Systems Lighting & Power Management Traction & UPS |

| By Distribution Channel | Direct Sales (OEM/ODM) Distributors (broadline and specialty) Online (manufacturer and authorized e-commerce) |

| By Component | Power Modules (IGBT/Sic/GaN modules) Integrated Power ICs (gate drivers, PMICs with power FETs) Discrete Devices (MOSFETs, IGBTs, BJTs) |

| By Price Range | Low-End (commodity discretes) Mid-Range (enhanced performance) High-End (automotive/industrial-grade, WBG) |

| By Technology | Silicon (Si) Gallium Nitride (GaN) Silicon Carbide (SiC) Others (e.g., Ga2O3, SiGe, emerging materials) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Power Transistor Applications | 120 | Automotive Engineers, Product Development Managers |

| Consumer Electronics Market | 90 | Product Managers, Supply Chain Analysts |

| Industrial Power Systems | 80 | Operations Managers, Technical Directors |

| Renewable Energy Sector | 60 | Energy Engineers, Project Managers |

| Telecommunications Equipment | 100 | Network Engineers, Procurement Specialists |

The Global Power Transistor Market is valued at approximately USD 14.5 billion, driven by the increasing demand for energy-efficient devices, advancements in semiconductor technology, and the rising adoption of electric vehicles and renewable energy systems.