Region:Global

Author(s):Geetanshi

Product Code:KRAC0025

Pages:81

Published On:August 2025

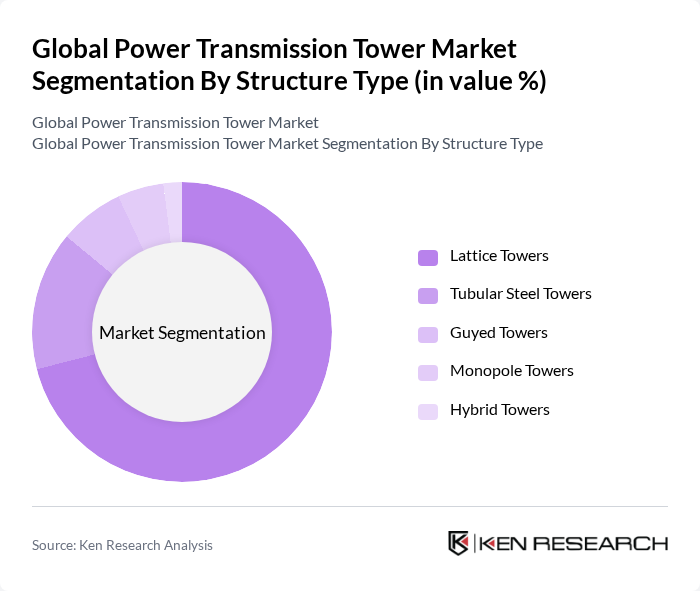

By Structure Type:The structure type segmentation includes various designs of power transmission towers, each serving specific needs based on geographical and environmental factors. Lattice towers are widely used due to their high strength-to-weight ratio, cost-effectiveness, and ability to support heavy conductors and withstand extreme weather. Tubular steel towers are gaining popularity for their aesthetic appeal, modular construction, and reduced wind resistance. Guyed towers are preferred in areas with limited space and for long-span applications, while monopole towers are increasingly used in urban settings for their minimal footprint and ease of installation. Hybrid towers combine features of different types to optimize performance and adapt to specific project requirements.

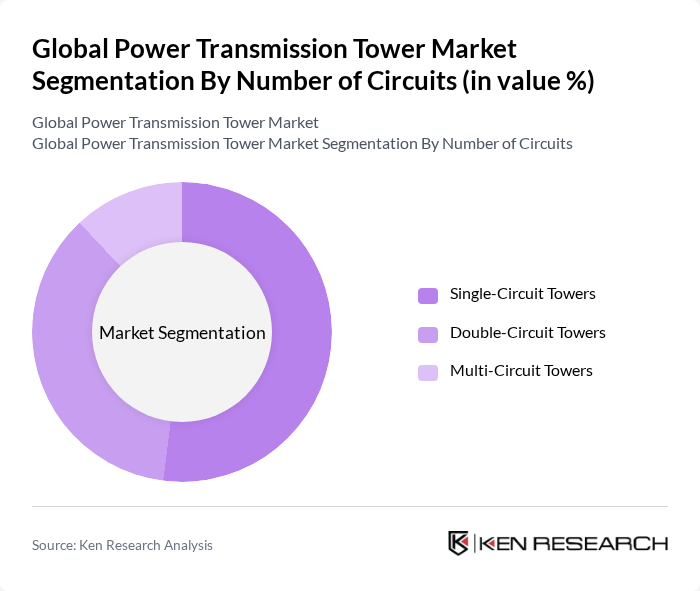

By Number of Circuits:The number of circuits in power transmission towers is crucial for determining their capacity and efficiency. Single-circuit towers are the most common due to their simplicity and lower costs, while double-circuit towers are increasingly favored for their ability to transmit more power without requiring additional land. Multi-circuit towers are less common but are used in high-demand areas where space is limited, allowing for greater efficiency in power distribution.

The Global Power Transmission Tower Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., General Electric Company, Schneider Electric SE, Nexans S.A., Prysmian Group, American Electric Power Company, Inc., Mitsubishi Electric Corporation, Hitachi, Ltd., Kalpataru Power Transmission Ltd., KEC International Ltd., Sterlite Power Transmission Limited, China Southern Power Grid Co., Ltd., State Grid Corporation of China, Terna S.p.A., TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the power transmission tower market in None is poised for transformation, driven by technological advancements and a shift towards sustainable energy solutions. As governments prioritize renewable energy integration, the demand for innovative tower designs and smart grid technologies will increase. Additionally, collaboration between public and private sectors is expected to enhance infrastructure development, ensuring that power transmission systems can meet the growing energy demands of urban populations while adhering to environmental standards.

| Segment | Sub-Segments |

|---|---|

| By Structure Type | Lattice Towers Tubular Steel Towers Guyed Towers Monopole Towers Hybrid Towers |

| By Number of Circuits | Single-Circuit Towers Double-Circuit Towers Multi-Circuit Towers |

| By Voltage Level | High Voltage (130kV–220kV) Extra-High Voltage (221kV–660kV) Ultra-High Voltage (Above 660kV) |

| By Application | Transmission Lines Distribution Lines Substation Support Crossings (River, Rail, etc.) |

| By Material | Steel Aluminum Composite Materials |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, UK, France, Italy, Russia, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA) |

| By Installation Type | New Installations Upgrades & Retrofits Maintenance & Replacement |

| By Financing Type | Public Funding Private Investment Joint Ventures & PPPs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High Voltage Transmission Projects | 100 | Project Managers, Electrical Engineers |

| Renewable Energy Integration | 90 | Renewable Energy Analysts, Utility Executives |

| Transmission Infrastructure Maintenance | 75 | Maintenance Supervisors, Operations Managers |

| Smart Grid Technologies | 60 | Technology Officers, Grid Operations Managers |

| International Power Transmission Standards | 45 | Regulatory Affairs Specialists, Compliance Managers |

The Global Power Transmission Tower Market is valued at approximately USD 15 billion, driven by increasing electricity demand, urbanization, and infrastructure upgrades, alongside investments in renewable energy and modernization of power grids.