Region:Global

Author(s):Shubham

Product Code:KRAD0642

Pages:88

Published On:August 2025

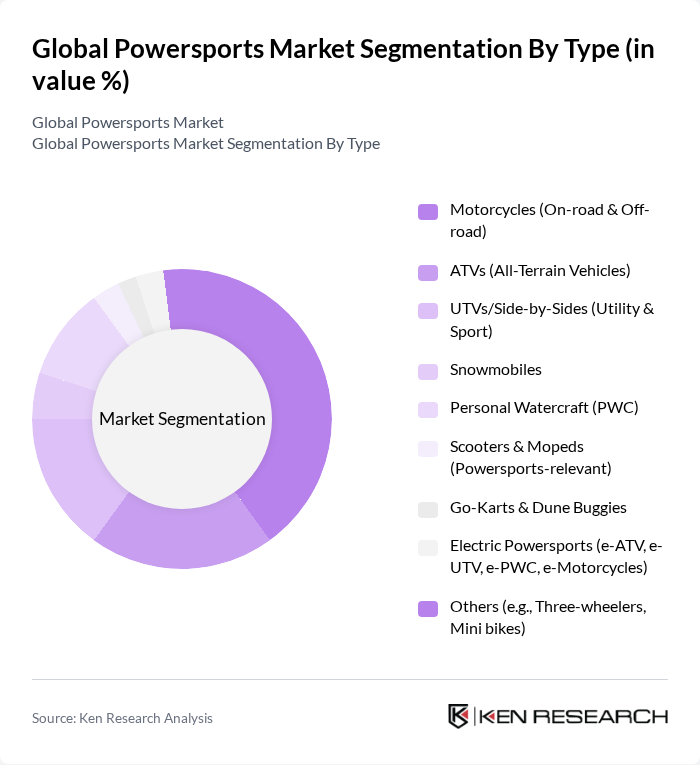

By Type:The powersports market is segmented into various types, including motorcycles, ATVs, UTVs, snowmobiles, personal watercraft, scooters, go-karts, electric powersports, and others. Among these, motorcycles and all-terrain/side-by-side categories collectively form the largest volume, with ATVs/UTVs holding the leading share in many markets by value due to higher average selling prices. Off-road motorcycles remain significant for recreation and sport, supported by adventure and trail-riding trends, while UTVs/side-by-sides have expanded rapidly in both recreational and utility applications .

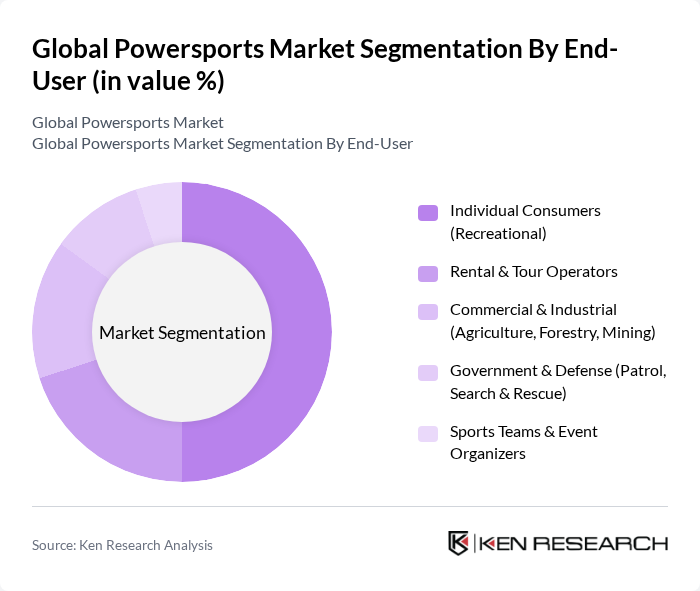

By End-User:The end-user segmentation includes individual consumers, rental and tour operators, commercial and industrial users, government and defense, and sports teams. Individual consumers, particularly those engaged in recreational activities, represent the largest segment. Growth is reinforced by outdoor recreation participation, while rental/tour operators and subscription models are gaining traction as alternative access channels, especially in tourism-oriented markets .

The Global Powersports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Polaris Inc., Yamaha Motor Co., Ltd., Honda Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., BRP Inc. (Bombardier Recreational Products), Suzuki Motor Corporation, KTM AG, Husqvarna Motorcycles GmbH, Triumph Motorcycles Ltd, Ducati Motor Holding S.p.A., BMW Motorrad (BMW AG), CFMoto (Zhejiang CFMoto Power Co., Ltd.), Hisun Motors, Textron Inc. (Arctic Cat), Segway Powersports (Ninebot Group), SANY Motor (Shanyang Motor) – Benelli QJ Motor Group, Rieju S.A., Beta Motor S.p.A., GasGas (Pierer Mobility AG), OSET Bikes Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the powersports market appears promising, driven by increasing consumer interest in adventure tourism and a shift towards eco-friendly vehicle options. As more consumers prioritize sustainability, manufacturers are likely to invest in electric and hybrid technologies, enhancing their product offerings. Additionally, the rise of online sales channels is expected to facilitate easier access to powersport vehicles, further expanding the market. These trends indicate a dynamic landscape that will evolve in response to consumer preferences and regulatory changes.

| Segment | Sub-Segments |

|---|---|

| By Type | Motorcycles (On-road & Off-road) ATVs (All-Terrain Vehicles) UTVs/Side-by-Sides (Utility & Sport) Snowmobiles Personal Watercraft (PWC) Scooters & Mopeds (Powersports-relevant) Go-Karts & Dune Buggies Electric Powersports (e-ATV, e-UTV, e-PWC, e-Motorcycles) Others (e.g., Three-wheelers, Mini bikes) |

| By End-User | Individual Consumers (Recreational) Rental & Tour Operators Commercial & Industrial (Agriculture, Forestry, Mining) Government & Defense (Patrol, Search & Rescue) Sports Teams & Event Organizers |

| By Sales Channel | Franchised Dealerships Independent Dealers Online Direct-to-Consumer Distributors & Importers Rental/Subscription Platforms |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry/Budget Mid-Range Premium Ultra-Premium/Performance |

| By Vehicle Size/Displacement | Small (?300cc or equivalent) Medium (301–800cc or equivalent) Large (?801cc or equivalent) |

| By Usage Type | Recreational Competitive/Racing Utility/Work Marine/Water Recreation Snow/Arctic Mobility |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Motorcycle Retail Market | 150 | Dealership Owners, Sales Managers |

| ATV and UTV Market | 100 | Product Managers, Marketing Directors |

| Personal Watercraft Sales | 80 | Retail Managers, Customer Experience Specialists |

| Aftermarket Parts and Accessories | 70 | Supply Chain Managers, Procurement Officers |

| Powersports Financing and Insurance | 90 | Financial Advisors, Insurance Brokers |

The Global Powersports Market is valued at approximately USD 40 billion, reflecting a significant increase driven by sustained demand for ATVs, UTVs, motorcycles, snowmobiles, and personal watercrafts, alongside rising consumer interest in recreational activities and advancements in technology.