Global Pre Workout Supplements Market Overview

- The Global Pre Workout Supplements Market is valued at USD 20 billion, based on a five?year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, the rise in fitness activities, and the growing popularity of sports nutrition products. The demand for pre-workout supplements has surged as individuals seek to enhance their workout performance and overall fitness levels. Additional growth drivers include the proliferation of fitness centers and gyms, expansion of online retail channels, and the adoption of home workout routines, which have broadened consumer access and awareness of pre-workout products .

- Key players in this market are predominantly located in North America and Europe, with the United States being a significant contributor due to its established fitness culture and high disposable income. Additionally, countries like Canada and the UK are also notable for their growing health and wellness trends, which further bolster the market's expansion. North America accounts for the largest market share, supported by a robust network of gyms, fitness influencers, and a strong e-commerce presence .

- In 2023, theDietary Supplement Labeling Act, 2023issued by the U.S. Food and Drug Administration (FDA) mandated that pre-workout supplement manufacturers disclose all ingredients and their respective dosages on product labels. This regulation aims to enhance consumer safety and transparency, ensuring that users are fully informed about the products they consume. The Act covers all dietary supplements sold in the United States, requiring clear labeling, ingredient transparency, and compliance with established safety thresholds .

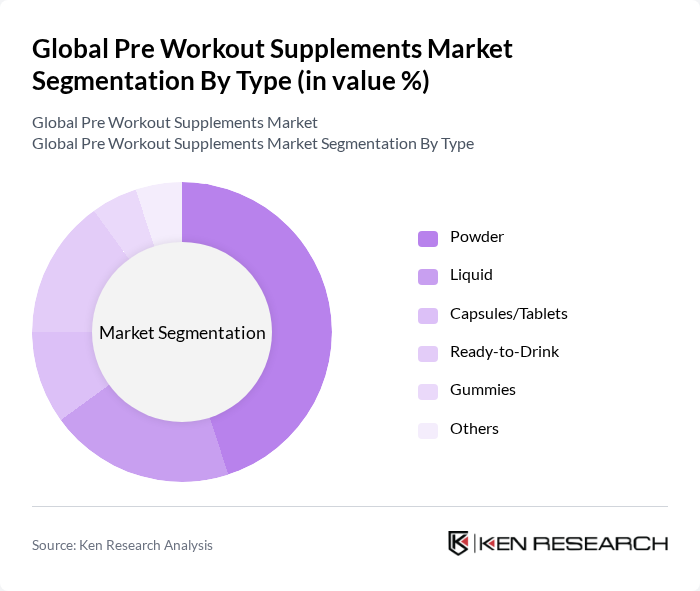

Global Pre Workout Supplements Market Segmentation

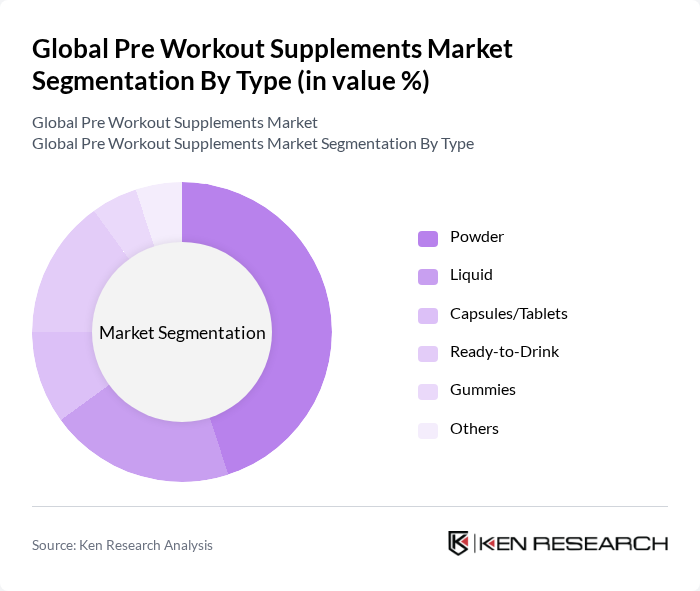

By Type:The market is segmented into various types of pre-workout supplements, including Powder, Liquid, Capsules/Tablets, Ready-to-Drink, Gummies, and Others. Among these, thePowdersegment is the most dominant due to its versatility, ease of use, and cost-effectiveness. Consumers prefer powdered supplements as they can be easily mixed with water or other beverages, allowing for customizable dosages. The Ready-to-Drink segment is also gaining traction, particularly among on-the-go consumers seeking convenience. Powdered forms account for a substantial majority of the market share, reflecting consumer preference for customization and value .

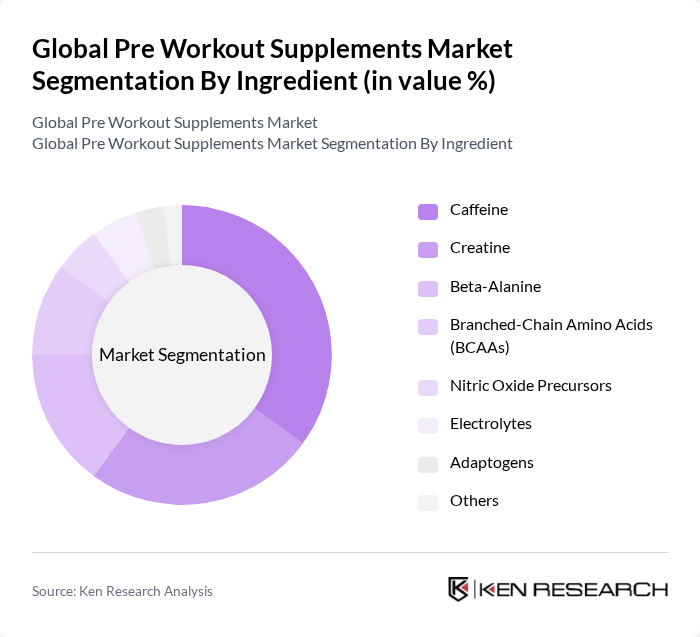

By Ingredient:The market is further segmented by key ingredients, including Caffeine, Creatine, Beta-Alanine, Branched-Chain Amino Acids (BCAAs), Nitric Oxide Precursors, Electrolytes, Adaptogens, and Others.Caffeineremains the leading ingredient due to its well-known efficacy in enhancing energy levels and focus during workouts. Creatine and Beta-Alanine are also popular among athletes and fitness enthusiasts for their performance-boosting properties, contributing significantly to the market's growth. The trend toward clean-label and natural ingredients is also influencing product development, with some brands incorporating adaptogens and plant-based components .

Global Pre Workout Supplements Market Competitive Landscape

The Global Pre Workout Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Optimum Nutrition (Glanbia plc), BSN (Bio-Engineered Supplements and Nutrition, Inc.), MusclePharm Corporation, Cellucor (Nutrabolt), Redcon1, GNC Holdings, LLC, Evlution Nutrition, JYM Supplement Science, Kaged, ProMix Nutrition, RSP Nutrition, Quest Nutrition (The Simply Good Foods Company), BPI Sports, Alani Nu, NutraBio Labs, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Pre Workout Supplements Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Fitness and Health:The global fitness industry is projected to reach $96 billion in future, driven by a surge in health consciousness among consumers. This trend is reflected in the rising number of gym memberships, which reached 210 million worldwide in future. As individuals prioritize health and fitness, the demand for pre-workout supplements, which enhance performance and energy, is expected to grow significantly, with an estimated increase of 15 million users annually.

- Rising Demand for Energy-Boosting Supplements:The global energy supplement market is anticipated to exceed $20 billion in future, fueled by consumers seeking enhanced physical performance. This demand is particularly pronounced among athletes and fitness enthusiasts, with over 40% of gym-goers reporting the use of energy supplements. The increasing prevalence of high-intensity workouts further drives the need for effective pre-workout solutions, leading to a projected annual growth of 10% in this segment.

- Growth of the Fitness Industry and Gym Culture:The fitness industry is experiencing robust growth, with the number of fitness clubs increasing by 3% annually, reaching approximately 210,000 facilities globally in future. This expansion is accompanied by a growing gym culture, particularly in urban areas, where over 60% of adults engage in regular exercise. As more individuals join gyms, the demand for pre-workout supplements is expected to rise, with an estimated 25% of gym members incorporating these products into their routines in future.

Market Challenges

- Regulatory Hurdles and Compliance Issues:The pre-workout supplement market faces significant regulatory challenges, particularly in regions with stringent dietary supplement regulations. For instance, the FDA has increased scrutiny on supplement ingredients, leading to a 30% rise in compliance costs for manufacturers. This regulatory environment can hinder product innovation and market entry, posing a challenge for companies looking to expand their offerings in a competitive landscape.

- Consumer Skepticism Regarding Supplement Efficacy:Despite the growing popularity of pre-workout supplements, consumer skepticism remains a significant barrier. Approximately 35% of consumers express doubts about the effectiveness of these products, often due to a lack of scientific evidence supporting health claims. This skepticism can lead to reduced sales and hinder market growth, as companies must invest in education and marketing to build trust and credibility among potential customers.

Global Pre Workout Supplements Market Future Outlook

The future of the pre-workout supplements market appears promising, driven by evolving consumer preferences and technological advancements. As the trend towards plant-based and clean-label products continues to gain traction, companies are likely to innovate their formulations to meet these demands. Additionally, the rise of e-commerce platforms is expected to enhance accessibility, allowing consumers to purchase supplements conveniently. This shift will likely lead to increased market penetration and a broader consumer base, fostering sustained growth in the coming years.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for pre-workout supplements. With a combined population exceeding 4 billion and increasing disposable incomes, these regions are witnessing a surge in fitness awareness. Companies can capitalize on this trend by tailoring products to local preferences, potentially increasing market share by 20% in these regions in future.

- Development of Clean-Label and Organic Products:The demand for clean-label and organic supplements is on the rise, with consumers increasingly seeking transparency in ingredient sourcing. In future, the organic supplement market is projected to reach $15 billion, driven by health-conscious consumers. Companies that prioritize clean formulations and sustainable practices can differentiate themselves, tapping into a lucrative segment that is expected to grow by 25% annually.