Region:Global

Author(s):Shubham

Product Code:KRAA2258

Pages:91

Published On:August 2025

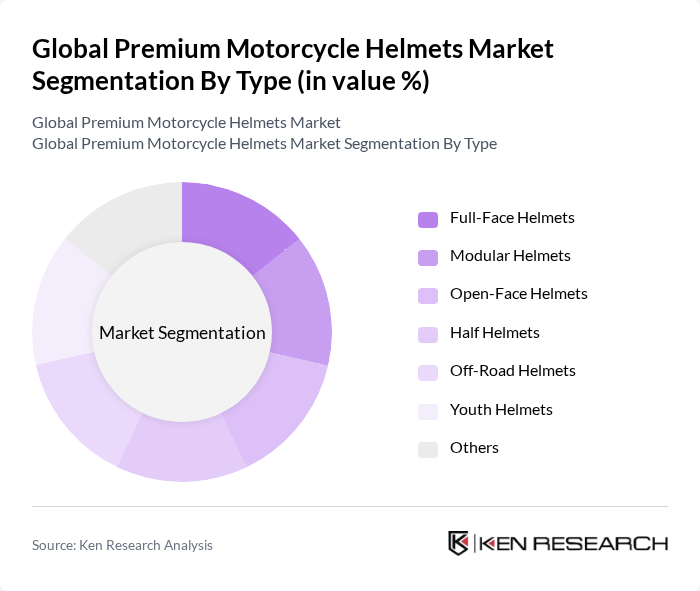

By Type:The market is segmented into various types of helmets, including Full-Face Helmets, Modular Helmets, Open-Face Helmets, Half Helmets, Off-Road Helmets, Youth Helmets, and Others. Among these, Full-Face Helmets dominate the market due to their comprehensive protection and popularity among both casual and professional riders. The increasing awareness of safety, regulatory changes, and the growing trend of high-speed biking contribute to the preference for this type of helmet. Modular Helmets also see significant demand as they offer versatility and comfort, appealing to a wide range of consumers .

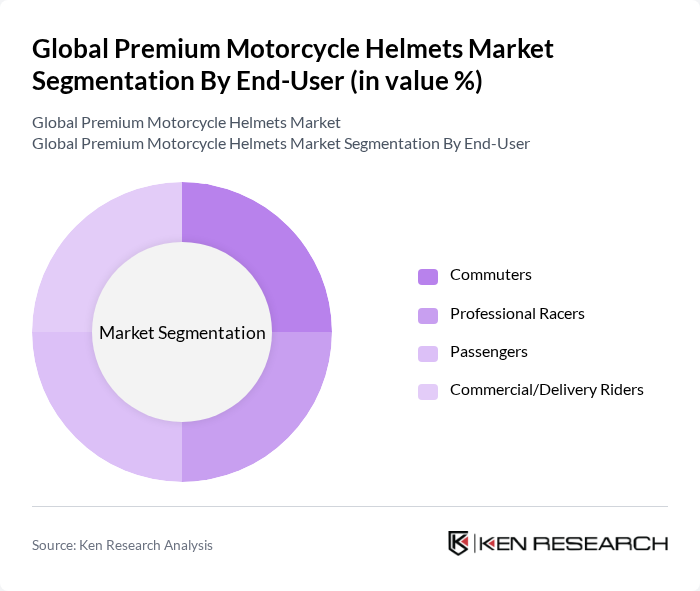

By End-User:The end-user segmentation includes Commuters, Professional Racers, Passengers, and Commercial/Delivery Riders. Commuters represent the largest segment, driven by the increasing use of motorcycles for daily transportation in urban areas. The rise in fuel prices, traffic congestion, and the growing adoption of motorcycles for last-mile delivery services have led many to opt for motorcycles, thereby boosting the demand for premium helmets. Professional Racers also contribute significantly to the market, as they require high-performance helmets that meet rigorous safety standards .

The Global Premium Motorcycle Helmets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shoei Co., Ltd., Arai Helmet Ltd., Bell Helmets (Bell Sports Inc.), HJC Helmets, AGV (subsidiary of Dainese S.p.A.), Schuberth GmbH, Nolan Group S.p.A., Icon Motosports (Parts Unlimited/LeMans Corporation), LS2 Helmets (Tech Design Team S.L.), Shark Helmets (Shark SAS), Biltwell Inc., O'Neal (O'Neal USA), Fly Racing (Western Power Sports, Inc.), ScorpionExo (KIDO Sports Co., Ltd.), AFX North America Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the premium motorcycle helmet market appears promising, driven by increasing safety awareness and technological advancements. As disposable incomes rise, particularly in emerging markets, the demand for high-quality helmets is expected to grow. Additionally, the trend towards eco-friendly materials and smart technology integration will likely shape product offerings. Manufacturers who adapt to these trends and focus on innovation will be well-positioned to capture market share and meet evolving consumer preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Face Helmets Modular Helmets Open-Face Helmets Half Helmets Off-Road Helmets Youth Helmets Others |

| By End-User | Commuters Professional Racers Passengers Commercial/Delivery Riders |

| By Distribution Channel | Online Retail Motorcycle Showrooms Helmet Manufacturer Showrooms Aftermarket Retailers |

| By Price Range | Premium Mid-Range Budget |

| By Brand | Established Brands Emerging Brands Private Labels |

| By Material | Fiberglass Carbon Fiber Plastics (including Polycarbonate, ABS) Others |

| By Certification Standard | DOT Certified ECE Certified Snell Certified Others |

| By Geography | North America Europe Asia-Pacific Rest of World |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Premium Helmet Retailers | 60 | Store Managers, Sales Representatives |

| Motorcycle Enthusiasts | 100 | Riders, Club Members |

| Helmet Manufacturers | 40 | Product Development Managers, Marketing Directors |

| Motorcycle Safety Experts | 40 | Safety Inspectors, Industry Analysts |

| Distributors and Wholesalers | 50 | Supply Chain Managers, Procurement Officers |

The Global Premium Motorcycle Helmets Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increased safety awareness, technological advancements, and a rising trend in motorcycle usage for commuting and leisure activities.