Region:Global

Author(s):Shubham

Product Code:KRAC0719

Pages:90

Published On:August 2025

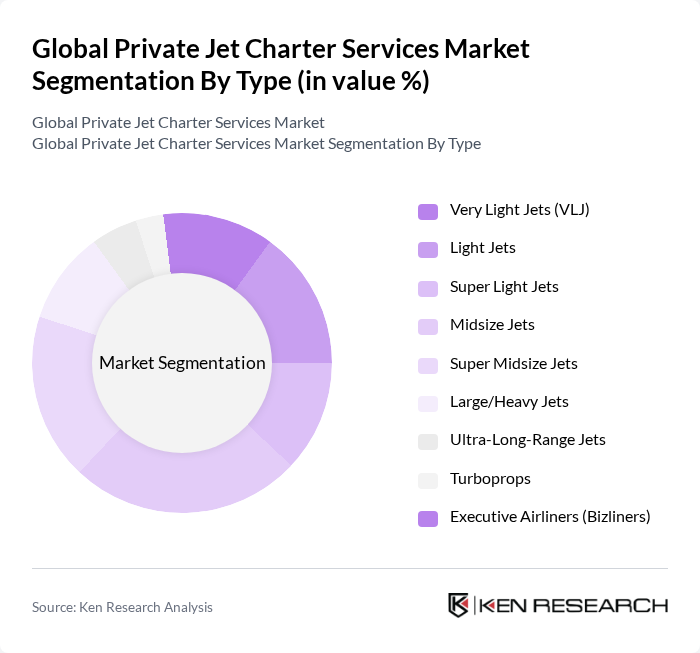

By Type:The market is segmented into various types of jets, including Very Light Jets (VLJ), Light Jets, Super Light Jets, Midsize Jets, Super Midsize Jets, Large/Heavy Jets, Ultra-Long-Range Jets, Turboprops, and Executive Airliners (Bizliners). Among these, Midsize and Super Midsize Jets are widely utilized in charter due to their balance of range, cabin size, and operating costs, supporting both regional and transcontinental missions that appeal to business and premium leisure users.

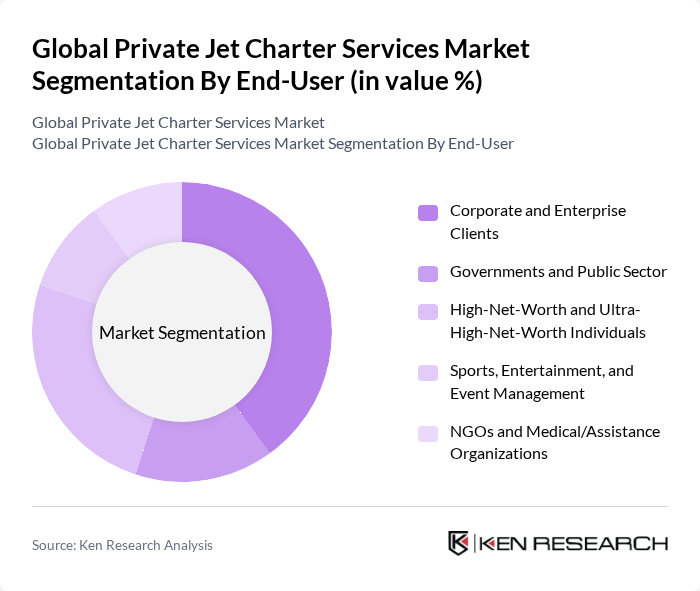

By End-User:The end-user segmentation includes Corporate and Enterprise Clients, Governments and Public Sector, High-Net-Worth and Ultra-High-Net-Worth Individuals, Sports, Entertainment, and Event Management, and NGOs and Medical/Assistance Organizations. The Corporate and Enterprise Clients segment is leading the market, driven by the increasing need for efficient travel solutions for business executives and teams, alongside continued adoption of jet-card and membership models that simplify procurement and budgeting for frequent corporate travel.

The Global Private Jet Charter Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as NetJets IP, LLC, Flexjet LLC, VistaJet Group Holding Limited, Wheels Up Experience Inc., Air Charter Service Group Limited, PrivateFly Limited, XO (An Vista Global Company), Jet Linx Aviation, LLC, Air Partner Limited, Paramount Business Jets, LLC, Stratos Jet Charters, Inc., Executive Jet Management, Inc. (a NetJets company), GlobeAir AG, Jet Edge International, Qatar Executive contribute to innovation, geographic expansion, and service delivery in this space.

The future of private jet charter services in the None region appears promising, driven by increasing demand for personalized travel experiences and advancements in aviation technology. As businesses continue to prioritize efficiency, the reliance on private aviation is expected to grow. Additionally, the shift towards sustainable practices will likely influence service offerings, with operators investing in eco-friendly aircraft. The integration of digital platforms for seamless booking will further enhance customer engagement, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Very Light Jets (VLJ) Light Jets Super Light Jets Midsize Jets Super Midsize Jets Large/Heavy Jets Ultra-Long-Range Jets Turboprops Executive Airliners (Bizliners) |

| By End-User | Corporate and Enterprise Clients Governments and Public Sector High-Net-Worth and Ultra-High-Net-Worth Individuals Sports, Entertainment, and Event Management NGOs and Medical/Assistance Organizations |

| By Booking Model | On-Demand (Ad-hoc) Charter Membership and Subscription Programs Jet Cards and Block Hour Programs Fractional Ownership Access |

| By Service Type | Business Travel Leisure and Lifestyle Travel Medical Evacuation (Medevac) and Air Ambulance Cargo and Special Missions |

| By Flight Range | Short-Haul (?1,500 nm) Medium-Haul (1,501–3,000 nm) Long-Haul (3,001–6,000 nm) Ultra-Long-Haul (>6,000 nm) |

| By Geographic Coverage | Domestic/Regional Flights International/Intercontinental Flights |

| By Customer Segment | Business Travelers and Executives Private Leisure Travelers Brokers and Travel Management Companies Sports Teams and Touring Artists Emergency and Medical Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Jet Charter Usage | 140 | CFOs, Travel Managers, Corporate Executives |

| Luxury Travel Preferences | 100 | High-Net-Worth Individuals, Travel Advisors |

| Private Jet Ownership Trends | 80 | Private Jet Owners, Aviation Consultants |

| Charter Service Satisfaction | 120 | Frequent Flyers, Customer Experience Managers |

| Market Entry Barriers for New Operators | 70 | Regulatory Experts, Industry Analysts |

The Global Private Jet Charter Services Market is valued at approximately USD 2123 billion, reflecting the passenger-focused charter segment's growth within the broader air charter market, driven by increasing demand for personalized travel experiences and rising disposable incomes among high-net-worth individuals.