Global Process Analytical Instrumentation Market Overview

- The Global Process Analytical Instrumentation Market is valued at USD 5.8 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for real-time monitoring and quality control in various industries, including pharmaceuticals, food and beverage, and chemicals. The need for enhanced process efficiency, digital transformation, and compliance with stringent safety and environmental regulations has further propelled the adoption of advanced analytical instruments. Industry 4.0 initiatives, integration of Internet of Things (IoT), and predictive analytics are accelerating market expansion by enabling remote monitoring, predictive maintenance, and process optimization .

- Key players in this market include the United States, Germany, and Japan, which dominate due to their strong industrial base, technological advancements, and significant investments in research and development. The presence of major manufacturing hubs and robust regulatory frameworks in these countries also contribute to their leadership in the process analytical instrumentation sector. North America holds the largest market share, with Asia-Pacific emerging as the fastest-growing region due to rapid industrialization and automation .

- In 2023, the U.S. government implemented the "21st Century Cures Act," which emphasizes the importance of modernizing the regulatory framework for medical devices and diagnostics. This regulation, issued by the U.S. Congress and the Food and Drug Administration (FDA), aims to accelerate the development and approval of innovative analytical instruments, thereby enhancing the efficiency and safety of healthcare processes. The Act mandates streamlined approval pathways, increased post-market surveillance, and adoption of advanced technologies in medical device evaluation .

Global Process Analytical Instrumentation Market Segmentation

By Type:The market is segmented into various types of analytical instruments, including Spectroscopy, Chromatography, Mass Spectrometry, Process Gas Analyzers, pH/ORP Meters, Conductivity/Turbidity Meters, TOC (Total Organic Carbon) Analyzers, Moisture Analyzers, and Others. Among these, Spectroscopy and Chromatography are the leading subsegments due to their widespread application in quality control and research across multiple industries.

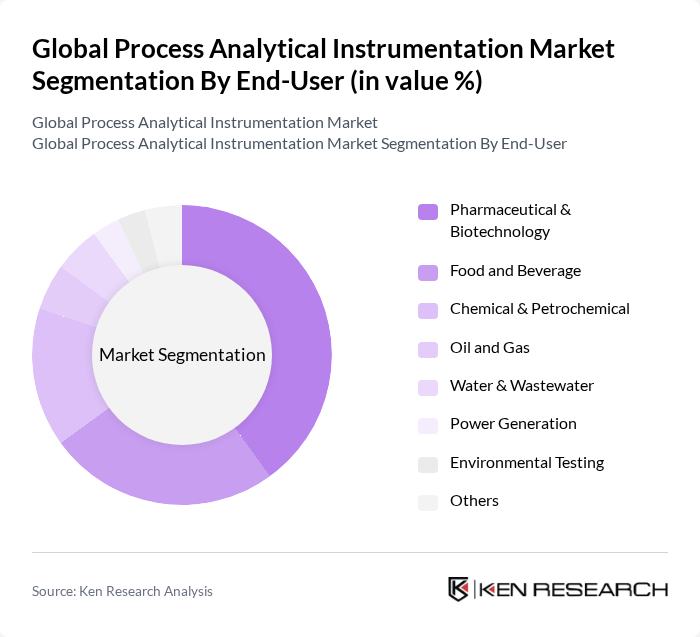

By End-User:The end-user segmentation includes Pharmaceutical & Biotechnology, Food and Beverage, Chemical & Petrochemical, Oil and Gas, Water & Wastewater, Power Generation, Environmental Testing, and Others. The Pharmaceutical & Biotechnology sector is the dominant segment, driven by stringent regulatory requirements and the need for precise quality control in drug manufacturing processes.

Global Process Analytical Instrumentation Market Competitive Landscape

The Global Process Analytical Instrumentation Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., Siemens AG, Emerson Electric Co., Honeywell International Inc., Yokogawa Electric Corporation, Endress+Hauser AG, Agilent Technologies, Inc., Thermo Fisher Scientific Inc., KROHNE Group, PerkinElmer, Inc., Mettler-Toledo International Inc., Parker Hannifin Corporation, Hach Company (Danaher Corporation), AMETEK, Inc., Rockwell Automation, Inc., Shimadzu Corporation, Bruker Corporation, Teledyne Technologies Incorporated, SICK AG, Analytical Technology, Inc. (ATI) contribute to innovation, geographic expansion, and service delivery in this space.

Global Process Analytical Instrumentation Market Industry Analysis

Growth Drivers

- Increasing Demand for Real-Time Monitoring:The global push for enhanced operational efficiency has led to a significant rise in the demand for real-time monitoring solutions. In future, the global market for real-time monitoring technologies is projected to reach approximately $12 billion, driven by industries such as pharmaceuticals and chemicals, which require immediate data for quality assurance. This trend is supported by the increasing need for process optimization, as companies aim to reduce waste and improve product quality, ultimately enhancing profitability.

- Advancements in Sensor Technology:The rapid evolution of sensor technology is a key growth driver in the process analytical instrumentation market. In future, the global sensor market is expected to exceed $200 billion, with innovations in miniaturization and sensitivity enhancing the capabilities of analytical instruments. These advancements enable more accurate and reliable measurements, which are crucial for industries like food and beverage, where compliance with safety standards is paramount. Enhanced sensor technology is thus pivotal in driving market growth.

- Rising Regulatory Requirements for Process Quality:Stringent regulatory frameworks across various industries are propelling the demand for process analytical instrumentation. In future, the global regulatory compliance market is anticipated to reach $50 billion, reflecting the increasing emphasis on quality control and safety. Industries such as pharmaceuticals are particularly affected, as they must adhere to regulations set by bodies like the FDA and EMA. This regulatory landscape necessitates the adoption of advanced analytical instruments to ensure compliance and maintain product integrity.

Market Challenges

- High Initial Investment Costs:One of the significant barriers to market growth is the high initial investment required for process analytical instrumentation. In future, the average cost of implementing advanced analytical systems is projected to be around $500,000 per facility. This financial burden can deter smaller companies from adopting these technologies, limiting market penetration. Additionally, the long payback period associated with these investments can further complicate decision-making for potential adopters.

- Complexity of Integration with Existing Systems:The integration of new analytical instruments with existing manufacturing systems poses a considerable challenge. In future, approximately 60% of companies report difficulties in achieving seamless integration, which can lead to operational disruptions. This complexity often results in increased downtime and additional costs, as companies must invest in training and system modifications. Consequently, this challenge can hinder the overall adoption of advanced process analytical technologies.

Global Process Analytical Instrumentation Market Future Outlook

The future of the process analytical instrumentation market appears promising, driven by ongoing technological advancements and increasing demand for automation. As industries continue to embrace digital transformation, the integration of AI and machine learning into analytical processes is expected to enhance data accuracy and operational efficiency. Furthermore, the growing emphasis on sustainability will likely lead to innovations in energy-efficient instrumentation, aligning with global environmental goals and regulatory standards, thus fostering market growth in the coming years.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present significant growth opportunities for process analytical instrumentation. In future, regions such as Asia-Pacific are expected to witness a 15% increase in demand, driven by rapid industrialization and investments in manufacturing. This growth is fueled by the need for advanced quality control measures, creating a favorable environment for market players to expand their presence and capitalize on new customer bases.

- Development of Smart Manufacturing Solutions:The shift towards smart manufacturing is creating new avenues for growth in the process analytical instrumentation market. In future, the smart manufacturing market is projected to reach $400 billion, with a significant portion dedicated to advanced analytical technologies. This trend is driven by the need for real-time data analytics and process optimization, offering companies the chance to innovate and enhance their operational capabilities through advanced instrumentation.