Region:Global

Author(s):Rebecca

Product Code:KRAD2790

Pages:80

Published On:November 2025

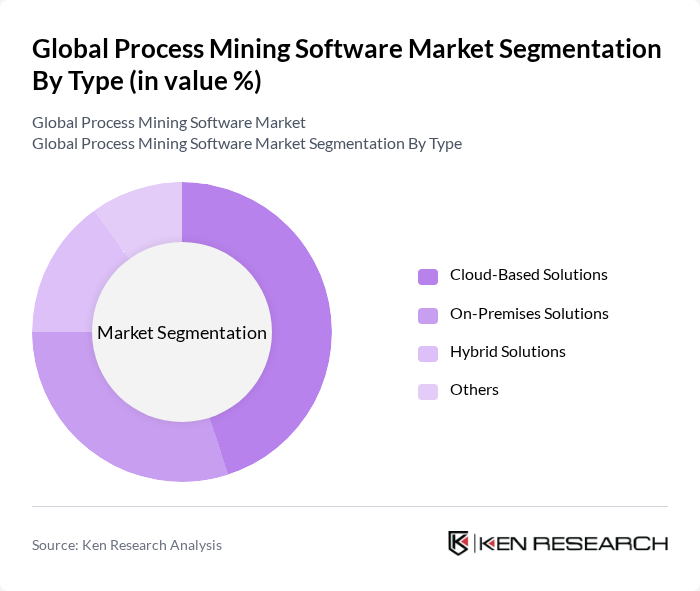

By Type:The market is segmented into Cloud-Based Solutions, On-Premises Solutions, Hybrid Solutions, and Others. Among these,Cloud-Based Solutionsare leading due to their scalability, cost-effectiveness, and ease of integration with existing systems. The growing trend of remote work, increased investments in cloud infrastructure, and the need for real-time data access further enhance the demand for cloud-based offerings. Enterprises are increasingly adopting cloud-based process mining to benefit from flexible deployment and seamless updates.

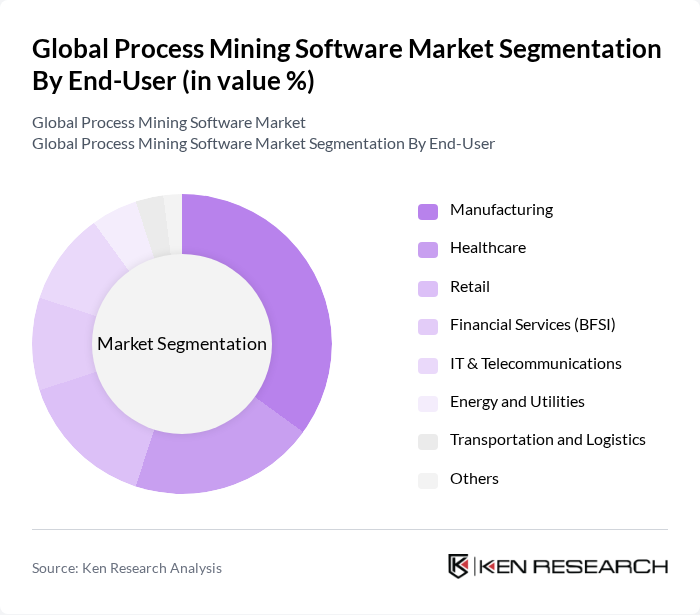

By End-User:The end-user segmentation includes Manufacturing, Healthcare, Retail, Financial Services (BFSI), IT & Telecommunications, Energy and Utilities, Transportation and Logistics, and Others. TheFinancial Services (BFSI)sector is the dominant segment by revenue, driven by the need for process optimization, compliance, and efficiency improvements in banking and insurance operations. Fierce competition among global financial service companies, regulatory requirements, and the need to improve client experience have accelerated adoption in BFSI. Manufacturing and healthcare also show significant demand, leveraging process mining to identify bottlenecks and enhance productivity.

The Global Process Mining Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Celonis, UiPath, Software AG, PAFnow (Process Analytics Factory GmbH), QPR Software, IBM, SAP Signavio, Minit (an IBM Company), ProcessGold (an UiPath Company), SAP, Microsoft, Oracle, Nintex, TIBCO Software, ABBYY Timeline contribute to innovation, geographic expansion, and service delivery in this space.

The future of the process mining software market appears promising, driven by technological advancements and increasing integration of AI and machine learning. As organizations continue to prioritize operational efficiency and data-driven strategies, the demand for real-time analytics and process automation will likely grow. Furthermore, the emphasis on user experience and cross-departmental collaboration will shape the development of innovative solutions, ensuring that businesses can adapt to evolving market demands and regulatory landscapes effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Others |

| By End-User | Manufacturing Healthcare Retail Financial Services (BFSI) IT & Telecommunications Energy and Utilities Transportation and Logistics Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Industry Vertical | BFSI (Banking, Financial Services, and Insurance) Manufacturing Retail & E-commerce Healthcare & Life Sciences IT & Telecommunications Energy & Utilities Transportation & Logistics Others |

| By Functionality | Process Discovery Conformance Checking Performance Analysis Predictive Analytics Automation Integration Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Process Optimization | 100 | Operations Managers, Process Engineers |

| Healthcare Workflow Improvement | 60 | Healthcare Administrators, IT Directors |

| Financial Services Compliance Tracking | 50 | Compliance Officers, Risk Managers |

| Retail Customer Journey Analysis | 70 | Marketing Managers, Data Analysts |

| Telecommunications Network Efficiency | 40 | Network Engineers, IT Operations Managers |

The Global Process Mining Software Market is valued at approximately USD 1.4 billion, reflecting a significant growth trend driven by the need for operational efficiency, cost reduction, and enhanced decision-making through data-driven insights.