Region:Global

Author(s):Dev

Product Code:KRAA3031

Pages:90

Published On:August 2025

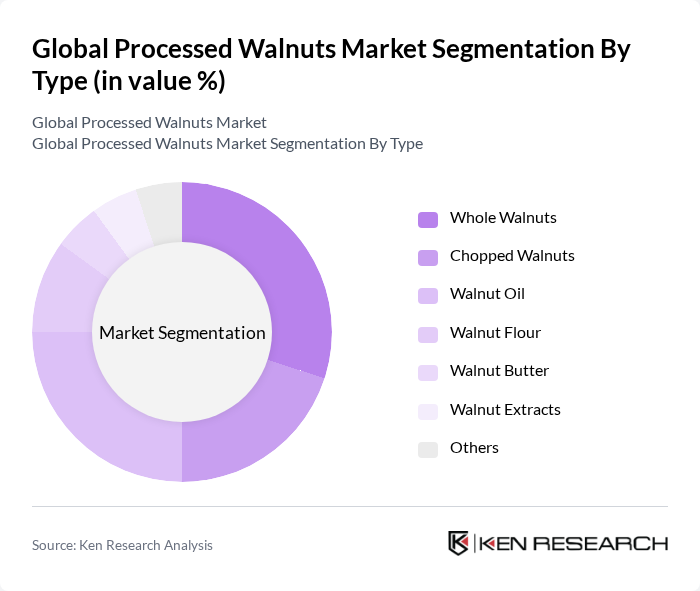

By Type:The processed walnuts market is segmented into Whole Walnuts, Chopped Walnuts, Walnut Oil, Walnut Flour, Walnut Butter, Walnut Extracts, and Others.Whole WalnutsandWalnut Oilare especially popular due to their versatility and health benefits. Whole Walnuts are widely used in baking, cooking, and snacking, while Walnut Oil is favored for its rich flavor and nutritional profile, including high omega-3 content. Processed forms such as walnut flour and butter are increasingly adopted in gluten-free and plant-based product formulations, reflecting the market’s shift toward functional and value-added ingredients.

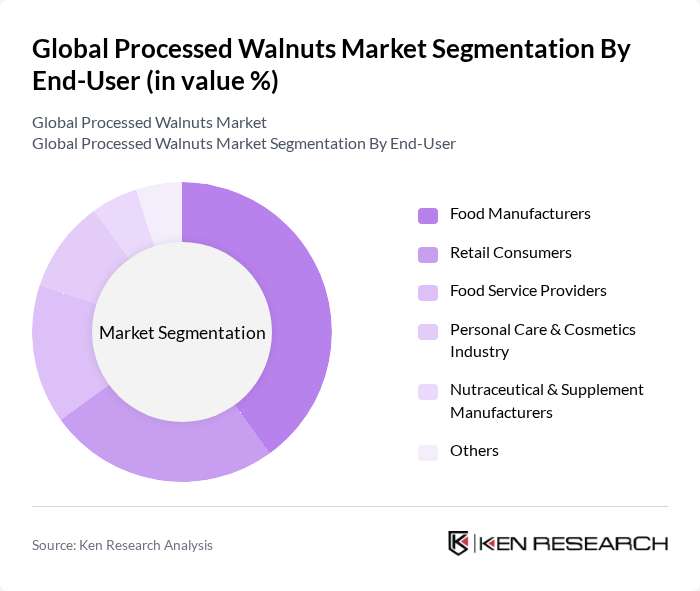

By End-User:The end-user segmentation includes Food Manufacturers, Retail Consumers, Food Service Providers, Personal Care & Cosmetics Industry, Nutraceutical & Supplement Manufacturers, and Others.Food Manufacturersare the dominant end-users, reflecting the increasing use of walnuts in snacks, bakery products, and health supplements. The personal care and cosmetics industry is also expanding its use of walnut derivatives, such as walnut oil and extracts, in skin and hair care formulations due to their natural antioxidant properties.

The Global Processed Walnuts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diamond Foods, Inc., California Walnut Commission, Blue Diamond Growers, Olam International, Archer Daniels Midland Company, Select Harvests Limited, Sahale Snacks, The Wonderful Company, Sun-Maid Growers of California, NutraBlend Foods, Royal Nut Company, The Nutty Company, Inc., Stahmann Farms Enterprises, Hain Celestial Group, Mariani Nut Company, Crain Walnut Shelling, Inc., Empire Nut Company, LLC, Guerra Nut Shelling Company, Grower Direct Nut Co., Inc., Morada Produce Company, L.P., Haleakala Walnut Shelling, Inc., Agromillora Group, Alpine Pacific Nut Company, GoldRiver Orchards, Inc., Kashmir Walnut Group, Poindexter Nut Company, Borges Agricultural & Industrial Nuts, Mid-Valley Nut Company, Inc., Royal Saffron Company, Andersen & Sons Shelling, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the processed walnuts market appears promising, driven by increasing health awareness and the demand for plant-based products. Innovations in product formulations and the expansion of online sales channels are expected to enhance market accessibility. Additionally, the growing trend towards sustainable sourcing will likely influence consumer preferences, pushing companies to adopt environmentally friendly practices. As the market evolves, these factors will play a crucial role in shaping the competitive landscape and driving growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Walnuts Chopped Walnuts Walnut Oil Walnut Flour Walnut Butter Walnut Extracts Others |

| By End-User | Food Manufacturers Retail Consumers Food Service Providers Personal Care & Cosmetics Industry Nutraceutical & Supplement Manufacturers Others |

| By Application | Bakery Products Snacks Confectionery Health Supplements Dairy Alternatives Sauces & Dressings Personal Care Products Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Direct Sales Foodservice Distribution Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Premium Mid-Range Economy |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Vacuum Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Processed Walnut Retailers | 100 | Store Managers, Category Buyers |

| Walnut Processing Companies | 70 | Operations Managers, Quality Control Supervisors |

| Exporters of Processed Walnuts | 50 | Export Managers, Trade Compliance Officers |

| Health Food Manufacturers | 60 | Product Development Managers, Nutritionists |

| Food Industry Analysts | 40 | Market Researchers, Industry Consultants |

The Global Processed Walnuts Market is valued at approximately USD 8.7 billion, reflecting a significant growth trend driven by health consciousness and the versatility of walnuts in various culinary applications.