Region:Global

Author(s):Dev

Product Code:KRAA1640

Pages:84

Published On:August 2025

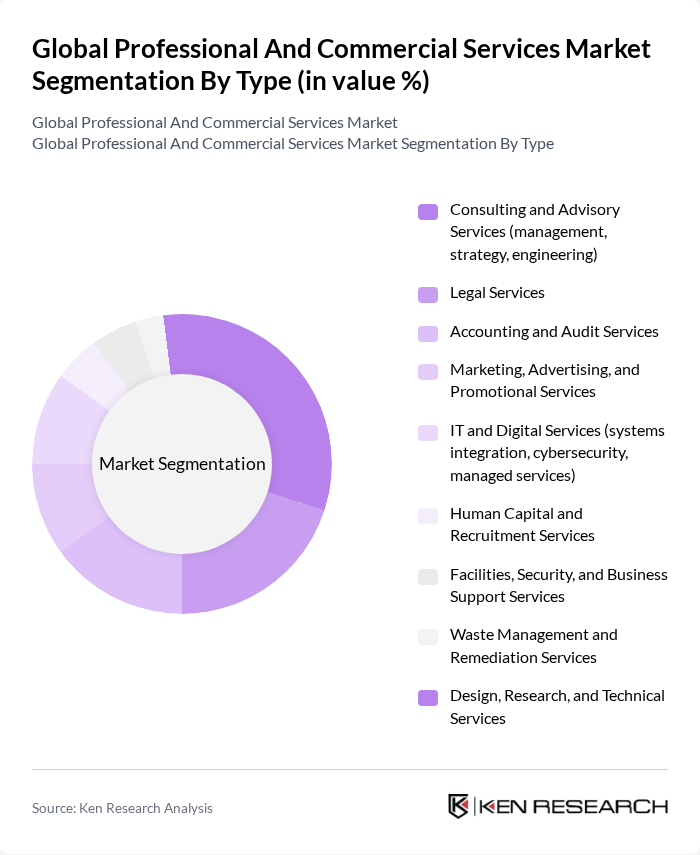

By Type:The market is segmented into various types of services, including consulting and advisory services, legal services, accounting and audit services, marketing, advertising, and promotional services, IT and digital services, human capital and recruitment services, facilities, security, and business support services, waste management and remediation services, and design, research, and technical services. Among these, consulting and advisory services are the most dominant, supported by rising digital transformation, cybersecurity needs, regulatory complexity, and demand for data/AI strategy and implementation services across industries .

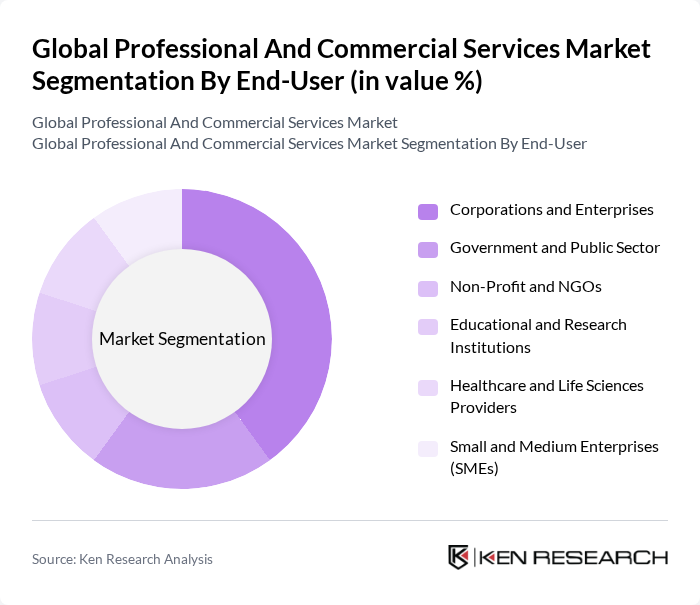

By End-User:The end-user segmentation includes corporations and enterprises, government and public sector, non-profit and NGOs, educational and research institutions, healthcare and life sciences providers, and small and medium enterprises (SMEs). Corporations and enterprises dominate this segment due to ongoing digitalization, compliance needs, and operating model modernization that drive demand for consulting, IT services, legal, and audit support .

The Global Professional And Commercial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deloitte, PricewaterhouseCoopers (PwC), EY (Ernst & Young), KPMG, Accenture, McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, IBM Consulting, Capgemini, Cognizant, HCLTech, Infosys, Tata Consultancy Services (TCS), Wipro, CBRE Group, Adecco Group, ManpowerGroup, ADP (Automatic Data Processing), WPP contribute to innovation, geographic expansion, and service delivery in this space.

The future of the professional services market is poised for transformation, driven by technological advancements and evolving client needs. As firms increasingly adopt hybrid service models, integrating in-person and digital interactions, the demand for innovative solutions will rise. Additionally, the emphasis on sustainability and corporate responsibility will shape service offerings, compelling providers to align with clients' values. This dynamic environment presents opportunities for growth and adaptation, ensuring that the sector remains resilient and responsive to changing market conditions.

| Segment | Sub-Segments |

|---|---|

| By Type | Consulting and Advisory Services (management, strategy, engineering) Legal Services Accounting and Audit Services Marketing, Advertising, and Promotional Services IT and Digital Services (systems integration, cybersecurity, managed services) Human Capital and Recruitment Services Facilities, Security, and Business Support Services Waste Management and Remediation Services Design, Research, and Technical Services |

| By End-User | Corporations and Enterprises Government and Public Sector Non-Profit and NGOs Educational and Research Institutions Healthcare and Life Sciences Providers Small and Medium Enterprises (SMEs) |

| By Service Delivery Model | On-Site Services Remote/Online Services Hybrid Services |

| By Industry Vertical | Financial Services Technology and Telecommunications Manufacturing and Industrial Retail and Consumer Energy and Utilities Real Estate and Construction Media and Entertainment Others |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Pricing Model | Fixed-Fee/Project-Based Time and Materials (Hourly/Day Rate) Retainer/Subscription Performance- or Outcome-Based Gainshare/Risk-Share and Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consulting Services | 120 | Consultants, Project Managers |

| Legal Services | 90 | Legal Advisors, Compliance Officers |

| IT Services | 110 | IT Managers, CTOs |

| Marketing and Advertising Services | 80 | Marketing Directors, Brand Managers |

| Human Resource Services | 80 | HR Managers, Talent Acquisition Specialists |

The Global Professional and Commercial Services Market is valued at approximately USD 6.3 trillion, reflecting a robust demand for specialized services across various sectors, including technology, finance, and healthcare.