Region:Global

Author(s):Shubham

Product Code:KRAD0783

Pages:91

Published On:August 2025

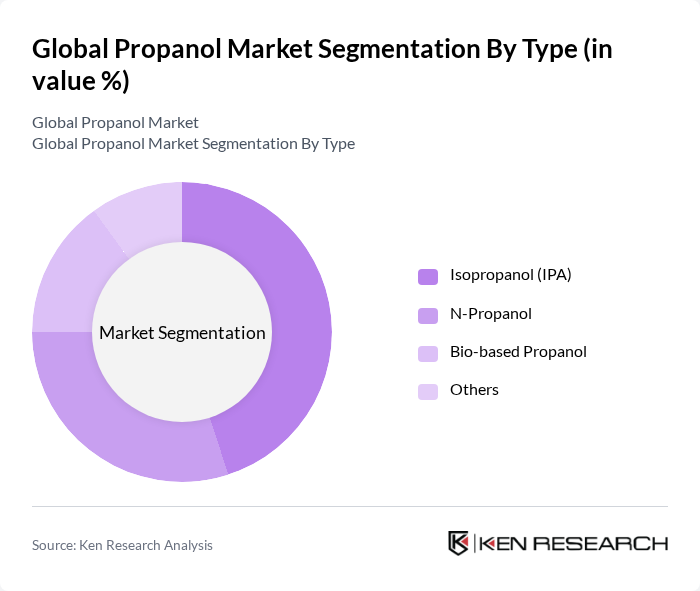

By Type:The market is segmented into Isopropanol (IPA), N-Propanol, Bio-based Propanol, and Others.Isopropanolremains the leading sub-segment due to its extensive use in pharmaceuticals, cleaning agents, and personal care products.N-Propanolis primarily utilized in coatings, inks, and chemical intermediates.Bio-based Propanolis gaining momentum as sustainability becomes a key purchasing criterion for consumers and manufacturers. The 'Others' category encompasses niche applications in specialty chemicals and industrial processes .

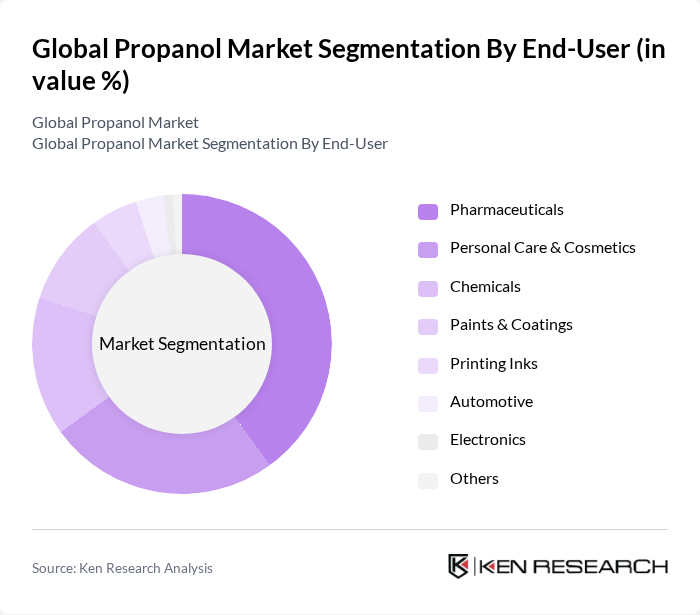

By End-User:The end-user segmentation includes Pharmaceuticals, Personal Care & Cosmetics, Chemicals, Paints & Coatings, Printing Inks, Automotive, Electronics, and Others. ThePharmaceuticalssegment is the largest, driven by high demand for propanol as a solvent and disinfectant in drug manufacturing and healthcare products.Personal Care & Cosmeticsalso contribute significantly, reflecting consumer preferences for safe and effective formulations. The Chemicals segment is supported by propanol’s role as an intermediate in various synthesis processes, while Paints & Coatings, Printing Inks, Automotive, and Electronics represent specialized industrial applications .

The Global Propanol Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., LyondellBasell Industries N.V., Eastman Chemical Company, INEOS Group Holdings S.A., Mitsubishi Gas Chemical Company, Inc., Shell Chemicals, Huntsman Corporation, OQ Chemicals GmbH, Sasol Limited, Repsol S.A., Formosa Plastics Corporation, Arkema S.A., Solvay S.A., Taminco BVBA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the propanol market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in production methods, such as bioprocessing, are expected to enhance efficiency and reduce environmental impact. Additionally, the increasing consumer preference for eco-friendly products is likely to spur demand for bio-based propanol, aligning with global sustainability goals. As industries adapt to these trends, strategic partnerships will play a crucial role in fostering growth and innovation within the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Isopropanol (IPA) N-Propanol Bio-based Propanol Others |

| By End-User | Pharmaceuticals Personal Care & Cosmetics Chemicals Paints & Coatings Printing Inks Automotive Electronics Others |

| By Application | Solvents Chemical Intermediates Cleaning Agents & Disinfectants Pharmaceuticals Formulations Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Source | Petrochemical-based Propanol Bio-based Propanol |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Quality Assurance Specialists |

| Cosmetic Industry Usage | 80 | Product Development Managers, Marketing Directors |

| Automotive Fuel Additives | 70 | Procurement Managers, Technical Sales Representatives |

| Industrial Solvent Applications | 90 | Operations Managers, Chemical Engineers |

| Emerging Markets Analysis | 50 | Market Analysts, Business Development Managers |

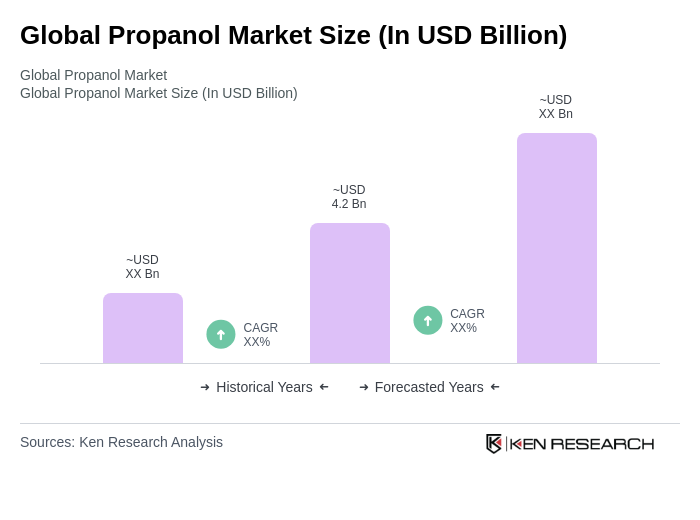

The Global Propanol Market is valued at approximately USD 4.2 billion, driven by increasing demand in various applications such as solvents, pharmaceuticals, and personal care products, particularly in the Asia-Pacific region.