Region:Global

Author(s):Dev

Product Code:KRAD0548

Pages:86

Published On:August 2025

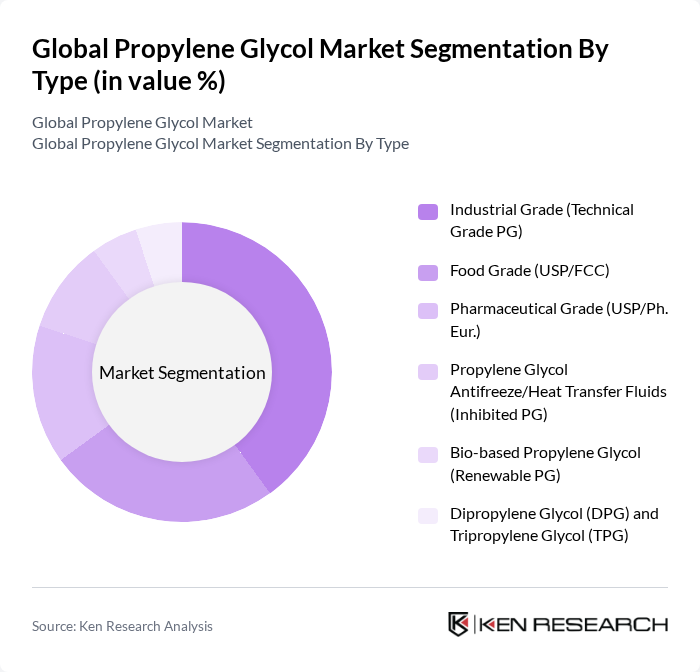

By Type:The market is segmented into various types, including Industrial Grade (Technical Grade PG), Food Grade (USP/FCC), Pharmaceutical Grade (USP/Ph. Eur.), Propylene Glycol Antifreeze/Heat Transfer Fluids (Inhibited PG), Bio-based Propylene Glycol (Renewable PG), and Dipropylene Glycol (DPG) and Tripropylene Glycol (TPG). Among these, the Industrial Grade segment is the most dominant due to its extensive use in industrial applications, including the production of unsaturated polyester resins and as a solvent in various chemical processes. The Food Grade and Pharmaceutical Grade segments are also significant, driven by the increasing demand for safe and effective ingredients in food and drug formulations .

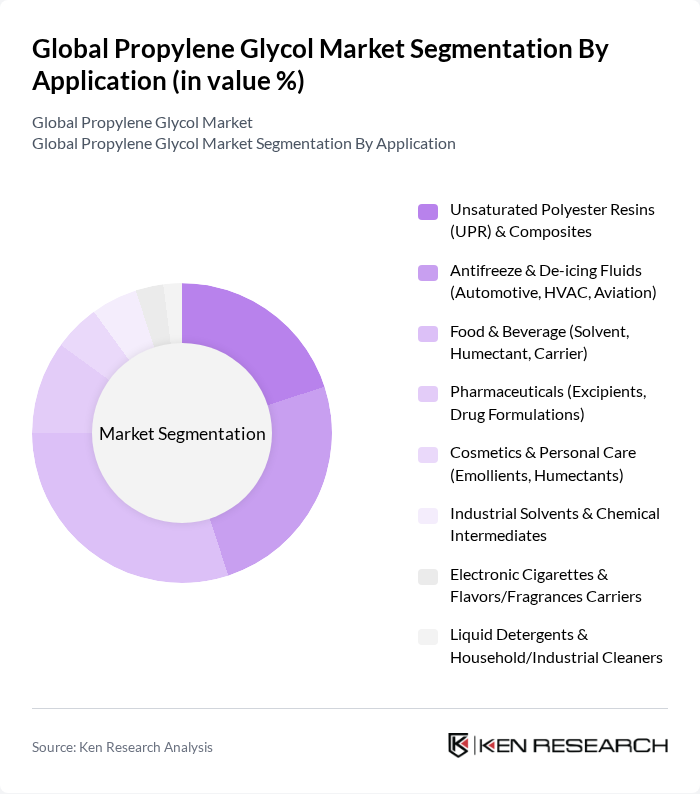

By Application:The applications of propylene glycol are diverse, including Unsaturated Polyester Resins (UPR) & Composites, Antifreeze & De-icing Fluids (Automotive, HVAC, Aviation), Food & Beverage (Solvent, Humectant, Carrier), Pharmaceuticals (Excipients, Drug Formulations), Cosmetics & Personal Care (Emollients, Humectants), Industrial Solvents & Chemical Intermediates, Electronic Cigarettes & Flavors/Fragrances Carriers, and Liquid Detergents & Household/Industrial Cleaners. The Food & Beverage application segment is particularly noteworthy, as propylene glycol serves as a safe and effective humectant and solvent, driving its demand in the food industry. The Antifreeze & De-icing Fluids segment also holds a significant share, owing to the increasing use of propylene glycol in automotive and HVAC applications .

The Global Propylene Glycol Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., Archer Daniels Midland Company (ADM), LyondellBasell Industries N.V., INEOS Group Holdings S.A. (INEOS Oxide), Huntsman Corporation, Shell plc, Repsol S.A., SK geo centric Co., Ltd., Eastman Chemical Company, OQEMA Group (formerly OXEA GmbH under OQ Chemicals), Mitsubishi Chemical Group Corporation, Formosa Plastics Corporation, Cargill, Incorporated, Trive Capital-backed Go Green Reprocessing (Reclaimed PG) contribute to innovation, geographic expansion, and service delivery in this space .

Latest market drivers and validation notes:

The future of the propylene glycol market appears promising, driven by increasing demand across various sectors, particularly food, pharmaceuticals, and automotive. Innovations in production technologies are expected to enhance efficiency and reduce costs, while the shift towards sustainable practices will likely open new avenues for growth. As consumer preferences evolve, the market is poised to adapt, with a focus on bio-based alternatives and eco-friendly products, ensuring resilience against challenges and fostering long-term sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade (Technical Grade PG) Food Grade (USP/FCC) Pharmaceutical Grade (USP/Ph. Eur.) Propylene Glycol Antifreeze/Heat Transfer Fluids (Inhibited PG) Bio-based Propylene Glycol (Renewable PG) Dipropylene Glycol (DPG) and Tripropylene Glycol (TPG) |

| By Application | Unsaturated Polyester Resins (UPR) & Composites Antifreeze & De-icing Fluids (Automotive, HVAC, Aviation) Food & Beverage (Solvent, Humectant, Carrier) Pharmaceuticals (Excipients, Drug Formulations) Cosmetics & Personal Care (Emollients, Humectants) Industrial Solvents & Chemical Intermediates Electronic Cigarettes & Flavors/Fragrances Carriers Liquid Detergents & Household/Industrial Cleaners |

| By End-User | Construction & Marine (via UPR end-use) Automotive & Transportation Food & Beverage Manufacturers Pharmaceutical Companies Personal Care & Cosmetics Manufacturers Industrial & Chemical Processing HVAC & Refrigeration Services |

| By Distribution Channel | Direct Sales (Producers to OEMs/Formulators) Distributors/Blenders (e.g., Heat Transfer Fluid Blenders) Online/Contract Platforms Wholesalers & Traders Others (Resellers, Regional Agents) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others (Rest of World) |

| By Packaging Type | Drums IBC Totes Bulk ISO Containers & Tank Trucks Railcars & Storage Tanks Others |

| By Price Range | Spot Contract Bio-based Premium Reclaimed/Technical Discount |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Industry | 100 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Sector | 80 | Regulatory Affairs Managers, R&D Directors |

| Cosmetics and Personal Care | 70 | Formulation Chemists, Brand Managers |

| Industrial Applications | 60 | Procurement Managers, Operations Directors |

| Automotive and Transportation | 90 | Supply Chain Managers, Product Engineers |

The Global Propylene Glycol Market is valued at approximately USD 4.8 billion, reflecting a comprehensive analysis over the past five years. This valuation is supported by its extensive applications across various industries, including food, pharmaceuticals, and automotive sectors.