Region:Global

Author(s):Dev

Product Code:KRAB0641

Pages:100

Published On:August 2025

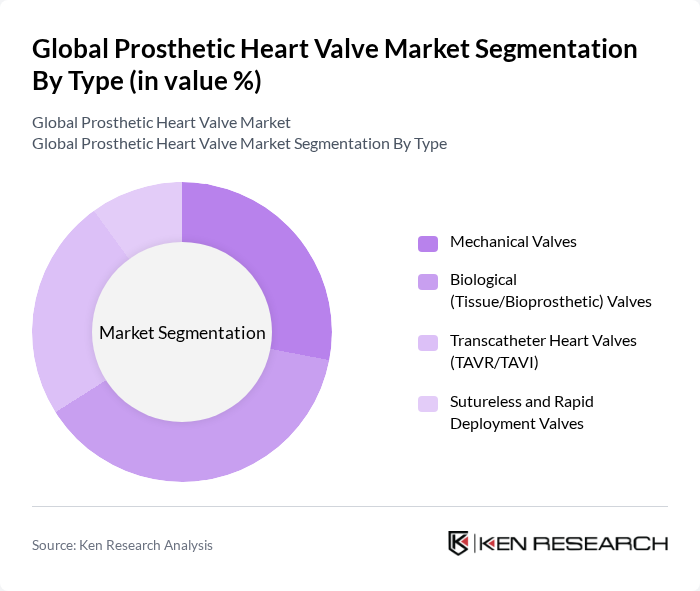

By Type:The prosthetic heart valve market is segmented into four main types: Mechanical Valves, Biological (Tissue/Bioprosthetic) Valves, Transcatheter Heart Valves (TAVR/TAVI), and Sutureless and Rapid Deployment Valves. Each type serves different patient needs and surgical requirements, with varying levels of durability, biocompatibility, and ease of implantation. Mechanical valves offer long-term durability but require lifelong anticoagulation, while biological valves are favored for their biocompatibility and reduced need for anticoagulants. Transcatheter valves are rapidly gaining adoption due to their minimally invasive delivery, particularly among high-risk and elderly patients .

TheBiological (Tissue/Bioprosthetic) Valvessegment is currently dominating the market due to their favorable biocompatibility and lower risk of thromboembolic complications compared to mechanical valves. This segment is particularly preferred among elderly patients and those with contraindications for anticoagulation therapy. The increasing adoption of minimally invasive surgical techniques, such as TAVR, has also contributed to the growth of this segment, as these valves are often easier to implant using less invasive methods .

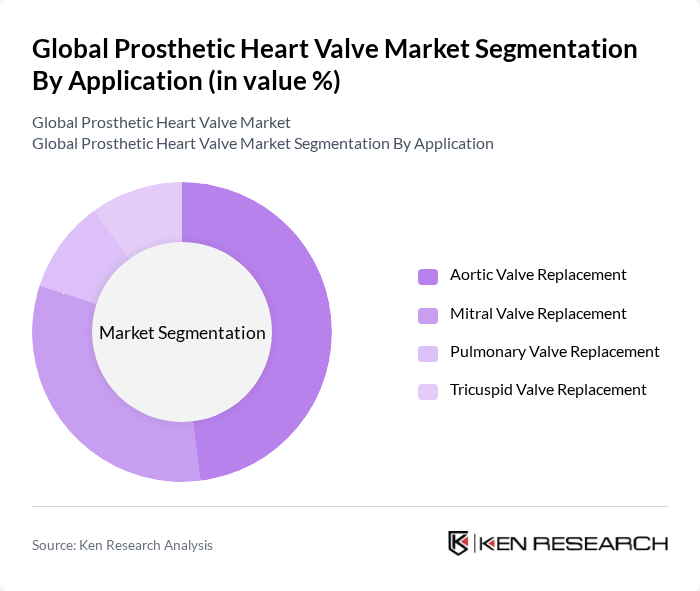

By Application:The applications of prosthetic heart valves include Aortic Valve Replacement, Mitral Valve Replacement, Pulmonary Valve Replacement, and Tricuspid Valve Replacement. Each application addresses specific heart valve diseases and conditions, with varying surgical techniques and patient demographics. Aortic valve replacement remains the most common procedure due to the high prevalence of aortic stenosis, especially in older adults .

TheAortic Valve Replacementsegment is the largest due to the high prevalence of aortic stenosis and the increasing number of surgical procedures performed annually. The growing awareness of heart valve diseases and advancements in surgical techniques, including the adoption of TAVR, have led to a rise in the number of patients opting for aortic valve replacement, further solidifying its dominance in the market .

The Global Prosthetic Heart Valve Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Edwards Lifesciences Corporation, Abbott Laboratories, Boston Scientific Corporation, Artivion, Inc. (formerly CryoLife, Inc.), LivaNova PLC, JenaValve Technology, Inc., MicroPort Scientific Corporation, Lepu Medical Technology (Beijing) Co., Ltd., Venus Medtech (Hangzhou) Inc., Meril Life Sciences Pvt. Ltd., TTK Healthcare Limited, Foldax, Inc., Transcatheter Technologies GmbH, Neovasc Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the prosthetic heart valve market appears promising, driven by ongoing technological advancements and an increasing focus on patient-centric care. As healthcare systems evolve, the integration of digital health technologies will enhance patient monitoring and outcomes. Furthermore, the expansion into emerging markets presents significant growth potential, as these regions seek to improve healthcare access and quality. The combination of these trends is likely to foster a more robust market environment, encouraging innovation and collaboration among industry stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Mechanical Valves Biological (Tissue/Bioprosthetic) Valves Transcatheter Heart Valves (TAVR/TAVI) Sutureless and Rapid Deployment Valves |

| By Application | Aortic Valve Replacement Mitral Valve Replacement Pulmonary Valve Replacement Tricuspid Valve Replacement |

| By End-User | Hospitals Cardiac Specialty Clinics Ambulatory Surgical Centers Academic & Research Institutes |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Sales Group Purchasing Organizations (GPOs) |

| By Region | North America (U.S., Canada) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (Japan, China, India, Australia, South Korea, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (South Africa, GCC, Rest of MEA) |

| By Price Range | Premium Mid-range Economy |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients High-risk Surgical Candidates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiologist Insights | 60 | Interventional Cardiologists, Electrophysiologists |

| Hospital Procurement Analysis | 50 | Procurement Managers, Supply Chain Directors |

| Patient Experience Surveys | 100 | Post-operative Patients, Caregivers |

| Biomedical Engineering Perspectives | 40 | Biomedical Engineers, Product Development Managers |

| Regulatory Insights | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Global Prosthetic Heart Valve Market is valued at approximately USD 9.6 billion, driven by the rising prevalence of cardiovascular diseases, advancements in valve technology, and an aging population requiring surgical interventions.