Region:Global

Author(s):Dev

Product Code:KRAB0445

Pages:87

Published On:August 2025

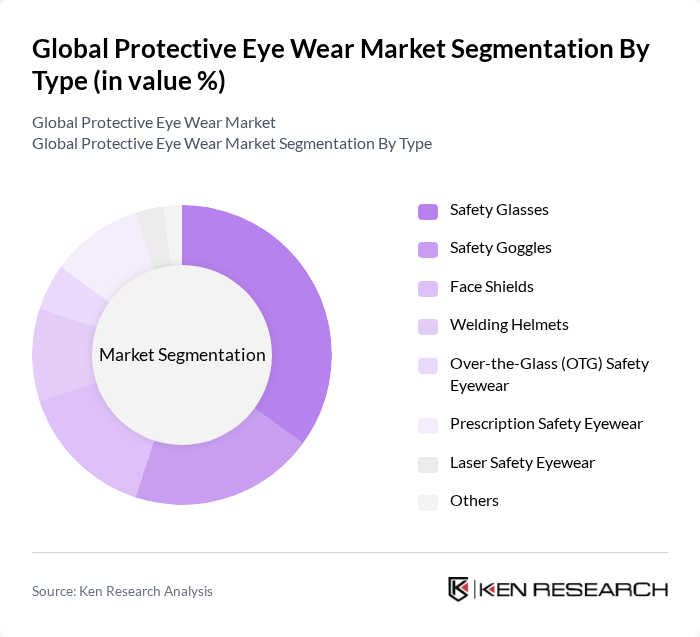

By Type:The protective eyewear market is segmented into various types, including Safety Glasses, Safety Goggles, Face Shields, Welding Helmets, Over-the-Glass (OTG) Safety Eyewear, Prescription Safety Eyewear, Laser Safety Eyewear, and Others. Among these, Safety Glasses dominate usage across general industry and construction due to ANSI/EN impact protection needs and everyday wearability; anti-fog coatings, lightweight frames, and wraparound designs are widely adopted to improve compliance.

By End-User:The market is segmented by end-user industries, including Construction, Manufacturing, Healthcare & Laboratory, Oil & Gas and Chemicals, Mining, Military & Defense, Transportation & Logistics, Sports & Outdoor, and Others. Construction and Manufacturing together account for the largest share given higher exposure to impact and chemical hazards and strong regulatory enforcement; healthcare and labs sustain demand for splash and infection control eyewear with anti-fog features.

The Global Protective Eye Wear Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Honeywell International Inc., MSA Safety Incorporated, uvex Safety Group (UVEX ARBEITSSCHUTZ GmbH), Bollé Safety, Radians, Inc., Pyramex Safety Products, LLC, Kimberly-Clark Professional, JSP Limited (Jackson Safety brand), Wiley X, Inc., Delta Plus Group, Elvex Corporation (a Delta Plus brand), MCR Safety, Lakeland Industries, Inc., TMC Industries dba Edge Eyewear contribute to innovation, geographic expansion, and service delivery in this space.

Enhancements to growth drivers and trends (validated):

The future of the protective eyewear market appears promising, driven by increasing regulatory pressures and a growing focus on employee safety. As industries evolve, the integration of smart technologies and augmented reality features into eyewear is expected to gain traction, enhancing user experience and functionality. Additionally, the shift towards sustainable materials will likely attract environmentally conscious consumers, further expanding market reach and fostering innovation in product development.

| Segment | Sub-Segments |

|---|---|

| By Type | Safety Glasses Safety Goggles Face Shields Welding Helmets Over-the-Glass (OTG) Safety Eyewear Prescription Safety Eyewear Laser Safety Eyewear Others |

| By End-User | Construction Manufacturing Healthcare & Laboratory Oil & Gas and Chemicals Mining Military & Defense Transportation & Logistics Sports & Outdoor Others |

| By Distribution Channel | Online Retail (eCommerce, Marketplaces) Offline Retail (Specialty Safety Stores) Direct-to-Enterprise (B2B) Industrial Distributors Others |

| By Material | Polycarbonate Trivex Glass CR-39/Plastic Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Certification Standard | ANSI Z87.1 EN 166 AS/NZS 1337 CSA Z94.3 Others |

| By Application | Impact and Particle Protection Chemical Splash Protection Radiation/Light Protection (UV/IR/Laser) Biohazard/Infectious Agent Protection Thermal/Heat and Welding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Safety Managers | 100 | Safety Managers, Site Supervisors |

| Manufacturing Sector Workers | 80 | Production Managers, Quality Control Inspectors |

| Healthcare Sector Safety Officers | 70 | Health and Safety Officers, Facility Managers |

| Laboratory and Research Facilities | 60 | Lab Managers, Research Scientists |

| Retail and Distribution Centers | 90 | Warehouse Managers, Safety Compliance Officers |

The Global Protective Eye Wear Market is valued at approximately USD 2.6 billion, based on a five-year historical analysis. This valuation is supported by various industry trackers indicating market sizes in the low-to-mid USD 2 billion range.