Region:Global

Author(s):Dev

Product Code:KRAB0423

Pages:97

Published On:August 2025

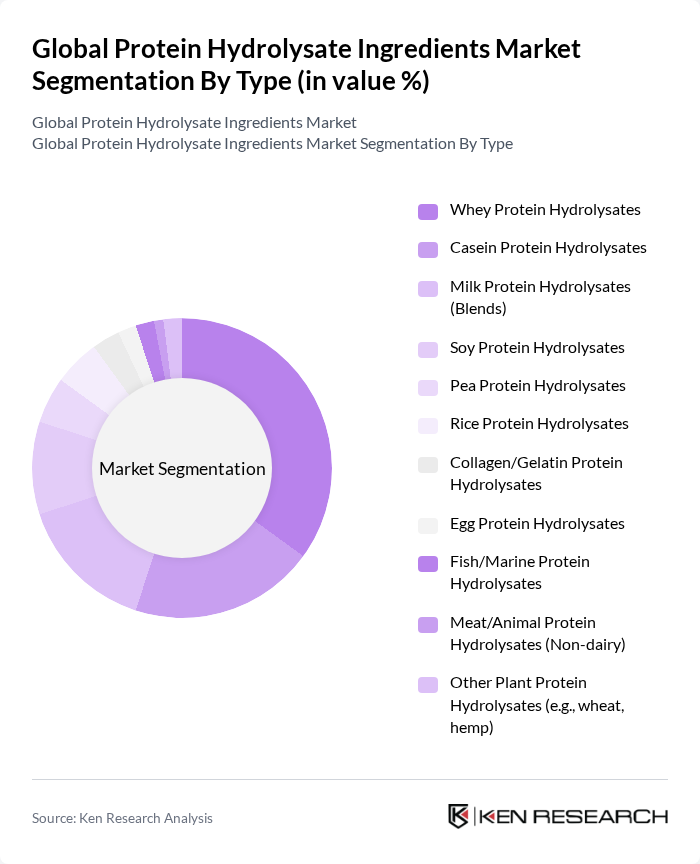

By Type:The protein hydrolysate ingredients market is segmented into various types, including whey protein hydrolysates, casein protein hydrolysates, milk protein hydrolysates (blends), soy protein hydrolysates, pea protein hydrolysates, rice protein hydrolysates, collagen/gelatin protein hydrolysates, egg protein hydrolysates, fish/marine protein hydrolysates, meat/animal protein hydrolysates (non-dairy), and other plant protein hydrolysates (e.g., wheat, hemp). Among these, whey protein hydrolysates are the most dominant due to their high bioavailability and popularity in sports nutrition and dietary supplements .

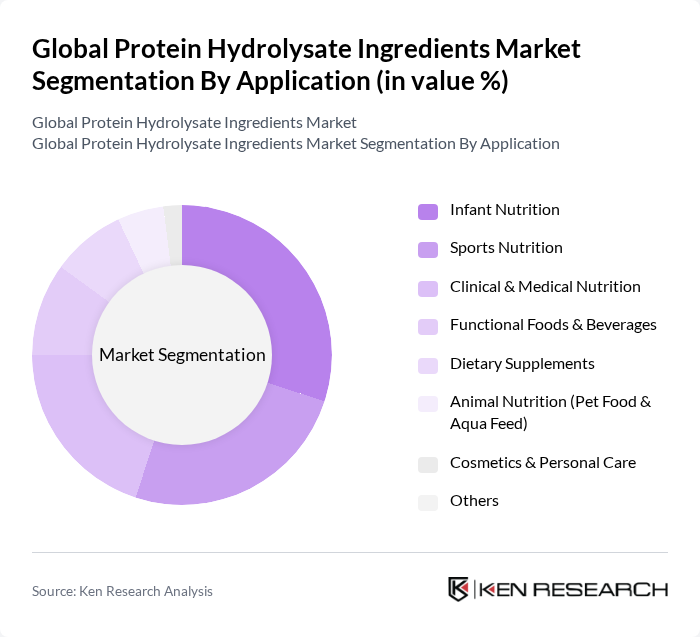

By Application:The applications of protein hydrolysate ingredients span across various sectors, including infant nutrition, sports nutrition, clinical & medical nutrition, functional foods & beverages, dietary supplements, animal nutrition (pet food & aqua feed), and cosmetics & personal care. The infant nutrition segment is particularly significant, driven by the increasing demand for specialized formulas that support growth and development in infants .

The Global Protein Hydrolysate Ingredients Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arla Foods Ingredients, FrieslandCampina Ingredients, Fonterra Co-operative Group, Glanbia Nutritionals, Kerry Group, dsm-firmenich, Cargill, IFF (formerly DuPont Nutrition & Biosciences), BASF, Ingredion, Tate & Lyle, Axiom Foods, Proliant Dairy Ingredients, BENEO GmbH, Abbott Nutrition, Nestlé Health Science, Hilmar, Carbery Group (Optipep), Armor Proteines (Savencia Group), Tatua Co-operative Dairy Company, Agropur Ingredients, Arla Foods amba (Milk/Casein hydrolysates), ADM (plant and hydrolyzed proteins), Kewpie Corporation (egg protein hydrolysates), Hofseth BioCare (fish/marine hydrolysates) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the protein hydrolysate ingredients market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for clean label products continues to rise, manufacturers are likely to innovate in sourcing and processing methods. Additionally, the increasing focus on personalized nutrition will create opportunities for tailored protein solutions, enhancing market growth. The expansion into emerging markets will further bolster the industry's potential, as consumers in these regions become more health-conscious and seek high-quality nutritional products.

| Segment | Sub-Segments |

|---|---|

| By Type | Whey Protein Hydrolysates Casein Protein Hydrolysates Milk Protein Hydrolysates (Blends) Soy Protein Hydrolysates Pea Protein Hydrolysates Rice Protein Hydrolysates Collagen/Gelatin Protein Hydrolysates Egg Protein Hydrolysates Fish/Marine Protein Hydrolysates Meat/Animal Protein Hydrolysates (Non-dairy) Other Plant Protein Hydrolysates (e.g., wheat, hemp) |

| By Application | Infant Nutrition Sports Nutrition Clinical & Medical Nutrition Functional Foods & Beverages Dietary Supplements Animal Nutrition (Pet Food & Aqua Feed) Cosmetics & Personal Care Others |

| By End-User | Infant Formula Manufacturers Sports & Active Nutrition Brands Food & Beverage Manufacturers Pharmaceutical & Medical Nutrition Companies Animal Nutrition Companies Cosmetics & Personal Care Companies Others |

| By Distribution Channel | B2B Direct (Ingredient Supply Contracts) Distributors/Wholesalers Online B2B Platforms Retail (Finished Products) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bulk Packaging (25 kg bags, drums, totes) Retail Packaging (sachets, jars, pouches) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Product Development Managers, R&D Directors |

| Dietary Supplement Producers | 90 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Sports Nutrition Brands | 70 | Marketing Managers, Brand Strategists |

| Health and Wellness Retailers | 60 | Purchasing Managers, Category Managers |

| Research Institutions and Universities | 50 | Food Scientists, Nutrition Researchers |

The Global Protein Hydrolysate Ingredients Market is valued at approximately USD 3.7 billion, driven by the increasing demand for protein-rich food products and the rise in health consciousness among consumers.