Region:Global

Author(s):Dev

Product Code:KRAD0554

Pages:88

Published On:August 2025

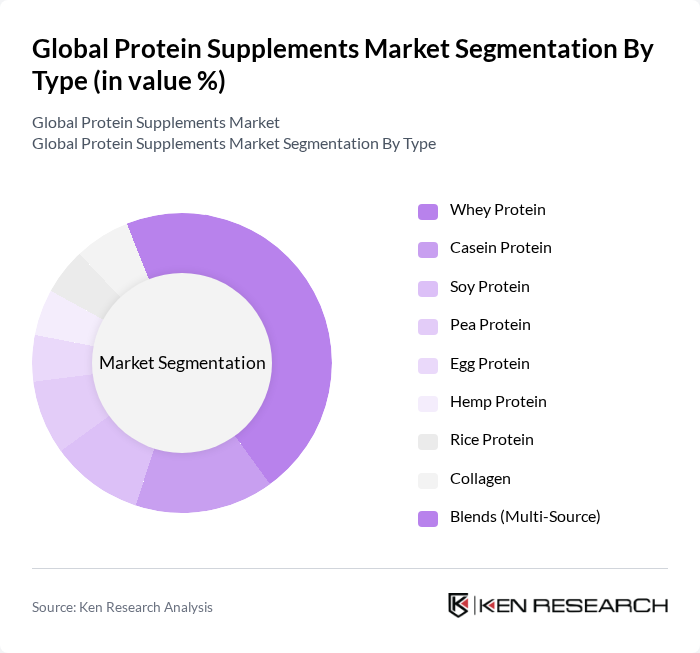

By Type:The protein supplements market is segmented into various types, including Whey Protein, Casein Protein, Soy Protein, Pea Protein, Egg Protein, Hemp Protein, Rice Protein, Collagen, and Blends (Multi-Source). Among these,Whey Proteinis the most dominant segment due to its high biological value, rapid absorption, and effectiveness in muscle recovery, supported by entrenched brand portfolios in powders and RTD formats across North America and Europe .

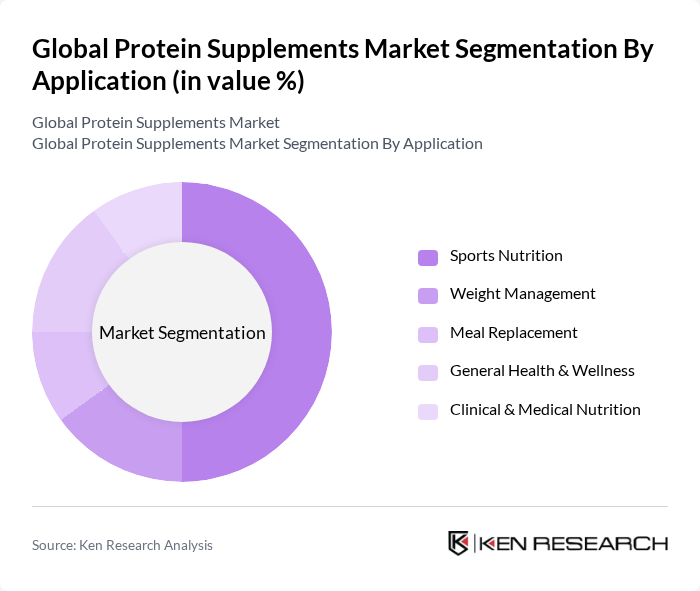

By Application:The market is also segmented by application, which includes Sports Nutrition, Weight Management, Meal Replacement, General Health & Wellness, and Clinical & Medical Nutrition.Sports Nutritionis the leading application segment, driven by the increasing number of athletes and fitness enthusiasts seeking effective recovery solutions and performance enhancement, and supported by the proliferation of protein powders, bars, and RTDs in specialty retail and online channels .

The Global Protein Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Optimum Nutrition (Glanbia Performance Nutrition), MusclePharm, BSN (Bio-Engineered Supplements & Nutrition), Dymatize Nutrition, Myprotein (The Hut Group), Quest Nutrition (The Simply Good Foods Company), Garden of Life (Nestlé Health Science), Vega (Danone Company), Isopure (Glanbia Performance Nutrition), EAS (Brand legacy; assets acquired by Abbott, discontinued), Bodybuilding.com (Private Label: Signature), Promix Nutrition, Orgain, Klean Athlete (Klean by Nature’s Bounty/THG Fulfilment), Tera’s Whey (tera’s® whey by TeraWhey/Agri-Pure legacy), MuscleTech (Iovate Health Sciences), GNC (General Nutrition Centers), Herbalife Nutrition, Garden of Life SPORT, NOW Sports (NOW Foods) contribute to innovation, geographic expansion, and service delivery in this space .

The protein supplements market is poised for continued evolution, driven by consumer preferences for clean label products and sustainable sourcing. As health awareness rises, personalized nutrition is expected to gain traction, with tailored protein solutions catering to individual dietary needs. Additionally, the integration of technology in product development and marketing strategies will enhance consumer engagement, fostering brand loyalty. Companies that adapt to these trends will likely thrive in an increasingly competitive landscape, ensuring long-term growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Whey Protein Casein Protein Soy Protein Pea Protein Egg Protein Hemp Protein Rice Protein Collagen Blends (Multi-Source) |

| By Application | Sports Nutrition Weight Management Meal Replacement General Health & Wellness Clinical & Medical Nutrition |

| By Distribution Channel | Online Retail (D2C and Marketplaces) Supermarkets/Hypermarkets Specialty Nutrition & Supplement Stores Pharmacies/Drugstores Gyms/Fitness Centers |

| By Formulation | Powder Ready-to-Drink (RTD) Bars Capsules/Tablets Gummies/Chews |

| By End-User | Athletes Bodybuilders Fitness Enthusiasts General Consumers Seniors/Active Aging |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Single-Serve Sachets Bulk Tubs/Pouches Multi-Serve Containers RTD Bottles/Cans |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Protein Supplements | 150 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Insights on Protein Supplement Sales | 100 | Retail Managers, Store Owners |

| Trends in Plant-based Protein Consumption | 80 | Vegan Consumers, Nutritionists |

| Impact of Marketing on Protein Supplement Choices | 120 | Marketing Professionals, Brand Managers |

| Usage Patterns Among Athletes | 90 | Athletes, Coaches |

The Global Protein Supplements Market is valued at approximately USD 2529 billion, reflecting sustained demand driven by health consciousness, fitness activities, and the rise of protein-rich diets. Recent estimates place the market size around USD 2528 billion.