Region:Global

Author(s):Geetanshi

Product Code:KRAA1275

Pages:92

Published On:August 2025

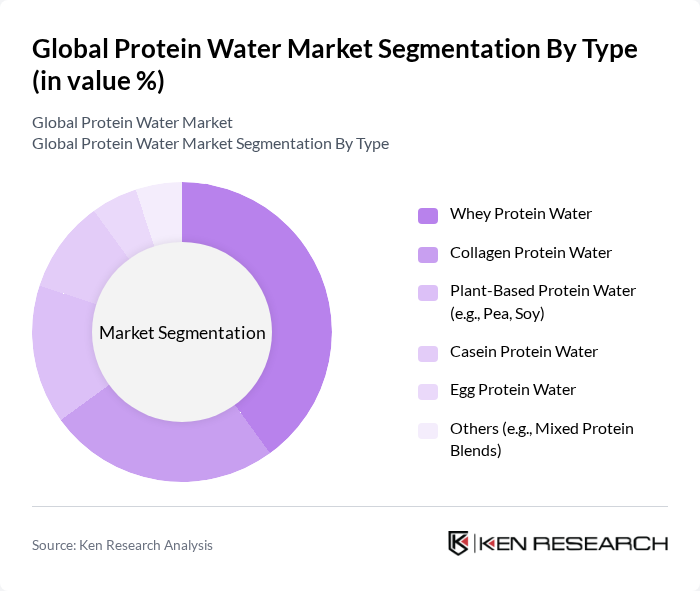

By Type:The protein water market is segmented into Whey Protein Water, Collagen Protein Water, Plant-Based Protein Water (e.g., Pea, Soy), Casein Protein Water, Egg Protein Water, and Others (e.g., Mixed Protein Blends). Among these, Whey Protein Water remains the most dominant segment, driven by its high protein content, rapid absorption, and popularity among athletes and fitness enthusiasts. Collagen Protein Water is gaining traction for its perceived benefits for skin and joint health, while plant-based options are expanding due to demand from vegan and vegetarian consumers. Clean-label and minimal-ingredient formulations are increasingly preferred, reflecting broader health and wellness trends.

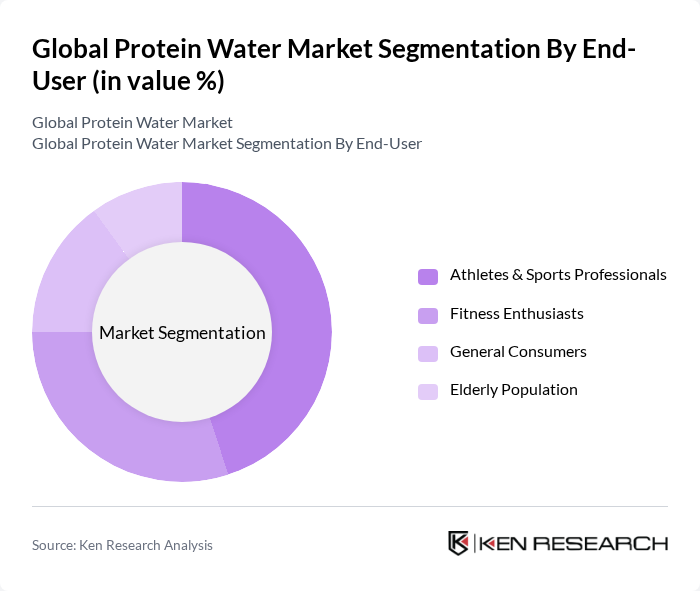

By End-User:The end-user segmentation includes Athletes & Sports Professionals, Fitness Enthusiasts, General Consumers, and the Elderly Population. Athletes and sports professionals represent the largest segment, driven by their need for quick recovery and muscle repair post-exercise. Fitness enthusiasts and general consumers are increasingly adopting protein water for its convenience and nutritional benefits, while the elderly population is drawn to protein water for its role in maintaining muscle mass and supporting healthy aging.

The Global Protein Water Market is characterized by a dynamic mix of regional and international players. Leading participants such as Protein2o, BODYARMOR (The Coca-Cola Company), Glacéau (Vitaminwater, owned by The Coca-Cola Company), Muscle Milk (CytoSport, Inc.), Naked Juice (PepsiCo, Inc.), Quest Nutrition (The Simply Good Foods Company), Premier Protein (BellRing Brands, Inc.), Isopure (Glanbia plc), Orgain, ALOHA, Myprotein (The Hut Group), Optimum Nutrition (Glanbia plc), Vega (Danone S.A.), Dymatize (BellRing Brands, Inc.), Alani Nu contribute to innovation, geographic expansion, and service delivery in this space.

The future of the protein water market appears promising, driven by increasing health consciousness and the demand for functional beverages. As consumers continue to prioritize wellness, brands are likely to innovate with new flavors and formulations. Additionally, the rise of e-commerce is expected to facilitate direct sales, making protein water more accessible. Companies that adapt to these trends and invest in consumer education will likely capture a larger market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Whey Protein Water Collagen Protein Water Plant-Based Protein Water (e.g., Pea, Soy) Casein Protein Water Egg Protein Water Others (e.g., Mixed Protein Blends) |

| By End-User | Athletes & Sports Professionals Fitness Enthusiasts General Consumers Elderly Population |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Health Food Stores Convenience Stores Specialty Stores (e.g., Sports Nutrition) |

| By Packaging Type | Bottles Tetra Packs Cans Sachets |

| By Flavor | Unflavored Chocolate Vanilla Fruit Flavors (e.g., Berry, Citrus, Tropical) Others (e.g., Coffee, Exotic Flavors) |

| By Price Range | Premium Mid-Range Budget |

| By Region | North America (U.S., Canada) Europe (Germany, UK, France, Rest of Europe) Asia-Pacific (China, Japan, India, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 150 | Store Managers, Category Buyers |

| Fitness Industry Feedback | 100 | Personal Trainers, Gym Owners |

| Consumer Preferences Survey | 150 | Health-Conscious Consumers, Athletes |

| Product Development Insights | 80 | R&D Managers, Beverage Formulators |

| Market Trend Analysis | 120 | Market Analysts, Nutrition Experts |

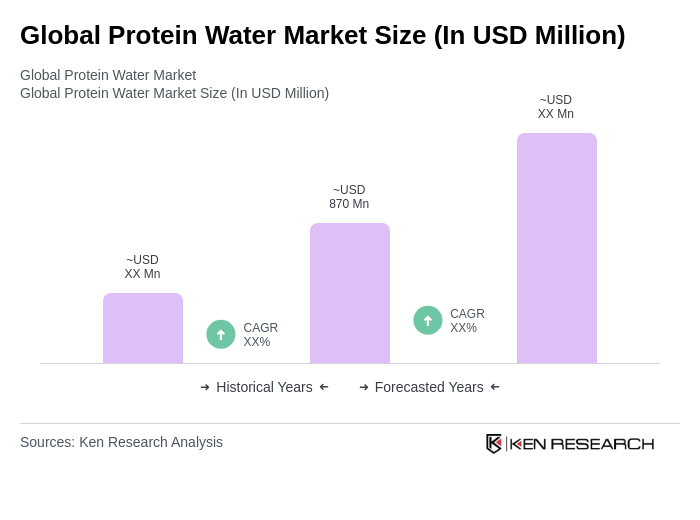

The Global Protein Water Market is valued at approximately USD 870 million, reflecting a growing consumer demand for healthy, low-calorie, and functional beverages that support fitness and wellness.