Global Proton Pump Inhibitors Market Overview

- The Global Proton Pump Inhibitors Market is valued at USD 4 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing prevalence of gastrointestinal disorders, such as gastroesophageal reflux disease (GERD) and peptic ulcers, alongside the rising geriatric population that is more susceptible to these conditions. The market is also supported by advancements in drug formulations, such as delayed-release and combination therapies, and the growing acceptance of PPIs as a first-line treatment option. The adoption of artificial intelligence in drug discovery and clinical decision support is further enhancing the market by promoting rational drug use and optimizing therapy outcomes .

- The United States, Germany, and Japan dominate the Global Proton Pump Inhibitors Market due to their advanced healthcare infrastructure, high healthcare expenditure, and significant research and development activities in the pharmaceutical sector. These countries have a well-established distribution network and a high rate of prescription and over-the-counter drug usage, contributing to their leading positions in the market .

- Recent regulatory trends emphasize the need for careful patient evaluation and monitoring to mitigate potential long-term side effects of proton pump inhibitors. Updated clinical guidelines in the United States and Europe recommend judicious prescription of PPIs, particularly for patients at risk of adverse effects, to enhance patient safety and treatment efficacy. Hospitals and healthcare systems are increasingly adopting AI-powered tools to identify inappropriate PPI prescriptions and ensure adherence to best-practice guidelines .

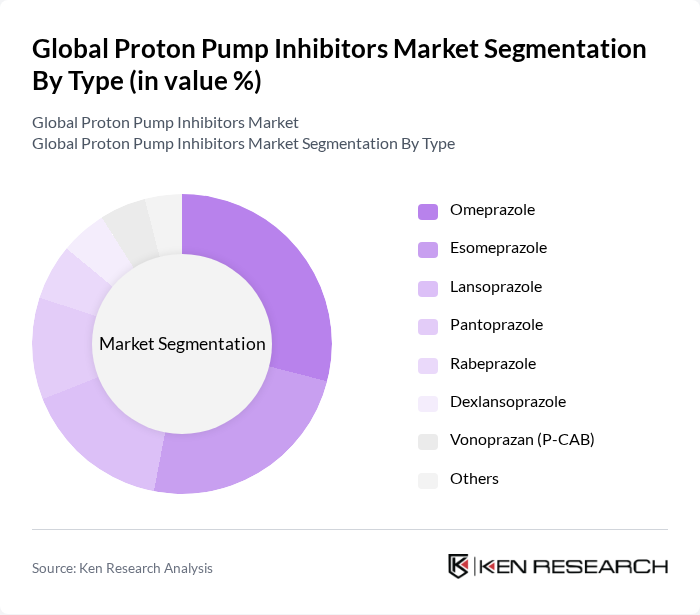

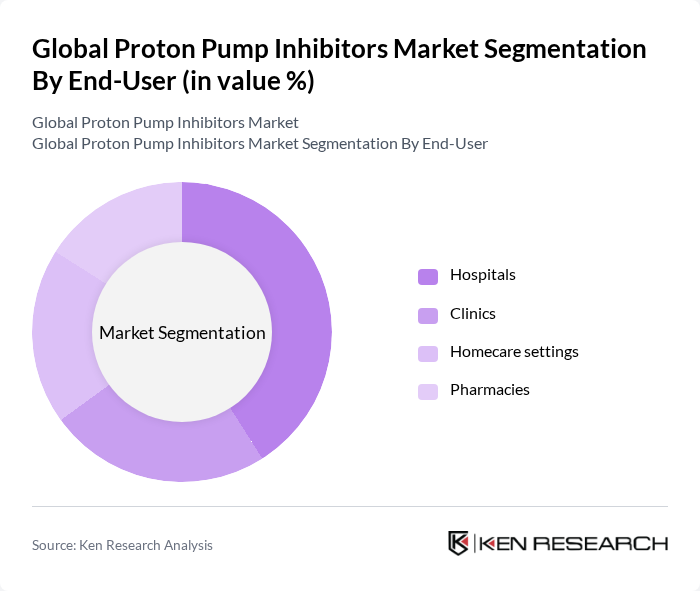

Global Proton Pump Inhibitors Market Segmentation

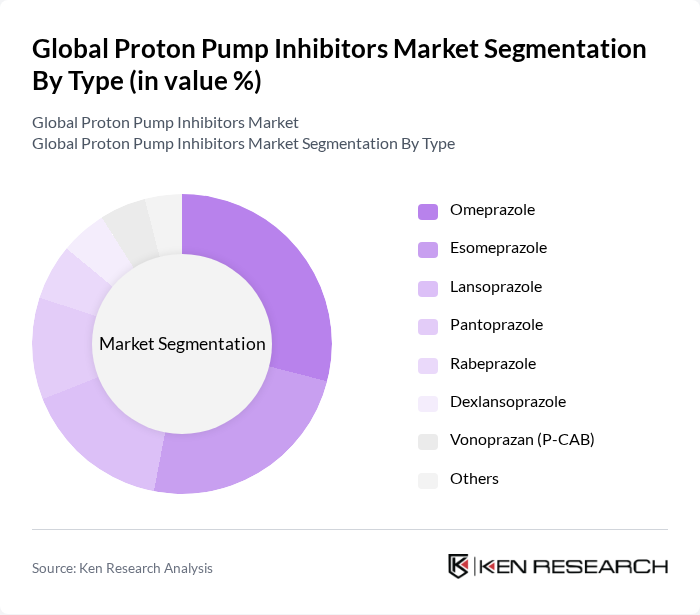

By Type:The market is segmented into various types of proton pump inhibitors, including Omeprazole, Esomeprazole, Lansoprazole, Pantoprazole, Rabeprazole, Dexlansoprazole, Vonoprazan (P-CAB), and Others. Among these, Omeprazole and Esomeprazole are the most widely used due to their effectiveness, established safety profiles, and broad over-the-counter availability. The increasing preference for generic formulations and the introduction of novel agents such as Vonoprazan have contributed to the growth of the Others segment, as healthcare providers seek cost-effective and advanced treatment options .

By End-User:The end-user segmentation includes Hospitals, Clinics, Homecare settings, and Pharmacies. Hospitals remain the leading end-user segment, driven by the high volume of patients requiring treatment for gastrointestinal disorders and the integration of AI tools for rational drug use. Clinics and Homecare settings are also growing due to the increasing trend of outpatient care, telemedicine, and self-medication. Pharmacies play a crucial role in the distribution of PPIs, catering to both prescription and over-the-counter markets, with e-pharmacy platforms expanding access in emerging regions .

Global Proton Pump Inhibitors Market Competitive Landscape

The Global Proton Pump Inhibitors Market is characterized by a dynamic mix of regional and international players. Leading participants such as AstraZeneca PLC, Takeda Pharmaceutical Company Limited, Pfizer Inc., Johnson & Johnson, Novartis AG, Sanofi S.A., Bayer AG, GlaxoSmithKline PLC, Merck & Co., Inc., Boehringer Ingelheim GmbH, Mylan N.V., Teva Pharmaceutical Industries Limited, Hikma Pharmaceuticals PLC, Aurobindo Pharma Limited, Sun Pharmaceutical Industries Limited, Dr. Reddy's Laboratories Ltd., Cipla Ltd., Zydus Lifesciences Ltd., Bausch Health Companies Inc., Perrigo Company plc, Glenmark Pharmaceuticals Ltd., Eisai Co., Ltd., RedHill Biopharma Ltd., Torrent Pharmaceuticals Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Proton Pump Inhibitors Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Gastrointestinal Disorders:The rise in gastrointestinal disorders, such as gastroesophageal reflux disease (GERD) and peptic ulcers, is a significant growth driver for proton pump inhibitors (PPIs). In future, approximately 13% to 20% of the global population is expected to experience GERD symptoms, translating to over 1 billion individuals. This increasing prevalence necessitates effective treatment options, propelling the demand for PPIs, which are considered the first-line therapy for these conditions, thus driving market growth.

- Rising Geriatric Population:The global geriatric population is projected to reach over 1.5 billion in future, with individuals aged 65 and older being particularly susceptible to gastrointestinal disorders. This demographic shift is expected to increase the demand for PPIs, as older adults often experience higher incidences of acid-related diseases. The World Health Organization estimates that a majority of older adults suffer from at least one chronic condition, further driving the need for effective gastrointestinal treatments, including PPIs.

- Advancements in Drug Formulations:Continuous advancements in PPI formulations are enhancing their efficacy and safety profiles, contributing to market growth. For instance, the development of delayed-release formulations has improved patient compliance and therapeutic outcomes. In future, the introduction of new formulations is expected to increase the market share of PPIs by approximately $2 billion, as healthcare providers and patients seek more effective treatment options for gastrointestinal disorders, thus expanding the market landscape.

Market Challenges

- Patent Expirations of Key Drugs:The expiration of patents for leading PPIs, such as omeprazole and lansoprazole, poses a significant challenge to market growth. In future, it is estimated that generic versions of these drugs will account for over 50% of the market, leading to increased competition and reduced profit margins for branded products. This shift may hinder investment in new drug development, impacting the overall market dynamics and innovation in the PPI sector.

- Stringent Regulatory Requirements:The pharmaceutical industry faces rigorous regulatory scrutiny, which can delay the approval of new PPI formulations. In future, the average time for drug approval is projected to be around 12-15 months, significantly impacting the speed at which new products can enter the market. These stringent requirements can increase development costs and limit the ability of companies to respond quickly to market demands, posing a challenge to growth in the PPI market.

Global Proton Pump Inhibitors Market Future Outlook

The future of the proton pump inhibitors market appears promising, driven by increasing healthcare expenditure and a growing focus on preventive healthcare. As more patients seek effective treatments for gastrointestinal disorders, the demand for innovative PPI formulations is expected to rise. Additionally, the integration of digital health technologies will enhance patient monitoring and adherence, further supporting market growth. Companies that invest in research and development will likely lead the way in addressing unmet medical needs and capturing market share.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for PPIs. With rising disposable incomes and increasing healthcare access, the demand for effective gastrointestinal treatments is expected to surge. In future, these regions could contribute an additional $1.5 billion to the global PPI market, driven by a growing awareness of health and wellness among consumers.

- Development of Novel Drug Delivery Systems:The advancement of novel drug delivery systems, such as nanoparticles and sustained-release formulations, offers substantial opportunities for innovation in the PPI market. These technologies can enhance drug bioavailability and patient compliance. In future, the adoption of such systems is anticipated to increase market penetration by approximately $1 billion, as healthcare providers seek more effective and patient-friendly treatment options.