Region:Global

Author(s):Rebecca

Product Code:KRAA1473

Pages:98

Published On:August 2025

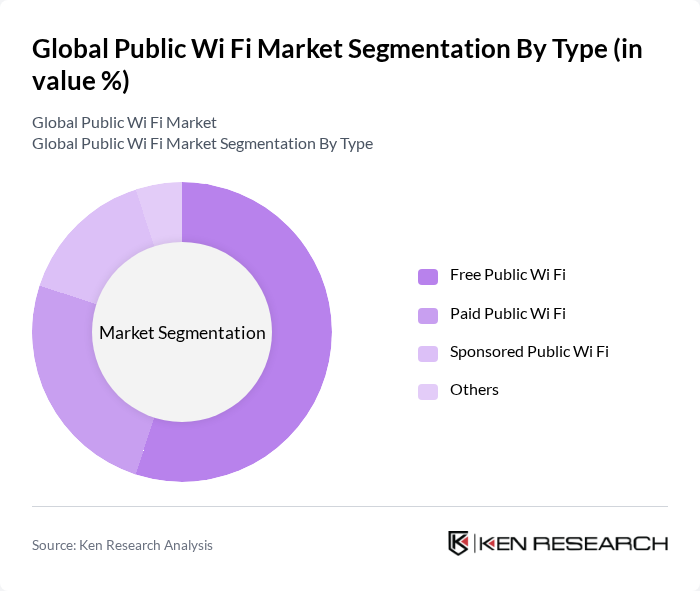

By Type:This segmentation includes Free Public Wi Fi, Paid Public Wi Fi, Sponsored Public Wi Fi, and Others. The Free Public Wi Fi sub-segment is currently dominating the market due to its widespread availability in urban areas, parks, and public transport hubs. Consumers increasingly prefer free access to the internet, which drives foot traffic to businesses and public spaces. Paid and sponsored options are also gaining traction, particularly in high-traffic areas where users are willing to pay for enhanced services or where businesses sponsor access to attract customers .

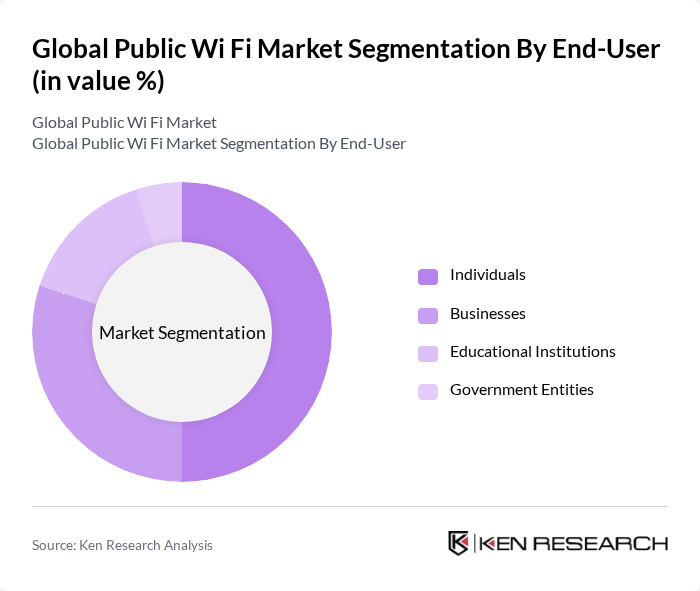

By End-User:This segmentation includes Individuals, Businesses, Educational Institutions, and Government Entities. The Individuals sub-segment is leading the market, driven by the increasing reliance on mobile devices for daily activities. The demand for public Wi Fi among individuals is fueled by the need for connectivity while commuting or in public spaces. Businesses are also leveraging public Wi Fi to enhance customer engagement, while educational institutions and government entities are focusing on providing accessible internet to support learning and public services .

The Global Public Wi Fi Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Aruba Networks, a Hewlett Packard Enterprise company, Ruckus Networks, a CommScope company, TP-Link Technologies Co., Ltd., Ubiquiti Inc., NETGEAR, Inc., D-Link Corporation, Extreme Networks, Inc., Huawei Technologies Co., Ltd., ZTE Corporation, Linksys, a division of Belkin International, Inc., Juniper Networks, Inc., Ericsson AB, Nokia Corporation, Qualcomm Technologies, Inc., Boingo Wireless, Inc., iPass Inc. (now part of Pareteum Corporation), Cloud4Wi, Inc., Purple WiFi (a Cisco Meraki Technology Partner), Fon Wireless Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of public Wi-Fi networks is poised for significant transformation, driven by advancements in technology and increasing urbanization. As cities continue to embrace smart technologies, the integration of 5G networks will enhance connectivity and user experience. Additionally, the growing emphasis on user privacy will lead to the development of more secure public Wi-Fi solutions. These trends indicate a robust evolution of public Wi-Fi, making it a critical component of urban infrastructure and connectivity strategies in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Free Public Wi Fi Paid Public Wi Fi Sponsored Public Wi Fi Others |

| By End-User | Individuals Businesses Educational Institutions Government Entities |

| By Location | Parks Airports Cafes and Restaurants Shopping Malls |

| By Service Provider | Telecom Operators Internet Service Providers Municipal Networks Technology Vendors |

| By Revenue Model | Subscription-Based Ad-Supported Pay-Per-Use Freemium |

| By User Demographics | Age Groups Income Levels Occupation Types Education Level |

| By Duration of Access | Short-Term Access Long-Term Access Unlimited Access Session-Based Access |

| By Geography | North America (United States, Canada, Mexico) South America (Brazil, Argentina, Rest of South America) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Parks and Recreational Areas | 100 | Facility Managers, City Planners |

| Transportation Hubs (Airports, Train Stations) | 70 | Operations Managers, IT Directors |

| Retail and Shopping Malls | 80 | Marketing Managers, Customer Experience Leads |

| Educational Institutions | 60 | IT Administrators, Campus Facility Managers |

| Healthcare Facilities | 50 | IT Managers, Administrative Heads |

The Global Public Wi-Fi Market is valued at approximately USD 27 billion, driven by the increasing demand for internet connectivity in public spaces, the rise of smart devices, and the trend of remote work and digital nomadism.