Region:Global

Author(s):Dev

Product Code:KRAC0527

Pages:99

Published On:August 2025

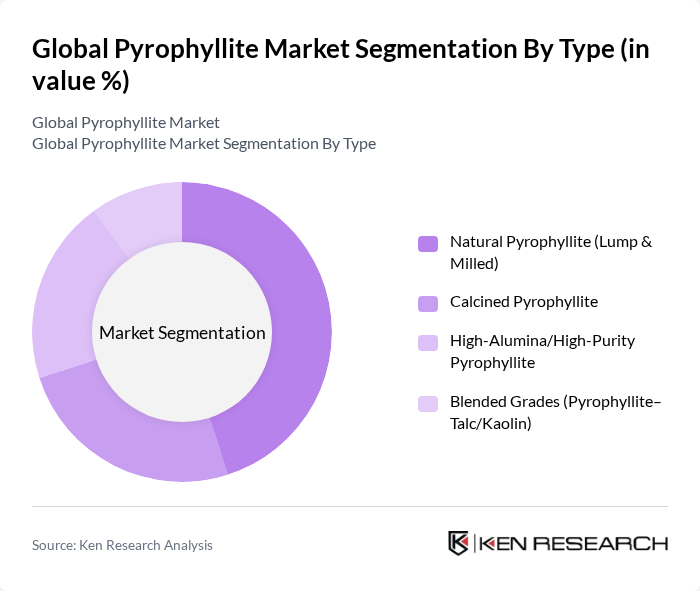

By Type:The pyrophyllite market is segmented into four main types: Natural Pyrophyllite (Lump & Milled), Calcined Pyrophyllite, High-Alumina/High-Purity Pyrophyllite, and Blended Grades (Pyrophyllite–Talc/Kaolin). Among these, Natural Pyrophyllite is the most dominant segment due to its wide application in ceramics and sanitaryware manufacturing. The demand for high-purity grades is also increasing, driven by the need for superior quality in industrial applications.

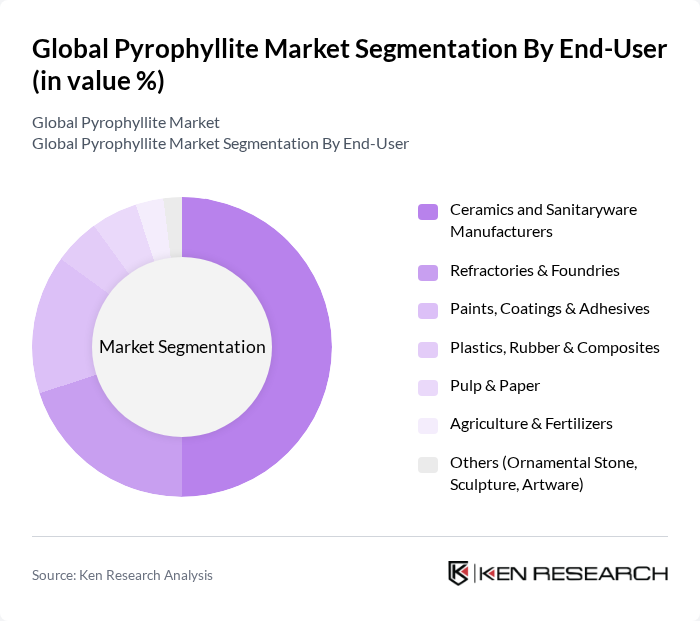

By End-User:The end-user segment includes Ceramics and Sanitaryware Manufacturers, Refractories & Foundries, Paints, Coatings & Adhesives, Plastics, Rubber & Composites, Pulp & Paper, Agriculture & Fertilizers, and Others (Ornamental Stone, Sculpture, Artware). The ceramics and sanitaryware manufacturers are the leading end-users, driven by the growing construction sector and the demand for high-quality ceramic products.

The Global Pyrophyllite Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imerys S.A., Ashapura Minechem Ltd., Sibelco, R.T. Vanderbilt Holding Company, Inc., SKKU Minerals Co., Ltd. (South Korea), The Ishwar Mining & Industrial Corporation, Kamlesh Minerals, Chirag Minerals, Anand Talc, Tsuchihashi Mining Co., Ltd. (Japan), PT Gunung Bale (Indonesia), Mineralstech Co., Ltd. (China), Oriental Minerals Co., Ltd. (South Korea), Destiny Chemicals (India), S.K. Sarawagi & Co. Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pyrophyllite market appears promising, driven by increasing demand across various industries and a shift towards sustainable practices. Innovations in extraction technologies are expected to enhance efficiency, while the growing preference for high-purity pyrophyllite will cater to specialized applications. Additionally, the expansion of emerging markets, particularly in Asia-Pacific, will provide new avenues for growth, as industries seek reliable sources of high-quality pyrophyllite to meet their evolving needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Pyrophyllite (Lump & Milled) Calcined Pyrophyllite High-Alumina/High-Purity Pyrophyllite Blended Grades (Pyrophyllite–Talc/Kaolin) |

| By End-User | Ceramics and Sanitaryware Manufacturers Refractories & Foundries Paints, Coatings & Adhesives Plastics, Rubber & Composites Pulp & Paper Agriculture & Fertilizers Others (Ornamental Stone, Sculpture, Artware) |

| By Application | Ceramics Body/Frits and Glazes Refractory Bricks, Monolithics & Kiln Furniture Industrial Mineral Fillers/Extenders (Paints, Paper, Insecticides) Rubber Dusting/Processing Aid and Roofing Fiberglass Batch Additive Soil Conditioner/Fertilizer Carrier Ornamental Stone & Architectural Uses |

| By Distribution Channel | Direct (Mine-to-Industry/Contract Supply) Industrial Mineral Distributors Traders/Exporters Online/Spot Platforms |

| By Region | Asia-Pacific (China, South Korea, Japan, India, Thailand, Rest of APAC) North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Russia, Rest of Europe) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA) |

| By Price Range | Commodity Grades (Bulk, Low- to Mid-Grade) Value-Added Grades (Micronized/Calcined) Specialty Grades (High-Purity/Customized Spec) |

| By Packaging Type | Bulk (Loose, Bulk Bags/Big Bags) Bagged (25–50 kg Sacks) Palletized/Containerized Loads |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ceramics Industry Usage | 100 | Production Managers, Materials Scientists |

| Paints and Coatings Sector | 80 | Product Development Managers, Quality Control Analysts |

| Cosmetics and Personal Care | 70 | Formulation Chemists, Brand Managers |

| Construction Materials | 90 | Project Managers, Procurement Specialists |

| Industrial Applications | 60 | Operations Managers, Technical Directors |

The Global Pyrophyllite Market is valued at approximately USD 75 million, driven by increasing demand in sectors such as ceramics, refractories, and industrial fillers, alongside growth in construction and automotive industries.