Region:Global

Author(s):Dev

Product Code:KRAA1528

Pages:96

Published On:August 2025

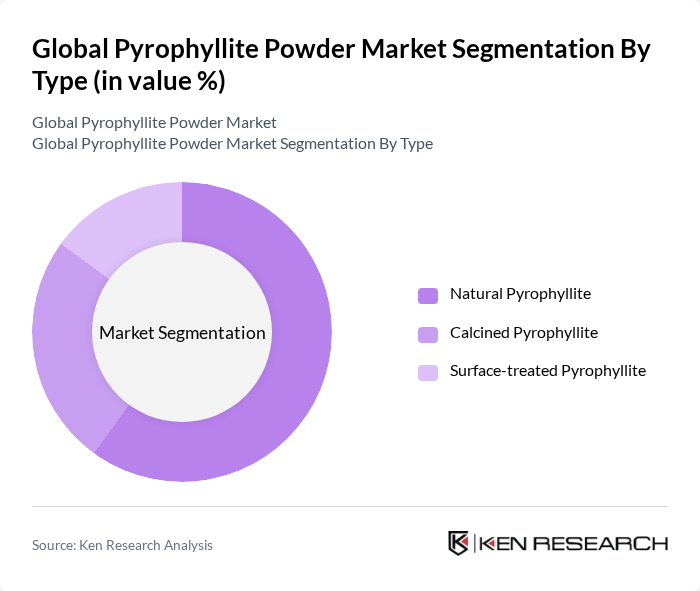

By Type:The market is segmented into three main types: Natural Pyrophyllite, Calcined Pyrophyllite, and Surface-treated Pyrophyllite. Among these, Natural Pyrophyllite is the dominant segment due to its wide application in ceramics and as a filler in various products. The demand for Natural Pyrophyllite is driven by its high thermal stability, low expansion, and chemical inertness, making it a preferred choice in industrial applications.

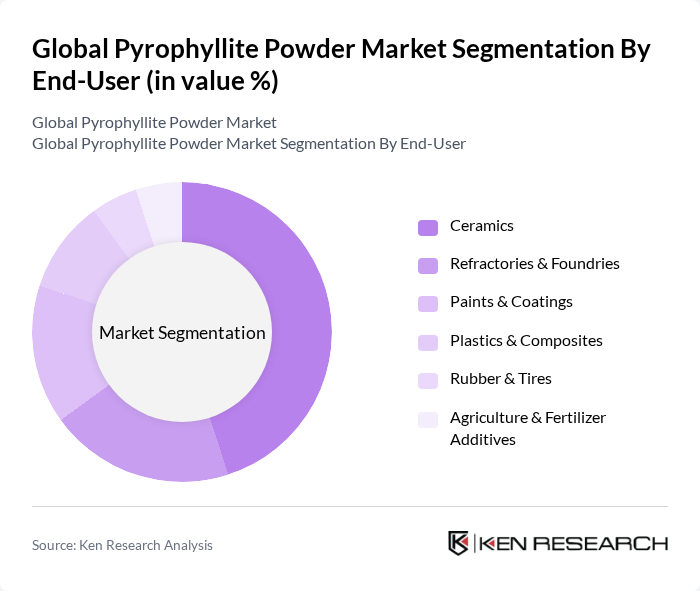

By End-User:The end-user segmentation includes Ceramics, Refractories & Foundries, Paints & Coatings, Plastics & Composites, Rubber & Tires, and Agriculture & Fertilizer Additives. The Ceramics segment holds the largest share, driven by the increasing demand for high-quality ceramic products in construction, consumer goods, and industrial applications. Growth in the ceramics industry, particularly in Asia-Pacific, is a significant factor contributing to the dominance of this segment.

The Global Pyrophyllite Powder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Imerys S.A., Sibelco, SKKU Minerals Pvt. Ltd., The Ishwar Mining & Industrial Corporation, Anand Talc, Chirag Minerals, Kamlesh Minerals, R.T. Vanderbilt Holding Company, Inc., Ashapura Minechem Ltd., Tsuchihashi Mining Co., Ltd., JLD Minerals, Wolkem India Ltd., Golchha Group (Golcha Minerals), Yimamura Kogyo Co., Ltd., and G&C Minerals (Gyeonggi & Chungcheong Minerals Co., South Korea) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pyrophyllite powder market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in processing techniques are expected to enhance product quality and reduce production costs. Additionally, the increasing focus on eco-friendly materials will likely boost demand for pyrophyllite in various industries. As emerging economies continue to develop, the market is poised for growth, with significant opportunities for companies that adapt to changing consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Natural Pyrophyllite Calcined Pyrophyllite Surface-treated Pyrophyllite |

| By End-User | Ceramics Refractories & Foundries Paints & Coatings Plastics & Composites Rubber & Tires Agriculture & Fertilizer Additives |

| By Application | Industrial Mineral Fillers (paper, insecticides, paints) Ceramics Bodies & Glazes Refractory Shapes & Monolithics Foundry Sand Additives Fiberglass Batch Additive Construction Materials (cement, tiles, ornamental stone) |

| By Distribution Channel | Direct Sales (mines to OEMs) Industrial Distributors Traders & Exporters |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Standard Grade High-Purity Grade Specialty Surface-Modified Grade |

| By Others | Specialty Applications (cosmetics, art/ornamental) Niche Markets (advanced ceramics, engineered fillers) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ceramics Industry Usage | 100 | Production Managers, Quality Control Supervisors |

| Paints and Coatings Sector | 80 | Product Development Managers, Procurement Specialists |

| Cosmetics and Personal Care | 70 | Formulation Chemists, Brand Managers |

| Construction Materials | 60 | Project Managers, Materials Engineers |

| Research and Development in Minerals | 40 | Geologists, R&D Directors |

The Global Pyrophyllite Powder Market is valued at approximately USD 1.7 billion, based on a five-year historical analysis. This valuation reflects the increasing demand for pyrophyllite in various industries, including ceramics, paints, and construction.