Region:Global

Author(s):Shubham

Product Code:KRAD0722

Pages:89

Published On:August 2025

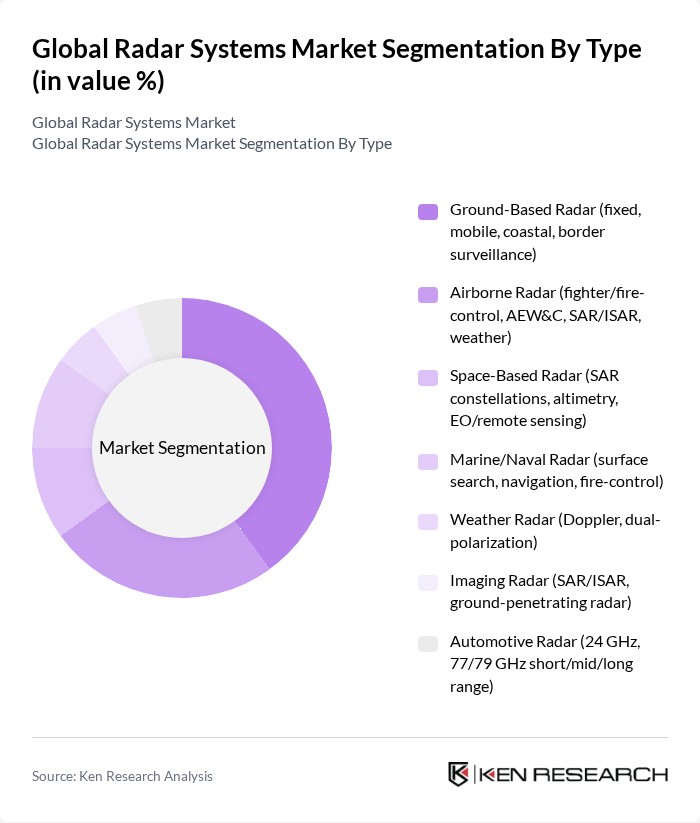

By Type:The radar systems market is segmented into various types, including Ground-Based Radar, Airborne Radar, Space-Based Radar, Marine/Naval Radar, Weather Radar, Imaging Radar, and Automotive Radar. Among these, Ground-Based Radar is currently the leading segment due to its extensive use in defense applications, border surveillance, and critical infrastructure monitoring. The demand for Airborne Radar is also significant, driven by advancements in military aircraft and air traffic management systems. The increasing need for real-time data and situational awareness in defense and civilian sectors is propelling the growth of these segments.

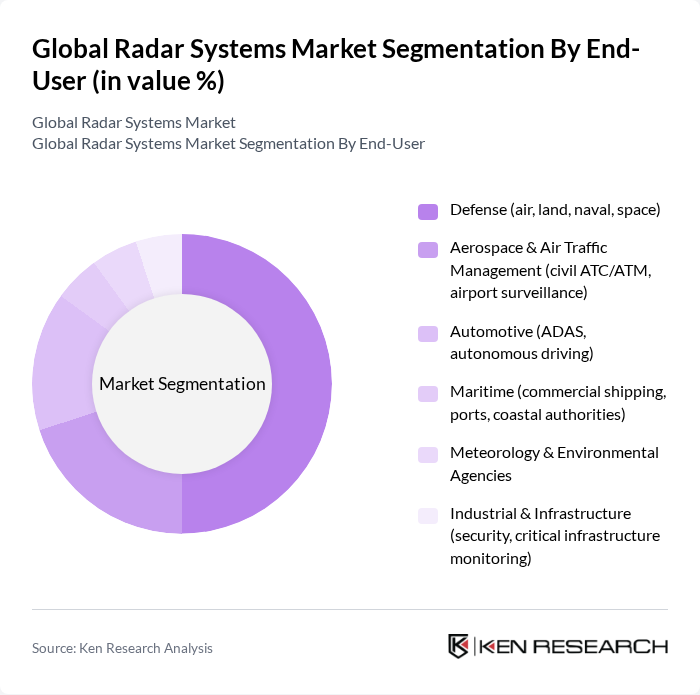

By End-User:The end-user segmentation of the radar systems market includes Defense, Aerospace & Air Traffic Management, Automotive, Maritime, Meteorology & Environmental Agencies, and Industrial & Infrastructure. The Defense sector is the dominant end-user, driven by the increasing need for advanced surveillance and reconnaissance capabilities. The Aerospace & Air Traffic Management segment is also growing, fueled by the rising air traffic and the need for efficient airspace management. The demand for radar systems in automotive applications is on the rise, particularly with the development of advanced driver-assistance systems (ADAS) and autonomous vehicles.

The Global Radar Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as RTX Corporation (Raytheon), Northrop Grumman Corporation, Lockheed Martin Corporation, Thales Group, BAE Systems plc, Leonardo S.p.A., Saab AB, Elbit Systems Ltd., HENSOLDT AG, General Dynamics Corporation, L3Harris Technologies, Inc., Mitsubishi Electric Corporation, Collins Aerospace (an RTX business), Honeywell International Inc., Rheinmetall AG, Israel Aerospace Industries (ELTA Systems), Indra Sistemas, S.A., NEC Corporation, Fujitsu Limited, Toshiba Infrastructure Systems & Solutions Corporation, Almaz-Antey Concern, Reutech Radar Systems, Telephonics Corporation, TERMA A/S, Kelvin Hughes Limited (HENSOLDT UK) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the radar systems market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of artificial intelligence and the Internet of Things is expected to enhance radar capabilities, making systems more efficient and versatile. Additionally, the growing focus on autonomous vehicles will likely spur demand for advanced radar technologies, as these systems are crucial for navigation and safety. Overall, the market is poised for significant growth as industries adapt to evolving technological landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Ground-Based Radar (fixed, mobile, coastal, border surveillance) Airborne Radar (fighter/fire-control, AEW&C, SAR/ISAR, weather) Space-Based Radar (SAR constellations, altimetry, EO/remote sensing) Marine/Naval Radar (surface search, navigation, fire-control) Weather Radar (Doppler, dual-polarization) Imaging Radar (SAR/ISAR, ground-penetrating radar) Automotive Radar (24 GHz, 77/79 GHz short/mid/long range) |

| By End-User | Defense (air, land, naval, space) Aerospace & Air Traffic Management (civil ATC/ATM, airport surveillance) Automotive (ADAS, autonomous driving) Maritime (commercial shipping, ports, coastal authorities) Meteorology & Environmental Agencies Industrial & Infrastructure (security, critical infrastructure monitoring) |

| By Application | Surveillance & Early Warning (air/missile defense, border, maritime domain awareness) Navigation & Collision Avoidance (aviation, maritime, automotive) Target Detection, Tracking & Fire Control Weather Monitoring & Nowcasting Air Traffic Control & Airport Surface Movement Remote Sensing & Mapping (SAR, terrain mapping, interferometry) |

| By Component | Transmitters/Power Amplifiers (TWT, GaN/GaAs solid-state) Receivers Antennas (mechanically scanned, AESA, PESA) Signal & Data Processors (DSP/FPGA, AI/ML-enabled) RF Front-End & Modules (TRMs, frequency synthesizers) Software (signal processing, tracking, visualization) |

| By Sales Channel | Direct Government Programs & Prime Contracts OEM Sales to Platform Integrators (aircraft, shipyards, vehicle OEMs) Distributors/Value-Added Resellers (commercial/industrial) Aftermarket & MRO Services |

| By Distribution Mode | Offline (tenders, G2B/B2B contracts) Online (spare parts, developer SDKs, commercial modules) Hybrid (framework agreements with digital support) |

| By Price Range | Entry-Level Modules & Sensors (automotive, industrial) Mid-Range Systems (ATC, maritime, weather) High-End/Military-Grade Systems (AESA, multi-function, BMD) Services & Upgrades (software, retrofit, lifecycle support) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Radar Systems | 120 | Defense Analysts, Military Procurement Officers |

| Civil Aviation Radar Solutions | 100 | Aviation Safety Managers, Air Traffic Control Supervisors |

| Maritime Surveillance Systems | 80 | Coast Guard Officials, Maritime Security Experts |

| Weather Radar Technologies | 70 | Meteorologists, Environmental Scientists |

| Automotive Radar Applications | 90 | Automotive Engineers, Safety System Designers |

The Global Radar Systems Market is valued at approximately USD 40 billion, driven by advancements in technology, increasing defense budgets, and rising demand for surveillance and reconnaissance systems across various sectors, including automotive and weather monitoring.