Region:Global

Author(s):Geetanshi

Product Code:KRAA0132

Pages:93

Published On:August 2025

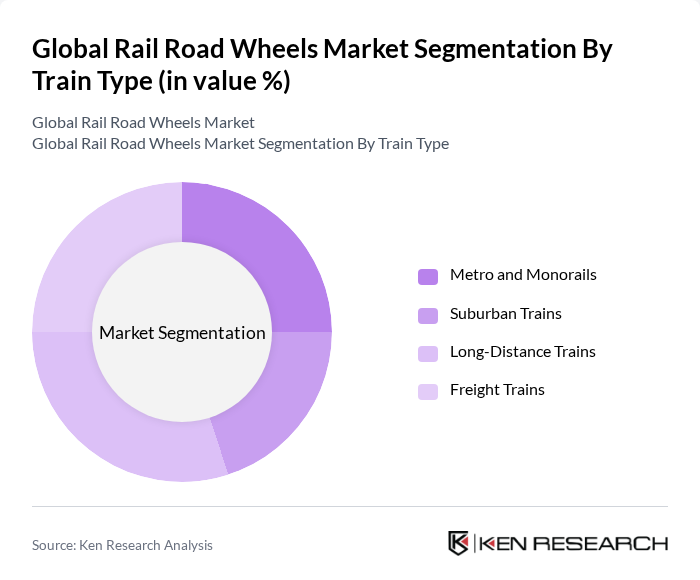

By Train Type:The train type segmentation includes Metro and Monorails, Suburban Trains, Long-Distance Trains, and Freight Trains. Among these, the Freight Trains sub-segment is a major contributor to market demand due to the increasing need for efficient goods transportation. The rise in e-commerce, global trade, and industrial output has led to a surge in freight transport, necessitating the use of durable and high-performance rail wheels. Investments in freight infrastructure, logistics networks, and modernization of rolling stock further support this trend. Meanwhile, urbanization and public transit expansion are also driving demand for metro and suburban train wheels.

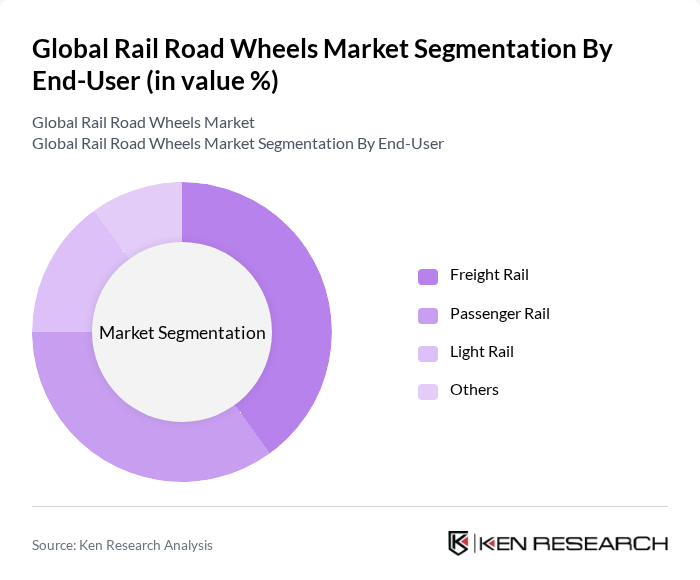

By End-User:The end-user segmentation encompasses Freight Rail, Passenger Rail, Light Rail, and Others. The Freight Rail sub-segment leads the market, driven by the increasing demand for freight transportation across various industries. Growth in e-commerce, industrial production, and the need for efficient supply chain solutions have significantly boosted demand for freight rail services, leading to a higher requirement for robust rail wheels that can withstand heavy loads and frequent use. Passenger Rail and Light Rail segments are also growing, supported by urbanization and investments in public transit systems.

The Global Rail Road Wheels Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amsted Rail Company, Inc., Nippon Steel Corporation, Lucchini RS S.p.A., Interpipe Group, GHH-BONATRANS Group, Maanshan Iron and Steel Company Limited (Maanshan Wheel Division), Taiyuan Heavy Industry Co., Ltd. (TYHI), Bharat Forge Limited, Bochumer Verein Verkehrstechnik GmbH (BVV), CAF MiiRA (CAF Group), OMK Steel (United Metallurgical Company), Sumitomo Metal Industries, Ltd., Kolowag AD, Rail Wheel Factory (Indian Railways), Arrium Mining and Materials (OneSteel) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the rail road wheels market appears promising, driven by ongoing technological advancements and increasing government support for rail infrastructure. As urbanization continues to rise, the demand for efficient rail transport solutions will likely grow. Furthermore, the integration of smart technologies and lightweight materials in wheel design is expected to enhance performance and safety. These trends will create a dynamic environment for innovation and investment, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Train Type | Metro and Monorails Suburban Trains Long-Distance Trains Freight Trains |

| By End-User | Freight Rail Passenger Rail Light Rail Others |

| By Application | Urban Transit Intercity Transport Heavy Haul Others |

| By Material | Steel Cast Iron Composite Materials Others |

| By Manufacturing Process | Forging Casting Machining Others |

| By Region | North America Europe Asia-Pacific South America Middle East & Africa |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Rail Wheel Manufacturers | 60 | Production Managers, Quality Assurance Leads |

| Passenger Rail Operators | 50 | Operations Directors, Fleet Managers |

| Rail Maintenance Service Providers | 40 | Maintenance Supervisors, Technical Directors |

| Rail Industry Consultants | 40 | Industry Analysts, Strategic Advisors |

| Government Transportation Officials | 40 | Policy Makers, Regulatory Affairs Managers |

The Global Rail Road Wheels Market is valued at approximately USD 4.6 billion, driven by increasing demand for rail transportation, urbanization, and investments in railway infrastructure. This growth reflects a significant trend towards efficient and sustainable transport solutions.