Region:Global

Author(s):Geetanshi

Product Code:KRAA1301

Pages:81

Published On:August 2025

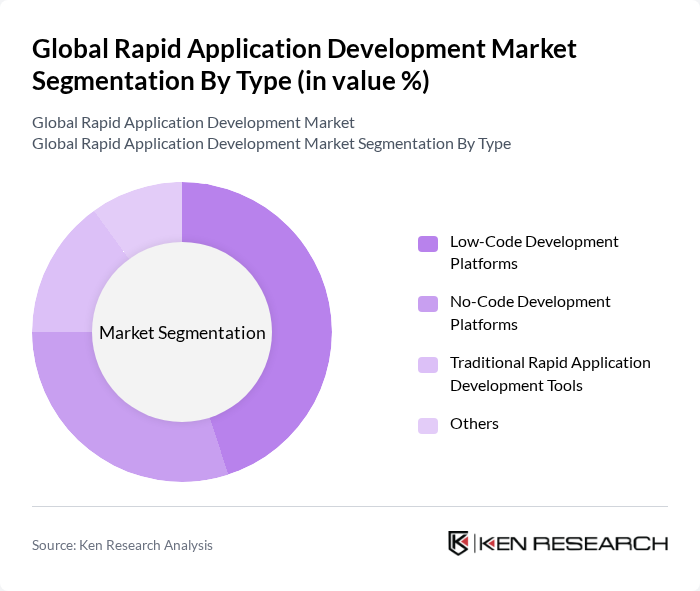

By Type:The rapid application development market is segmented into four main types: Low-Code Development Platforms, No-Code Development Platforms, Traditional Rapid Application Development Tools, and Others. Among these, Low-Code Development Platforms are experiencing the highest adoption due to their ability to accelerate development cycles while supporting customization and integration. Businesses favor these platforms to streamline application development efforts, reduce reliance on specialized coding skills, and address evolving business needs more rapidly .

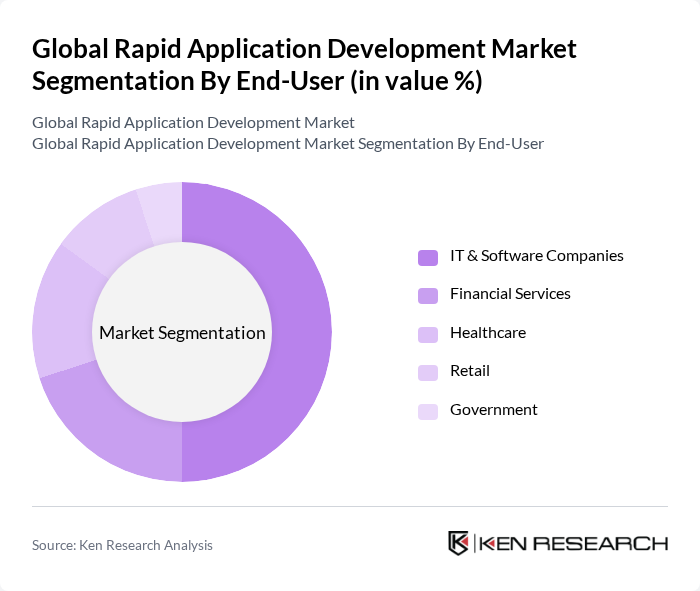

By End-User:The end-user segment of the rapid application development market includes IT & Software Companies, Financial Services, Healthcare, Retail, Government, and Others. IT & Software Companies are the dominant end-users, driven by the necessity for rapid development cycles to keep pace with technological advancements and shifting customer expectations. The increasing adoption of agile and iterative development methodologies in these firms further accelerates the uptake of rapid application development tools .

The Global Rapid Application Development Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce.com, Inc., Microsoft Corporation, OutSystems, Mendix, Appian Corporation, Pegasystems Inc., Betty Blocks, Zoho Corporation, Google LLC, IBM Corporation, Oracle Corporation, ServiceNow, Inc., Quickbase, Inc., Kintone Corporation, Nintex Global Ltd., Kissflow Inc., LANSA Inc., Kony, Inc. (now Temenos), MatsSoft Ltd. (now Netcall), ORO Labs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the rapid application development market appears promising, driven by technological advancements and evolving business needs. The integration of artificial intelligence and machine learning into development processes is expected to enhance automation and efficiency. Additionally, the growing emphasis on user experience design will shape the development landscape, pushing companies to prioritize intuitive interfaces. As organizations continue to embrace digital transformation, the demand for rapid application development tools will likely increase, fostering innovation and agility in software development.

| Segment | Sub-Segments |

|---|---|

| By Type | Low-Code Development Platforms No-Code Development Platforms Traditional Rapid Application Development Tools Others |

| By End-User | IT & Software Companies Financial Services Healthcare Retail Government Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Application | Mobile Applications Web Applications Enterprise Applications Others |

| By Industry Vertical | Banking, Financial Services, and Insurance (BFSI) IT & Telecommunications Healthcare Retail & E-commerce Manufacturing Education Entertainment & Media Government Others |

| By Business Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Application Development | 100 | IT Managers, Software Developers |

| Financial Services Rapid Development | 80 | Product Managers, Compliance Officers |

| Retail Software Solutions | 90 | Operations Managers, E-commerce Directors |

| Education Technology Platforms | 60 | Instructional Designers, IT Coordinators |

| Manufacturing Process Automation | 50 | Process Engineers, IT Directors |

The Global Rapid Application Development Market is valued at approximately USD 52 billion, driven by the increasing demand for faster application delivery and the adoption of low-code and no-code platforms that enable non-technical users to build applications efficiently.