Region:Global

Author(s):Geetanshi

Product Code:KRAC0090

Pages:93

Published On:August 2025

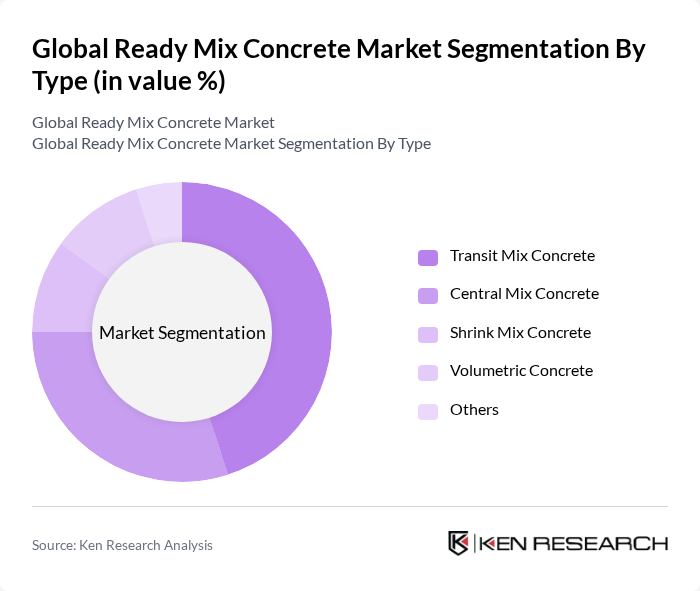

By Type:The ready mix concrete market is segmented into Transit Mix Concrete, Central Mix Concrete, Shrink Mix Concrete, Volumetric Concrete, and Others. Transit Mix Concrete is the most widely used due to its convenience and efficiency in transportation and on-site mixing. Central Mix Concrete is gaining traction in large-scale projects where stringent quality control is required. Shrink Mix Concrete is increasingly used for specialized construction projects that demand precise material properties .

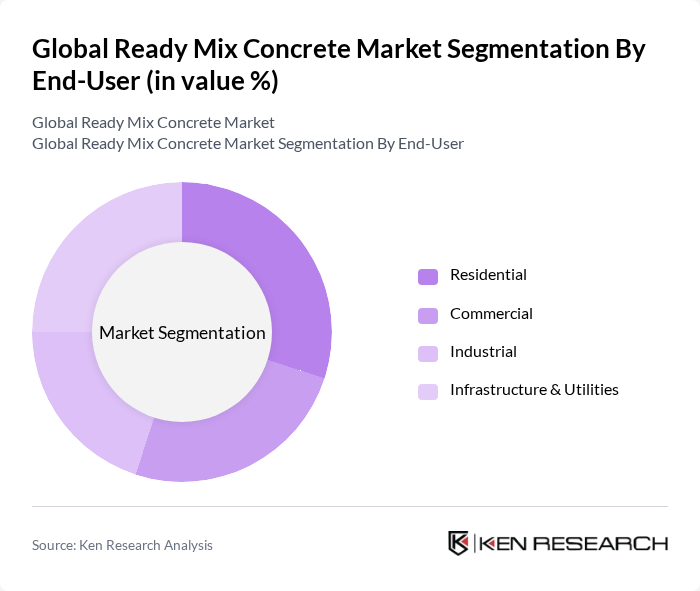

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Infrastructure & Utilities. The Infrastructure & Utilities segment is the largest, driven by global investments in infrastructure projects such as roads, bridges, and public utilities. The Residential segment is significant due to rising demand for housing and urban development. Commercial construction is expanding steadily, supported by economic growth and urbanization trends. Industrial applications are also increasing, particularly in regions investing in manufacturing and logistics infrastructure .

The Global Ready Mix Concrete Market is characterized by a dynamic mix of regional and international players. Leading participants such as CEMEX S.A.B. de C.V., Holcim Ltd., CRH plc, Heidelberg Materials AG, Buzzi Unicem S.p.A., Martin Marietta Materials, Inc., Vulcan Materials Company, Aggregate Industries (a member of Holcim Group), Tarmac (a CRH company), Sika AG, UltraTech Cement Limited, Rinker Group Limited, U.S. Concrete, Inc., CEMEX Holdings Philippines, Inc., Concrete Supply Co., LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ready mix concrete market appears promising, driven by ongoing urbanization and infrastructure investments. As cities expand, the demand for high-quality concrete solutions will continue to rise. Additionally, the increasing focus on sustainability and smart construction practices will likely lead to innovations in concrete technology, enhancing performance and reducing environmental impact. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Transit Mix Concrete Central Mix Concrete Shrink Mix Concrete Volumetric Concrete Others |

| By End-User | Residential Commercial Industrial Infrastructure & Utilities |

| By Application | Infrastructure Projects (Bridges, Roads, Dams) Residential Construction Commercial Buildings Industrial Facilities |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low Price Mid Price High Price |

| By Sustainability Features | Recycled Content Low Carbon Footprint Energy Efficiency Use of Supplementary Cementitious Materials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Supervisors |

| Commercial Building Developments | 80 | Construction Managers, Architects |

| Infrastructure and Public Works | 60 | Government Officials, Civil Engineers |

| Ready Mix Concrete Suppliers | 50 | Sales Managers, Operations Directors |

| Research and Development in Concrete Technology | 40 | R&D Managers, Material Scientists |

The Global Ready Mix Concrete Market is valued at approximately USD 810 billion, driven by increasing infrastructure development, urbanization, and construction activities across various sectors, including residential, commercial, and industrial.