Region:Global

Author(s):Dev

Product Code:KRAA1674

Pages:92

Published On:August 2025

By Type:

The Real-Time PCR (qPCR) segment is currently dominating the market due to its widespread application in clinical diagnostics, particularly in infectious disease detection and genetic testing. The technology's ability to provide quantitative results in real-time has made it a preferred choice among laboratories. Additionally, the increasing adoption of qPCR in research and drug discovery further solidifies its leading position. The demand for rapid and accurate diagnostic tools continues to drive growth in this segment, making it essential for healthcare providers and researchers alike.

By Application:

The Clinical Diagnostics application segment leads the market, driven by the increasing incidence of infectious diseases and the growing emphasis on early diagnosis and personalized medicine. The rise in genetic testing for hereditary diseases and oncology has further propelled this segment's growth. Additionally, advancements in PCR technology have enhanced the sensitivity and specificity of diagnostic tests, making them indispensable in clinical settings. As healthcare providers seek to improve patient outcomes, the demand for reliable and efficient diagnostic solutions continues to rise.

The Global Real Time Pcr Digital Pcr And End Point Pcr Market market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd (Roche Diagnostics), Agilent Technologies, Inc., QIAGEN N.V., Abbott Laboratories, Revvity, Inc. (formerly PerkinElmer, Inc.), BGI Genomics Co., Ltd., Merck KGaA (Merck Life Science), Takara Bio Inc., Promega Corporation, Danaher Corporation (Beckman Coulter Life Sciences), Eppendorf SE, LGC Limited, Biomérieux SA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the PCR market is poised for significant advancements, driven by technological innovations and evolving healthcare needs. The integration of artificial intelligence in PCR processes is expected to enhance accuracy and efficiency, while the shift towards point-of-care testing will facilitate rapid diagnostics in diverse settings. Additionally, the expansion of PCR applications in personalized medicine will further drive market growth, as healthcare providers increasingly seek tailored treatment solutions based on genetic insights.

| Segment | Sub-Segments |

|---|---|

| By Type | Real-Time PCR (qPCR) Digital PCR (dPCR) End-Point PCR (Conventional PCR) Multiplex and High-Throughput PCR |

| By Application | Clinical Diagnostics (Infectious Diseases, Oncology, Genetic Testing) Research and Drug Discovery Applied Testing (Food Safety, Environmental, Veterinary, Forensics) Others (Agrigenomics, Biodefense) |

| By End-User | Hospitals and Clinics Diagnostic Laboratories and Reference Labs Academic and Research Institutes Pharmaceutical & Biotechnology Companies |

| By Component | Instruments/Systems Reagents & Kits Consumables (Plastics, Plates, Tubes, Tips) Software & Services |

| By Sales Channel | Direct Sales (OEM) Authorized Distributors/Dealers E-commerce/Online Sales Tender/Institutional Sales |

| By Distribution Mode | Retail Distribution (Specialty Lab Suppliers) Wholesale/B2B Distribution E-commerce Marketplaces Hybrid (Direct + Channel Partners) |

| By Price Range | Low Price (Entry-level benchtop systems, basic kits) Mid Price (Mainstream lab systems, mid-throughput kits) High Price (High-throughput, digital PCR platforms) Enterprise/Custom (Integrated automated workflows) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Diagnostics Laboratories | 150 | Laboratory Managers, Clinical Pathologists |

| Research Institutions | 120 | Research Scientists, Lab Technicians |

| Biotechnology Firms | 90 | Product Development Managers, R&D Directors |

| Healthcare Providers | 80 | Medical Directors, Diagnostic Coordinators |

| Regulatory Bodies | 50 | Regulatory Affairs Specialists, Compliance Officers |

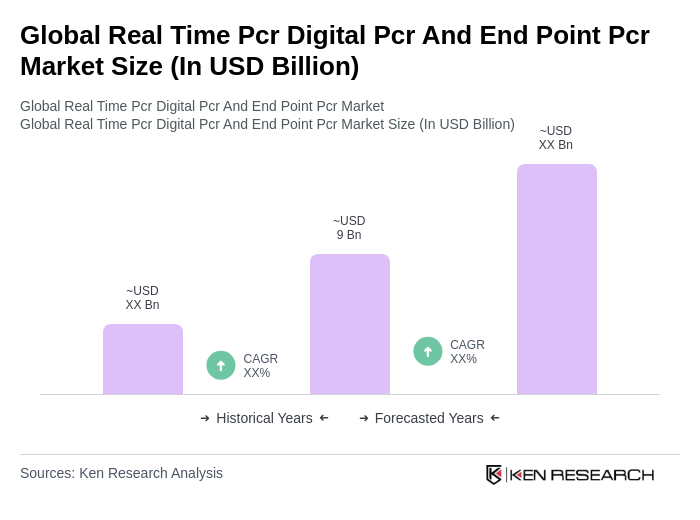

The Global Real Time PCR, Digital PCR, and End Point PCR market is valued at approximately USD 9 billion, reflecting a significant growth driven by advancements in molecular diagnostics and the increasing prevalence of infectious diseases.