Region:Global

Author(s):Rebecca

Product Code:KRAA2127

Pages:96

Published On:August 2025

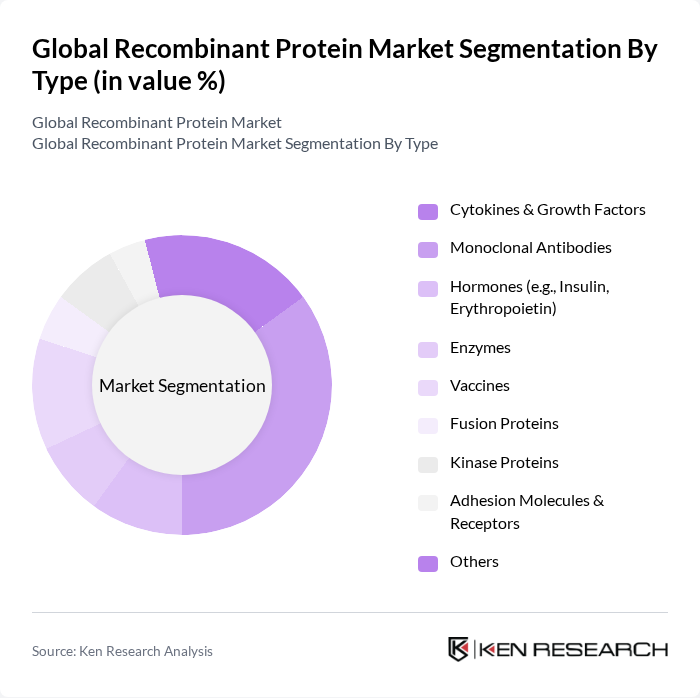

By Type:The recombinant protein market is segmented into various types, including Cytokines & Growth Factors, Monoclonal Antibodies, Hormones (e.g., Insulin, Erythropoietin), Enzymes, Vaccines, Fusion Proteins, Kinase Proteins, Adhesion Molecules & Receptors, and Others. Among these, Monoclonal Antibodies are leading the market due to their widespread application in therapeutics, particularly in oncology and autoimmune diseases. The increasing prevalence of these conditions and the growing demand for targeted therapies are driving the growth of this sub-segment. Cytokines & Growth Factors also hold a significant share, especially in cancer, immunology, and infectious disease research.

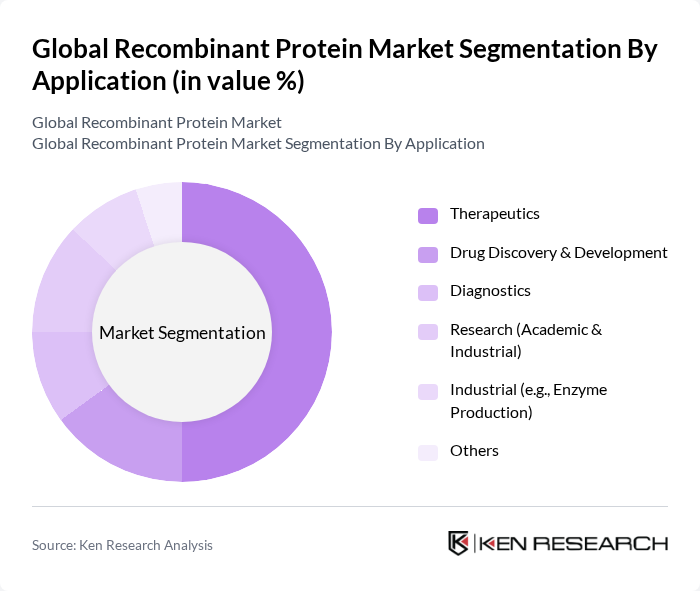

By Application:The applications of recombinant proteins are diverse, including Therapeutics, Drug Discovery & Development, Diagnostics, Research (Academic & Industrial), Industrial (e.g., Enzyme Production), and Others. The Therapeutics segment is the most significant, driven by the increasing demand for biologics in treating chronic diseases and the growing focus on personalized medicine. This trend is further supported by advancements in biotechnology and the rising prevalence of various health conditions. Drug discovery and development also represent a major application area, reflecting the market’s role in accelerating pharmaceutical innovation.

The Global Recombinant Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Genentech, Inc. (Roche Group), Merck KGaA, Pfizer Inc., Novartis AG, Sanofi S.A., F. Hoffmann-La Roche AG, Eli Lilly and Company, Regeneron Pharmaceuticals, Inc., Takeda Pharmaceutical Company Limited, Bayer AG, AbbVie Inc., GSK plc, Biogen Inc., CSL Limited, Thermo Fisher Scientific Inc., Bio-Techne Corporation, Sino Biological, Inc., GenScript Biotech Corporation, Abcam plc, ACROBiosystems, Proteintech Group, Inc., Enzo Life Sciences, Inc., RayBiotech Life, Inc., STEMCELL Technologies Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the recombinant protein market in None appears promising, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence in drug development is expected to streamline processes, enhancing efficiency and reducing costs. Additionally, the growing focus on personalized medicine will likely create new avenues for recombinant protein applications, catering to specific patient needs and improving treatment outcomes in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Cytokines & Growth Factors Monoclonal Antibodies Hormones (e.g., Insulin, Erythropoietin) Enzymes Vaccines Fusion Proteins Kinase Proteins Adhesion Molecules & Receptors Others |

| By Application | Therapeutics Drug Discovery & Development Diagnostics Research (Academic & Industrial) Industrial (e.g., Enzyme Production) Others |

| By End-User | Pharmaceutical & Biopharmaceutical Companies Biotechnology Companies Academic & Research Institutes Contract Research Organizations (CROs) Contract Manufacturing Organizations (CMOs) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Product Formulation | Liquid Formulations Lyophilized (Freeze-Dried) Formulations Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharmaceutical Development | 120 | R&D Directors, Biotech Scientists |

| Clinical Research Applications | 90 | Clinical Trial Managers, Regulatory Affairs Specialists |

| Production and Manufacturing | 70 | Production Managers, Quality Control Analysts |

| Market Access and Commercialization | 60 | Market Access Managers, Business Development Executives |

| Academic and Research Institutions | 50 | University Professors, Research Lab Managers |

The Global Recombinant Protein Market is valued at approximately USD 3.5 billion, driven by advancements in biotechnology and the increasing prevalence of chronic diseases, including cancer and diabetes, alongside a rising demand for personalized medicine.