Region:Global

Author(s):Dev

Product Code:KRAC0339

Pages:90

Published On:August 2025

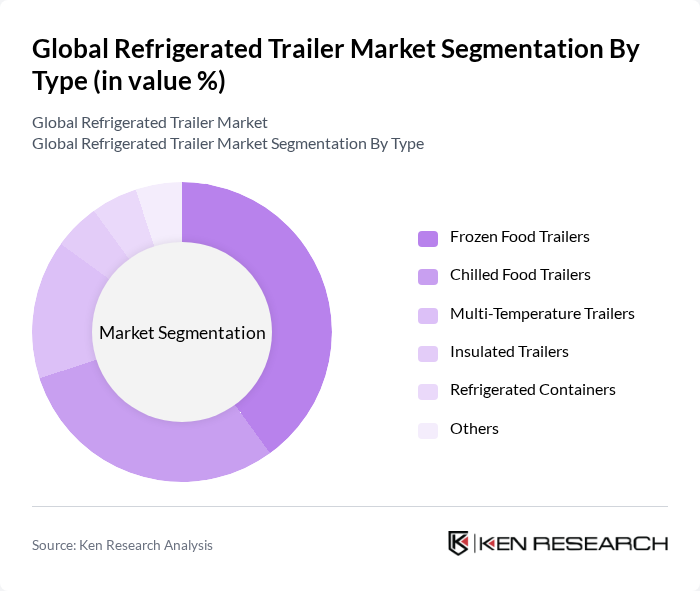

By Type:The market is segmented into various types of refrigerated trailers, including Frozen Food Trailers, Chilled Food Trailers, Multi-Temperature Trailers, Insulated Trailers, Refrigerated Containers, and Others. Among these, Frozen Food Trailers hold the largest share, driven by rising demand for frozen food products and changing consumer lifestyles favoring convenience. Chilled Food Trailers also maintain a significant share, serving the need for fresh produce and dairy products. Multi-Temperature Trailers are gaining traction due to their versatility in transporting goods at varying temperatures, making them a preferred choice for logistics companies handling mixed loads.

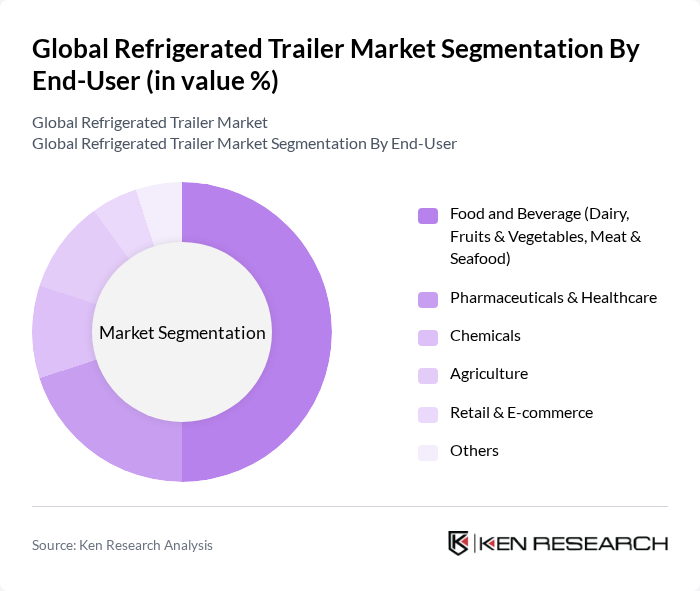

By End-User:The end-user segmentation includes Food and Beverage (Dairy, Fruits & Vegetables, Meat & Seafood), Pharmaceuticals & Healthcare, Chemicals, Agriculture, Retail & E-commerce, and Others. The Food and Beverage sector is the dominant end-user, propelled by increased consumption of perishable goods and the need for efficient cold chain logistics. Pharmaceuticals & Healthcare is also significant, requiring strict temperature control for sensitive medical products. Retail & E-commerce is rapidly growing, fueled by the expansion of online grocery shopping and home delivery services.

The Global Refrigerated Trailer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Utility Trailer Manufacturing Company, Wabash National Corporation, Great Dane Trailers, Thermo King Corporation, Carrier Transicold, Fruehauf Trailer Corporation, Kögel Trailer GmbH & Co. KG, Schmitz Cargobull AG, Hyundai Translead, Dorsey Trailers, Montracon Ltd., Morgan Corporation, Gray & Adams Ltd., Lamberet Refrigerated SAAS, Fahrzeugwerk Bernard KRONE GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the refrigerated trailer market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As sustainability becomes a priority, companies are increasingly adopting electric refrigerated trailers, which are projected to reduce operational costs and emissions. Furthermore, the integration of IoT technology will enhance supply chain visibility, allowing for better temperature control and monitoring. These trends indicate a shift towards more efficient and environmentally friendly refrigerated transport solutions, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Frozen Food Trailers Chilled Food Trailers Multi-Temperature Trailers Insulated Trailers Refrigerated Containers Others |

| By End-User | Food and Beverage (Dairy, Fruits & Vegetables, Meat & Seafood) Pharmaceuticals & Healthcare Chemicals Agriculture Retail & E-commerce Others |

| By Payload Capacity | Less than 10,000 lbs ,000 - 20,000 lbs ,000 - 30,000 lbs More than 30,000 lbs |

| By Trailer Size | Standard Size Trailers Custom Size Trailers |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America (United States, Canada) Europe (Germany, United Kingdom, France, Russia, Spain, Rest of Europe) Asia-Pacific (India, China, Japan, South Korea, Rest of Asia-Pacific) Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Logistics | 100 | Logistics Managers, Supply Chain Analysts |

| Pharmaceutical Transport Solutions | 70 | Operations Directors, Compliance Officers |

| Cold Chain Technology Providers | 50 | Product Managers, Technical Directors |

| Retail Sector Refrigerated Logistics | 90 | Supply Chain Managers, Procurement Specialists |

| Refrigerated Trailer Manufacturers | 40 | Engineering Managers, Sales Directors |

The Global Refrigerated Trailer Market was valued at approximately USD 7.2 billion, driven by the increasing demand for temperature-sensitive goods, particularly in the food and pharmaceutical sectors, as well as the growth of e-commerce and logistics services.