Region:Global

Author(s):Dev

Product Code:KRAD0536

Pages:97

Published On:August 2025

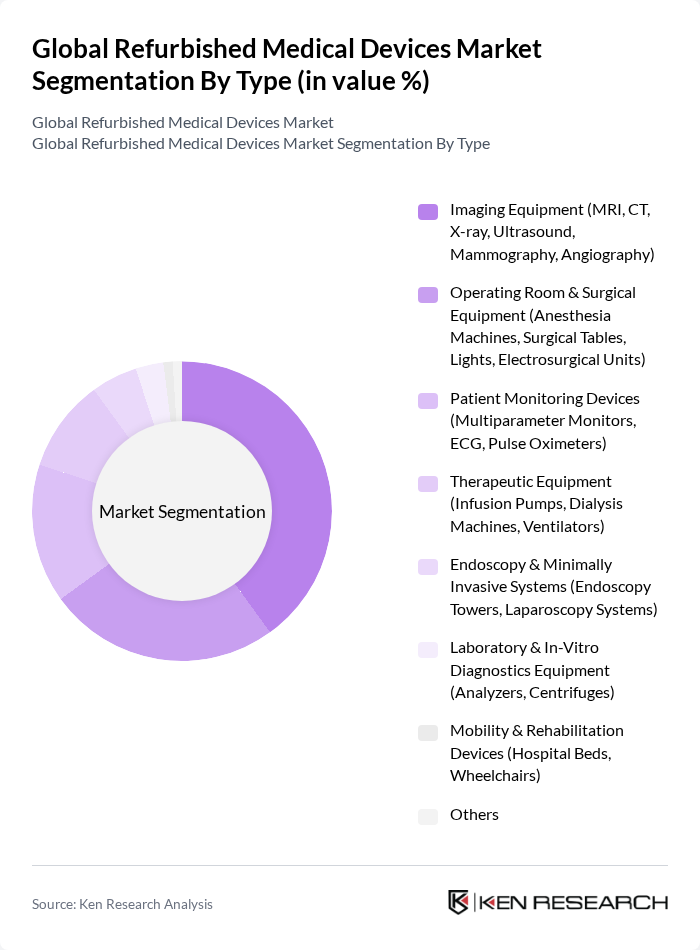

By Type:The market is segmented into various types of refurbished medical devices, including Imaging Equipment, Operating Room & Surgical Equipment, Patient Monitoring Devices, Therapeutic Equipment, Endoscopy & Minimally Invasive Systems, Laboratory & In-Vitro Diagnostics Equipment, Mobility & Rehabilitation Devices, and Others. Among these, Imaging Equipment is the most dominant segment due to its critical role in diagnostics and the high cost of new imaging technologies, prompting healthcare providers to opt for refurbished alternatives.

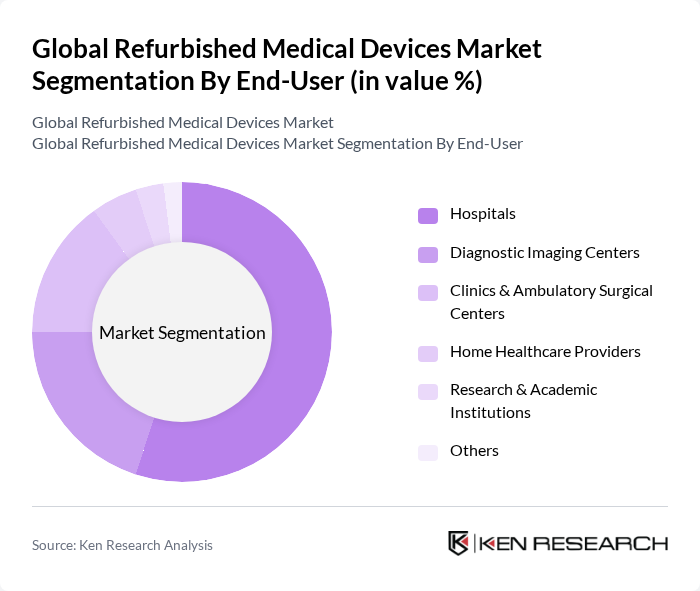

By End-User:The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Clinics & Ambulatory Surgical Centers, Home Healthcare Providers, Research & Academic Institutions, and Others. Hospitals are the leading end-user segment, driven by the increasing need for cost-effective medical solutions and the growing prevalence of chronic diseases that require advanced diagnostic and therapeutic equipment.

The Global Refurbished Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as GE HealthCare (GoldSeal Refurbished Systems), Siemens Healthineers (Certified Refurbished Systems), Philips (Certified Pre?Owned / Diamond Select), Canon Medical Systems (SecondLife), Fujifilm Healthcare, Agiliti, Inc., Stryker (Medical Equipment & Beds; Stryker Global Sustainability Solutions), Medtronic (Selected Therapeutic Systems Refurbishment), Johnson & Johnson MedTech (including Ethicon/DePuy platforms), Baxter International (including Hillrom), Mindray, Hologic, Inc., Olympus Corporation, Varian (a Siemens Healthineers company), Avante Health Solutions (formerly DRE Medical), Soma Tech Intl., Block Imaging, US Med?Equip, TRIMEDX, Agito Medical (a Philips company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the refurbished medical devices market appears promising, driven by increasing healthcare costs and a growing emphasis on sustainability. As healthcare providers seek to balance quality and affordability, the adoption of refurbished devices is likely to rise. Additionally, advancements in refurbishment technologies will enhance product reliability, further encouraging market penetration. The integration of telemedicine will also create new avenues for refurbished devices, as remote monitoring becomes more prevalent in patient care strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Imaging Equipment (MRI, CT, X-ray, Ultrasound, Mammography, Angiography) Operating Room & Surgical Equipment (Anesthesia Machines, Surgical Tables, Lights, Electrosurgical Units) Patient Monitoring Devices (Multiparameter Monitors, ECG, Pulse Oximeters) Therapeutic Equipment (Infusion Pumps, Dialysis Machines, Ventilators) Endoscopy & Minimally Invasive Systems (Endoscopy Towers, Laparoscopy Systems) Laboratory & In?Vitro Diagnostics Equipment (Analyzers, Centrifuges) Mobility & Rehabilitation Devices (Hospital Beds, Wheelchairs) Others |

| By End-User | Hospitals Diagnostic Imaging Centers Clinics & Ambulatory Surgical Centers Home Healthcare Providers Research & Academic Institutions Others |

| By Distribution Channel | Direct Sales (OEM Certified Refurbishment Programs) Online Marketplaces & E-commerce Independent Refurbishers/Distributors Group Purchasing Organizations (GPOs) Retail/Dealer Networks Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Brand | OEM-Certified Refurbished (e.g., GE, Siemens, Philips, Canon) Independent Third-Party Refurbishers Distributor/Private Label Programs Others |

| By Application | Diagnostic Applications (Radiology, Cardiology, Oncology) Therapeutic Applications (Surgery, Respiratory Care, Renal Care) Monitoring Applications (Critical Care, Perioperative, Telemetry) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospitals Utilizing Refurbished Devices | 120 | Healthcare Administrators, Procurement Managers |

| Manufacturers of Refurbished Medical Devices | 60 | Product Managers, Quality Assurance Officers |

| Distributors of Medical Equipment | 50 | Sales Directors, Supply Chain Managers |

| Regulatory Bodies and Compliance Experts | 40 | Regulatory Affairs Specialists, Compliance Managers |

| Healthcare Providers and Clinics | 70 | Clinical Directors, Equipment Managers |

The Global Refurbished Medical Devices Market is valued at approximately USD 17 billion, driven by the increasing demand for cost-effective healthcare solutions and a focus on sustainability in medical practices.