Region:Global

Author(s):Rebecca

Product Code:KRAB0223

Pages:84

Published On:August 2025

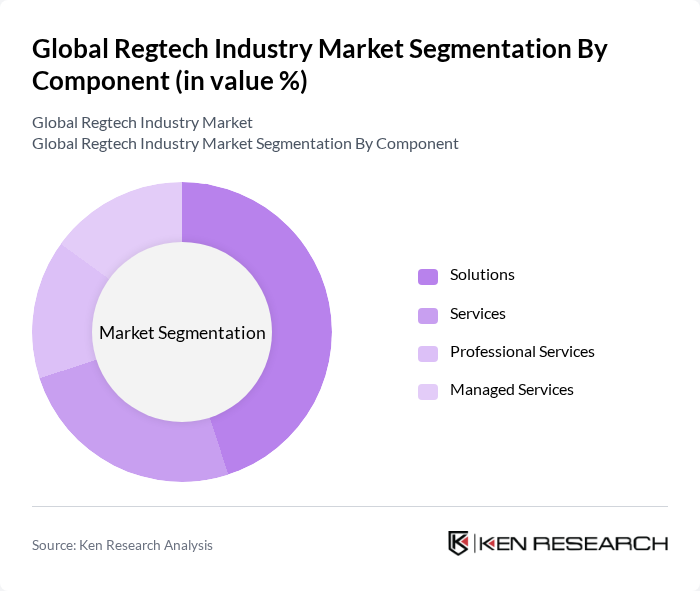

By Component:

The components of the regtech market include Solutions, Services, Professional Services, and Managed Services. Among these, Solutions are dominating the market due to the increasing demand for automated compliance tools that enhance operational efficiency and reduce human error. Organizations are increasingly investing in software solutions that provide real-time monitoring and reporting capabilities, which are essential for meeting regulatory requirements. The trend towards digital transformation in financial services, coupled with the adoption of artificial intelligence, big data analytics, and cloud-based platforms, is further propelling the growth of this segment.

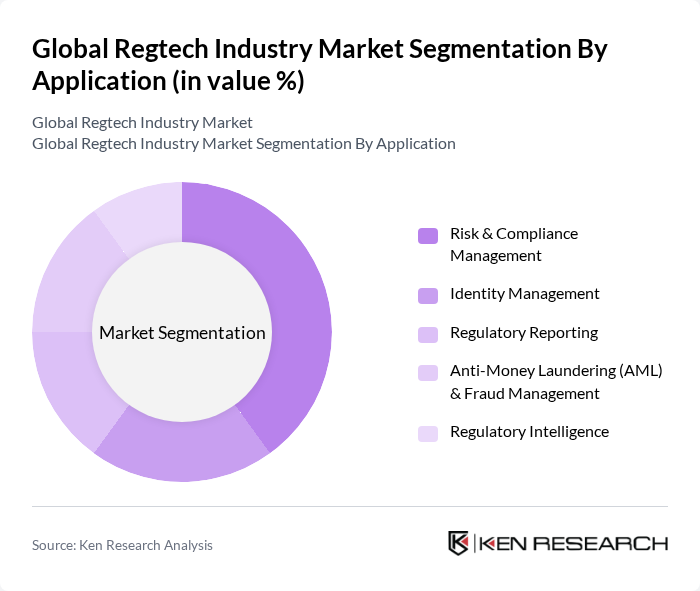

By Application:

The applications of regtech include Risk & Compliance Management, Identity Management, Regulatory Reporting, Anti-Money Laundering (AML) & Fraud Management, and Regulatory Intelligence. The Risk & Compliance Management segment is leading the market as organizations prioritize risk mitigation and compliance adherence. The increasing frequency of regulatory changes, the rise in financial crimes, and the need for organizations to adapt quickly to evolving regulations are driving the demand for solutions that can effectively manage compliance risks and ensure regulatory adherence.

The Global Regtech Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fenergo, ComplyAdvantage, Riskified, NICE Actimize, AxiomSL, SAS Institute, Oracle, Thomson Reuters, Wolters Kluwer, Verafin, Encompass Corporation, ACTICO GmbH, ComplySci, Quantexa, TrueLayer, Ascent Technologies, Ayasdi AI, Broadridge Financial Solutions, Chainalysis, IdentityMind, London Stock Exchange Group (LSEG), Deloitte contribute to innovation, geographic expansion, and service delivery in this space.

The Regtech industry is poised for significant transformation as organizations increasingly prioritize compliance efficiency and risk management. In future, the integration of innovative technologies such as blockchain and AI will reshape the landscape, enabling real-time compliance monitoring and reporting. Additionally, the growing emphasis on sustainability and ethical practices will drive demand for Regtech solutions that align with corporate social responsibility goals, fostering a more resilient and adaptive regulatory environment.

| Segment | Sub-Segments |

|---|---|

| By Component | Solutions Services Professional Services Managed Services |

| By Application | Risk & Compliance Management Identity Management Regulatory Reporting Anti-Money Laundering (AML) & Fraud Management Regulatory Intelligence |

| By Vertical | Banking Insurance Non-Financial |

| By Deployment Type | Cloud-Based On-Premises |

| By Organization Size | Large Enterprises Small and Medium-Sized Enterprises (SMEs) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Compliance Solutions | 100 | Compliance Officers, Risk Managers |

| Insurance Regulatory Technology | 80 | Regulatory Affairs Managers, IT Directors |

| Investment Firms' Risk Management Tools | 60 | Chief Compliance Officers, Portfolio Managers |

| Fintech Startups' Regulatory Solutions | 50 | Founders, Product Managers |

| AML and KYC Compliance Technologies | 120 | AML Officers, Data Analysts |

The Global Regtech Industry Market is valued at approximately USD 15.8 billion, driven by the increasing complexity of regulatory requirements and the demand for enhanced compliance solutions in financial services.