Region:Global

Author(s):Shubham

Product Code:KRAA1771

Pages:94

Published On:August 2025

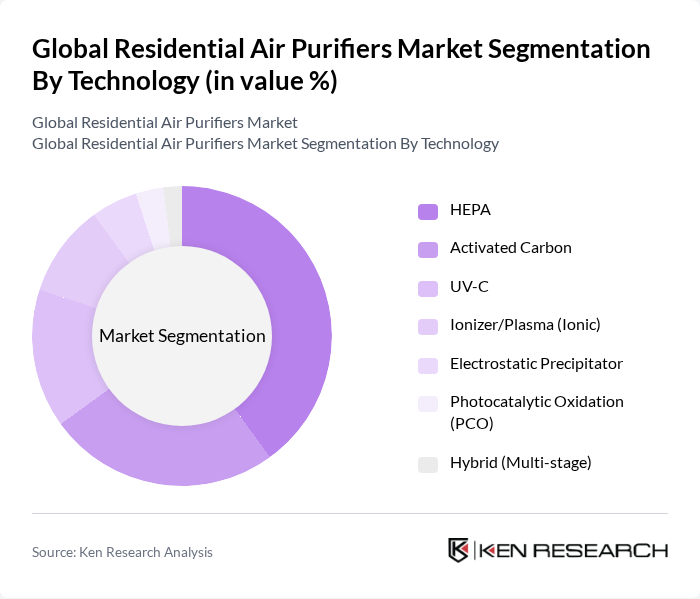

By Technology:The technology segment of the market includes various filtration methods that cater to different consumer needs. The dominant technologies include HEPA filters, known for their efficiency in trapping small particles, and activated carbon filters, which are effective in removing odors and volatile organic compounds. UV-C technology is used for microbial inactivation in certain products, while ionizers and hybrid systems combine multiple stages to address particulates and gases. Buyers increasingly consider CADR ratings, filter replacement costs, noise, and smart sensing/connectivity as decision factors .

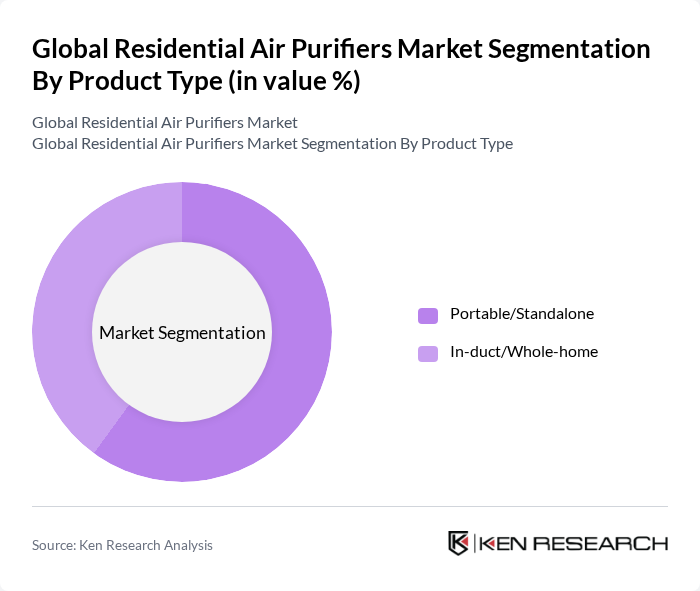

By Product Type:The product type segment is divided into portable/standalone units and in-duct/whole-home systems. Portable air purifiers are favored for their convenience and flexibility, allowing users to move them between rooms. In contrast, in-duct systems are preferred for whole-home solutions, providing comprehensive air purification throughout the residence. Increasing adoption of smart-connected purifiers with app control and sensors continues to influence product development and consumer preferences .

The Global Residential Air Purifiers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dyson Ltd., Honeywell International Inc., Koninklijke Philips N.V., Blueair AB (Unilever), Coway Co., Ltd. (Airmega), Sharp Corporation, LG Electronics Inc., Panasonic Holdings Corporation, Xiaomi Corporation, Levoit (Vesync Co., Ltd.), Guardian Technologies (GermGuardian), Winix Inc., IQAir AG, Daikin Industries, Ltd., Whirlpool Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the residential air purifiers market appears promising, driven by increasing urbanization and a heightened focus on health and wellness. As more consumers become aware of the detrimental effects of air pollution, the demand for advanced air purification solutions is expected to rise. Additionally, the integration of smart technologies and eco-friendly products will likely shape consumer preferences, leading to innovative offerings that cater to evolving market needs and preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Technology | HEPA Activated Carbon UV-C Ionizer/Plasma (Ionic) Electrostatic Precipitator Photocatalytic Oxidation (PCO) Hybrid (Multi-stage) |

| By Product Type | Portable/Standalone In-duct/Whole-home |

| By Room Size/Coverage | Small Rooms (<200 sq.ft.) Medium Rooms (200–400 sq.ft.) Large Rooms (>400 sq.ft.) |

| By Filter Class | Pre-filter HEPA (H13/H14) Activated Carbon Antibacterial/HEPA Antimicrobial |

| By Connectivity | Smart/Connected (App/IoT) Non-connected |

| By Distribution Channel | Online (E-commerce/Brand.com) Offline (Electronics & Appliance Retailers) Direct-to-Consumer |

| By Price Range | Budget ( |

| By Application (Residential Use-cases) | Bedrooms/Nurseries Living Rooms Kitchens/Smoke and Odor Control Allergy/Asthma Management Pet Dander Control |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Air Purifier Users | 150 | Homeowners, Renters |

| Health and Wellness Professionals | 100 | Doctors, Respiratory Therapists, Allergists |

| Retailers of Air Purifiers | 80 | Store Managers, Sales Representatives |

| Environmental Health Researchers | 60 | Academics, Policy Makers |

| Manufacturers of Air Purification Technologies | 70 | Product Development Managers, Engineers |

The Global Residential Air Purifiers Market is valued at approximately USD 12 billion, based on a five-year historical analysis. This figure reflects a consistent demand driven by increasing awareness of indoor air quality and health-conscious purchasing behavior among consumers.