Region:Global

Author(s):Shubham

Product Code:KRAA1731

Pages:92

Published On:August 2025

By Type:The market is segmented into three main types: Built-in Induction Cooktops (hob-only), Portable/Countertop Single- and Double-Burner Units, and Freestanding Ranges with Induction Cooktops. Built-in induction cooktops are gaining popularity due to their seamless integration into modular kitchen designs and premiumization trends in renovations. Portable units are favored for their convenience, affordability, and suitability for small spaces and rentals. Freestanding ranges combine traditional oven formats with modern induction tops, appealing to households upgrading full ranges in North America and Europe.

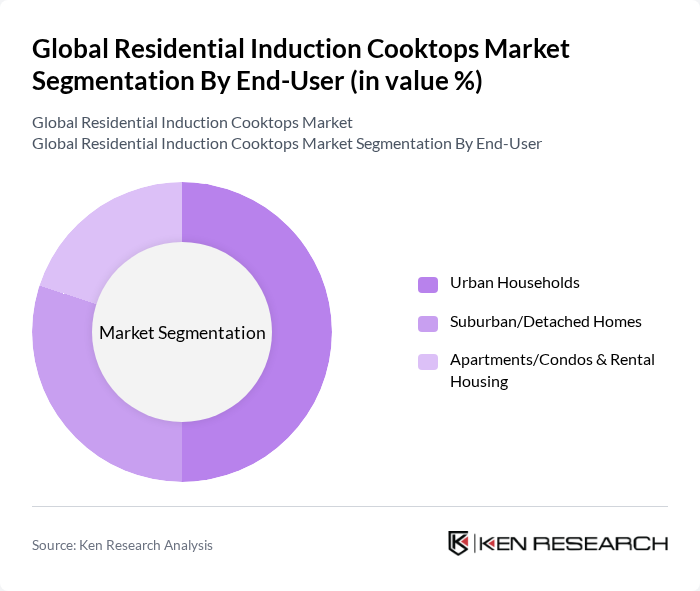

By End-User:The end-user segmentation includes Urban Households, Suburban/Detached Homes, and Apartments/Condos & Rental Housing. Urban households are the largest segment, driven by space constraints, faster cooking needs, and safety benefits compared with gas in dense dwellings. Suburban homes show strong demand owing to larger kitchen remodels favoring built-in hobs and full induction ranges. Apartments and condos are increasingly adopting induction for compactness, quick installation, and compatibility with electrification policies in multifamily housing.

The Global Residential Induction Cooktops Market is characterized by a dynamic mix of regional and international players. Leading participants such as BSH Hausgeräte GmbH (Bosch, Siemens, Neff, Gaggenau), Whirlpool Corporation (KitchenAid, JennAir, Whirlpool), GE Appliances, a Haier company, Samsung Electronics Co., Ltd., LG Electronics Inc., Electrolux AB (Electrolux, AEG, Frigidaire), Panasonic Corporation, Miele & Cie. KG, Haier Smart Home Co., Ltd. (Haier, Candy, Hoover), Sharp Corporation, Arçelik A.?. (Beko, Grundig), SMEG S.p.A., Fisher & Paykel Appliances Ltd (a Haier company), FOTILE Group, Midea Group (including COLMO) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the residential induction cooktops market appears promising, driven by technological advancements and changing consumer preferences. As urbanization accelerates, more households are likely to invest in modern kitchen solutions, including induction cooktops. Additionally, the integration of IoT technology will enhance user experience, making cooking more efficient and convenient. With increasing government incentives for energy-efficient appliances, the market is poised for significant growth, particularly in regions where awareness is rising.

| Segment | Sub-Segments |

|---|---|

| By Type | Built-in Induction Cooktops (hob-only) Portable/Countertop Single- and Double-Burner Units Freestanding Ranges with Induction Cooktops |

| By End-User | Urban Households Suburban/Detached Homes Apartments/Condos & Rental Housing |

| By Sales Channel | Online Retail (Brand.com, Marketplaces) Offline Retail (Specialty, Big-Box, Hypermarkets) Direct-to-Installer/Builder & Kitchen Studios |

| By Price Range | Entry/Budget (< USD 300 portable; < USD 800 built-in) Mid-Range (USD 300–800 portable; USD 800–1,500 built-in) Premium (USD 800+ portable; USD 1,500+ built-in/pro ranges) |

| By Brand Positioning | Global Mass-Market Brands Premium/Luxury Brands Value/Private Labels |

| By Features | Smart Connectivity (Wi?Fi, App, Voice, Guided Cooking) Safety & Compliance (Child Lock, Auto Shutoff, Pan Detection) Performance & Efficiency (PowerBoost, Flex Zones, Efficiency Rating) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Sales Representatives |

| Consumer Preferences | 150 | Homeowners, Apartment Dwellers |

| Manufacturer Feedback | 100 | Product Development Teams, Marketing Managers |

| Energy Efficiency Trends | 80 | Energy Consultants, Sustainability Experts |

| Market Distribution Channels | 100 | Distributors, Wholesalers |

The Global Residential Induction Cooktops Market is valued at approximately USD 15 billion, reflecting a significant growth trend driven by consumer preferences for energy-efficient cooking solutions and the transition from gas to electric cooking methods.