Region:Global

Author(s):Rebecca

Product Code:KRAD7384

Pages:98

Published On:December 2025

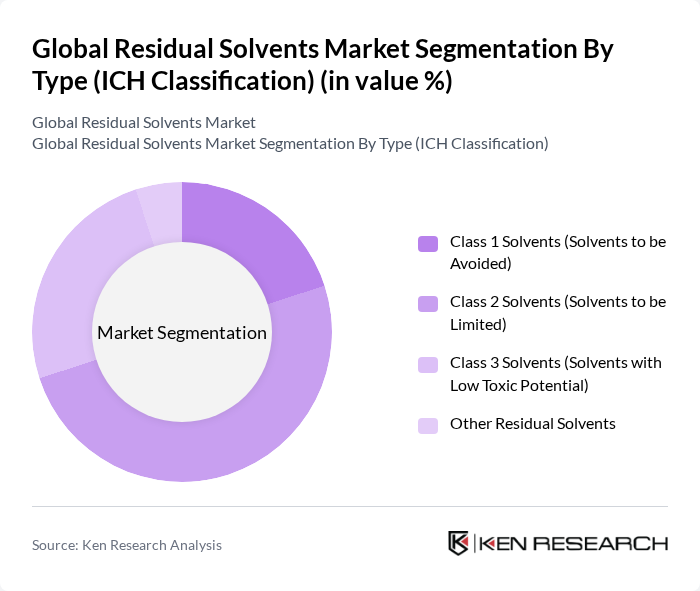

By Type (ICH Classification):

The market is segmented into Class 1 Solvents (Solvents to be Avoided), Class 2 Solvents (Solvents to be Limited), Class 3 Solvents (Solvents with Low Toxic Potential), and Other Residual Solvents. Among these, Class 2 Solvents dominate the market due to their widespread use in pharmaceutical formulations where safety is a priority. The increasing regulatory scrutiny on solvent residues has led to a shift towards Class 2 Solvents, which are considered safer alternatives. This trend is driven by consumer demand for safer products and the need for compliance with stringent regulations.

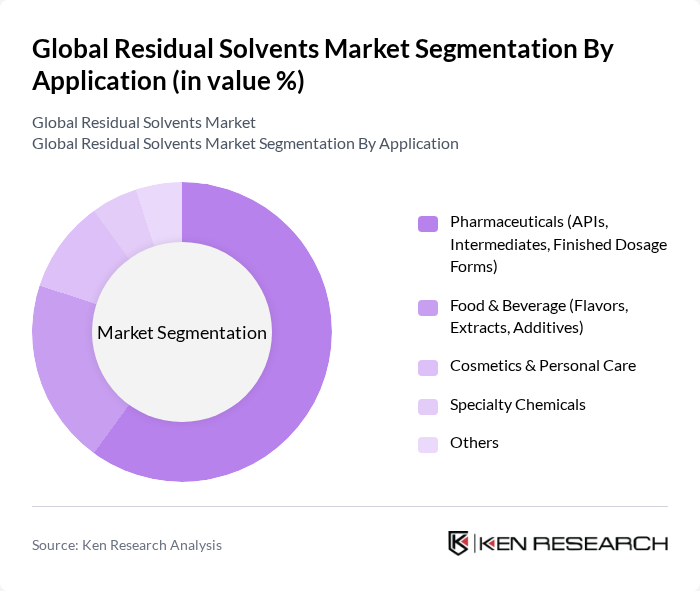

By Application:

The market is segmented into Pharmaceuticals (APIs, Intermediates, Finished Dosage Forms), Food & Beverage (Flavors, Extracts, Additives), Cosmetics & Personal Care, Specialty Chemicals, and Others. The Pharmaceuticals segment leads the market, driven by the increasing demand for active pharmaceutical ingredients (APIs) and the need for stringent quality control in drug manufacturing. The growing focus on health and wellness has also led to a rise in the use of residual solvents in food and beverage applications, although pharmaceuticals remain the dominant application area.

The Global Residual Solvents Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Agilent Technologies Inc., Shimadzu Corporation, Merck KGaA (Merck Millipore), Waters Corporation, PerkinElmer Inc., Bruker Corporation, BASF SE, Dow Inc., Eastman Chemical Company, LyondellBasell Industries N.V., Solvay S.A., Clariant AG, Mitsubishi Chemical Group Corporation, and SGS SA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the residual solvents market is poised for significant transformation, driven by the increasing emphasis on sustainability and regulatory compliance. As industries adopt greener practices, the demand for eco-friendly solvents is expected to rise, with innovations in recovery technologies enhancing efficiency. Additionally, the expansion into emerging markets will provide new growth avenues, as these regions increasingly recognize the importance of product quality and safety in their manufacturing processes, fostering a more competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type (ICH Classification) | Class 1 Solvents (Solvents to be Avoided) Class 2 Solvents (Solvents to be Limited) Class 3 Solvents (Solvents with Low Toxic Potential) Other Residual Solvents |

| By Application | Pharmaceuticals (APIs, Intermediates, Finished Dosage Forms) Food & Beverage (Flavors, Extracts, Additives) Cosmetics & Personal Care Specialty Chemicals Others |

| By Analytical Technology | Gas Chromatography (GC) Liquid Chromatography (HPLC/UPLC) Spectroscopy (GC-MS, LC-MS, IR, NMR) Other Techniques |

| By End-Use Industry | Pharmaceutical & Biopharmaceutical Food & Beverage Processing Cosmetics & Personal Care Chemical & Petrochemical Others |

| By Service Type | Residual Solvent Testing & Analytical Services Method Development & Validation Regulatory Compliance & Documentation Support In-house Testing Solutions & Instrumentation |

| By Organization Size (End User) | Large Enterprises Small & Medium-sized Enterprises (SMEs) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Solvent Usage | 120 | Production Managers, Quality Control Analysts |

| Food & Beverage Residual Solvents | 90 | Food Safety Officers, Production Supervisors |

| Cosmetic Industry Solvent Applications | 80 | Product Development Managers, Regulatory Affairs Specialists |

| Industrial Cleaning Solvents | 110 | Facility Managers, Procurement Specialists |

| Environmental Compliance in Solvent Use | 70 | Environmental Managers, Compliance Officers |

The Global Residual Solvents Market is valued at approximately USD 1.1 billion, driven by increasing demand in pharmaceuticals, food and beverage, and cosmetics industries, alongside stringent regulatory requirements for high-quality solvents.