Global Retail Digital Signage Market Overview

- The Global Retail Digital Signage Market is valued at USD 6.4 billion, based on a five-year historical analysis. Growth is primarily driven by the increasing adoption of digital advertising solutions, the need for enhanced customer engagement, and rising demand for real-time information dissemination in retail environments. The shift from traditional signage to digital formats has accelerated due to advancements in display technologies, integration of analytics, and the growing importance of immersive visual communication in retail strategies. Retailers report measurable benefits, including an average sales increase of 32% and a 55% higher ad recall rate among shoppers using digital signage solutions .

- Key players in this market include the United States, Germany, and China, which dominate due to robust retail sectors, high consumer spending, and significant investments in technology. North America leads with over 34% market share, driven by the presence of major retail chains, advanced digital infrastructure, and a strong focus on innovative marketing strategies. Asia Pacific is rapidly expanding, supported by a strong manufacturing base and increasing adoption of digital display technologies in retail and entertainment venues .

- The European Union’s Regulation (EU) 2019/2021, issued by the European Commission, sets binding energy efficiency requirements for electronic displays, including digital signage. This regulation mandates that all new digital signage installations in retail environments must comply with specific energy consumption standards, driving the adoption of energy-efficient technologies and reducing the environmental impact of retail operations .

Global Retail Digital Signage Market Segmentation

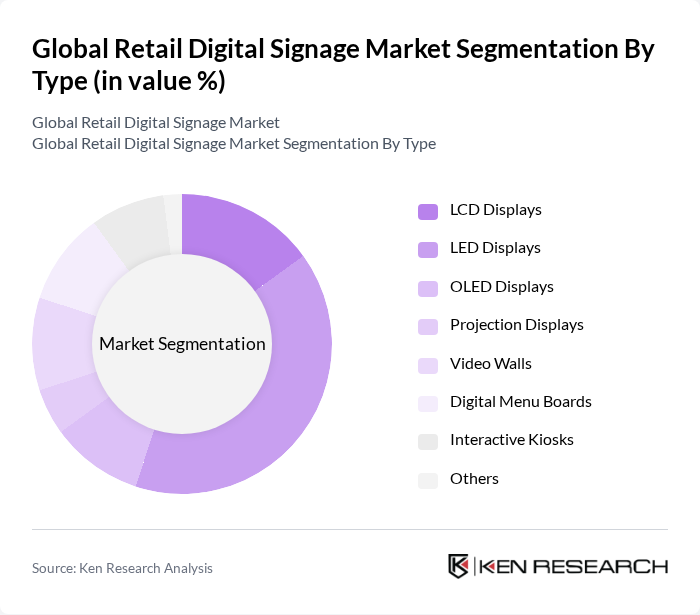

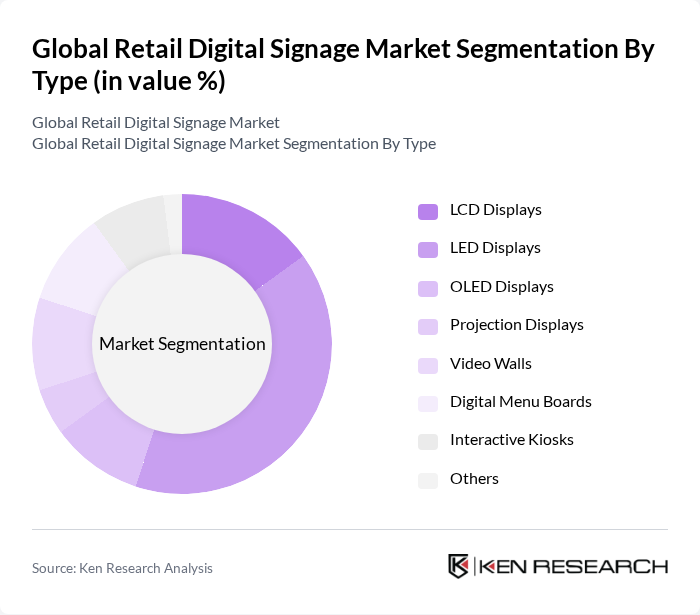

By Type:The market is segmented into LCD Displays, LED Displays, OLED Displays, Projection Displays, Video Walls, Digital Menu Boards, Interactive Kiosks, and Others.LED Displaysare currently leading the market due to their superior brightness, energy efficiency, and versatility in various retail environments. The demand for high-quality visual content and the ability to attract customer attention effectively are key growth drivers for LED Displays. The trend toward interactive and engaging customer experiences has further accelerated the adoption ofInteractive Kiosks, which enable retailers to deliver personalized content and facilitate seamless transactions .

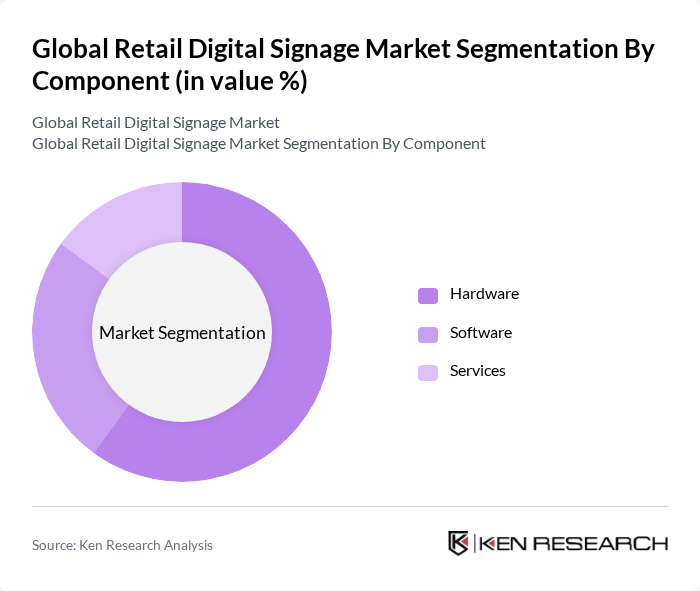

By Component:The market is divided into Hardware, Software, and Services.Hardwareremains the dominant segment, driven by the demand for advanced display technologies and high-quality visual content. Growth in this segment is fueled by rapid advancements in LED, OLED, and micro-LED displays, which offer superior image quality, energy efficiency, and longer lifespans. The integration of software solutions for real-time content management, analytics, and remote updates is enhancing the overall value proposition of hardware components, making digital signage more dynamic and responsive to retail needs .

Global Retail Digital Signage Market Competitive Landscape

The Global Retail Digital Signage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., LG Display Co., Ltd., NEC Display Solutions, Ltd., Sharp Corporation, Panasonic Corporation, Sony Corporation, ViewSonic Corporation, Daktronics, Inc., Leyard Optoelectronic Co., Ltd., BrightSign, LLC, Scala, Inc., Signagelive (Remote Media Group Ltd.), Cisco Systems, Inc., Epson America, Inc., AOPEN Inc., STRATACACHE, Inc., Advantech Co., Ltd., Intel Corporation, Mvix, Inc., Broadsign International, LLC contribute to innovation, geographic expansion, and service delivery in this space.

Global Retail Digital Signage Market Industry Analysis

Growth Drivers

- Increasing Demand for Interactive Customer Engagement:The retail sector is witnessing a significant shift towards interactive digital signage, with a projected increase in consumer engagement by 30% in future. This trend is driven by the need for personalized shopping experiences, as 70% of consumers prefer brands that offer interactive content. Retailers are investing in digital signage solutions to enhance customer interaction, leading to a projected increase in sales by $1.5 billion in future, according to industry reports.

- Rising Adoption of Digital Marketing Strategies:In future, digital marketing expenditures are expected to reach $500 billion globally, with a significant portion allocated to digital signage. Retailers are increasingly integrating digital signage into their marketing strategies to capture consumer attention effectively. This shift is supported by the fact that 80% of consumers recall seeing digital signage ads, leading to a 20% increase in foot traffic for stores utilizing these technologies, as reported by marketing analytics firms.

- Technological Advancements in Display Technologies:The retail digital signage market is benefiting from advancements in display technologies, with the global market for OLED displays projected to reach $30 billion in future. Enhanced display quality, including higher resolution and energy efficiency, is driving adoption among retailers. As a result, 60% of retailers plan to upgrade their signage systems to incorporate these technologies, which are expected to improve customer engagement and reduce operational costs significantly.

Market Challenges

- High Initial Investment Costs:The initial investment for implementing digital signage solutions can be substantial, often exceeding $10,000 per installation. This high cost poses a barrier for small to medium-sized retailers, limiting their ability to adopt these technologies. Additionally, ongoing maintenance and content management expenses can add another $2,000 annually, making it challenging for businesses to justify the investment without clear ROI metrics, as highlighted in financial analyses.

- Content Management Complexity:Managing content across multiple digital signage platforms can be complex and time-consuming. Retailers often face challenges in ensuring content is up-to-date and relevant, leading to potential customer disengagement. Approximately 40% of retailers report difficulties in content scheduling and updates, which can result in a 15% decrease in customer engagement. This complexity necessitates investment in specialized content management systems, further complicating the operational landscape.

Global Retail Digital Signage Market Future Outlook

The future of the retail digital signage market appears promising, driven by technological innovations and evolving consumer preferences. As retailers increasingly adopt cloud-based solutions, operational efficiency is expected to improve significantly. Furthermore, the integration of AI and IoT technologies will enhance personalization and analytics capabilities, allowing retailers to tailor content dynamically. This evolution is likely to foster a more engaging shopping experience, ultimately leading to increased sales and customer loyalty in the coming years.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets are projected to see a 25% increase in digital signage adoption in future, driven by urbanization and rising disposable incomes. Retailers in these regions can leverage digital signage to enhance brand visibility and customer engagement, tapping into a growing consumer base eager for modern shopping experiences.

- Integration with IoT and AI Technologies:The integration of IoT and AI in digital signage is expected to create new opportunities for retailers. In future, 50% of digital signage systems are anticipated to incorporate AI-driven analytics, enabling real-time content adjustments based on customer behavior. This capability can significantly enhance customer engagement and drive sales conversions.