Region:Global

Author(s):Geetanshi

Product Code:KRAC0005

Pages:99

Published On:August 2025

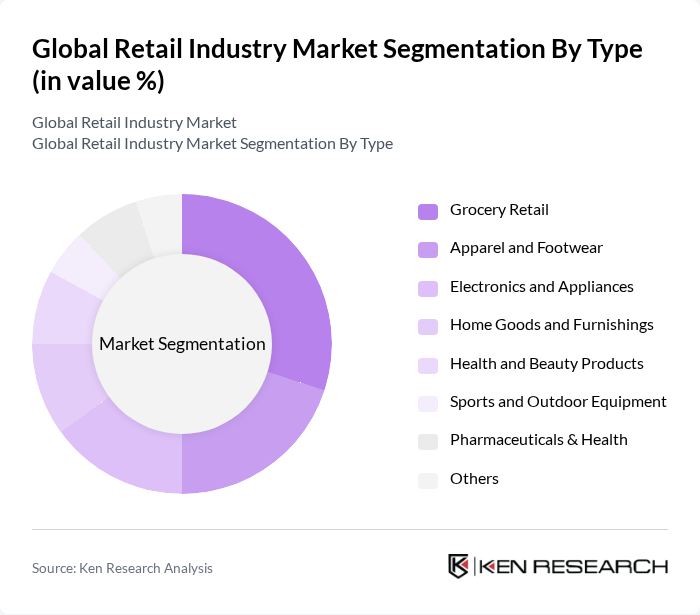

By Type:The retail market can be segmented into various types, including Grocery Retail, Apparel and Footwear, Electronics and Appliances, Home Goods and Furnishings, Health and Beauty Products, Sports and Outdoor Equipment, Pharmaceuticals & Health, and Others. Each of these segments caters to different consumer needs and preferences. Grocery Retail remains the largest contributor due to the essential nature of food and daily necessities, while Electronics and Appliances and Apparel and Footwear are also significant, driven by rising disposable incomes and evolving lifestyle trends. Health and Beauty Products and Pharmaceuticals & Health are experiencing accelerated growth, supported by increased health awareness and wellness trends .

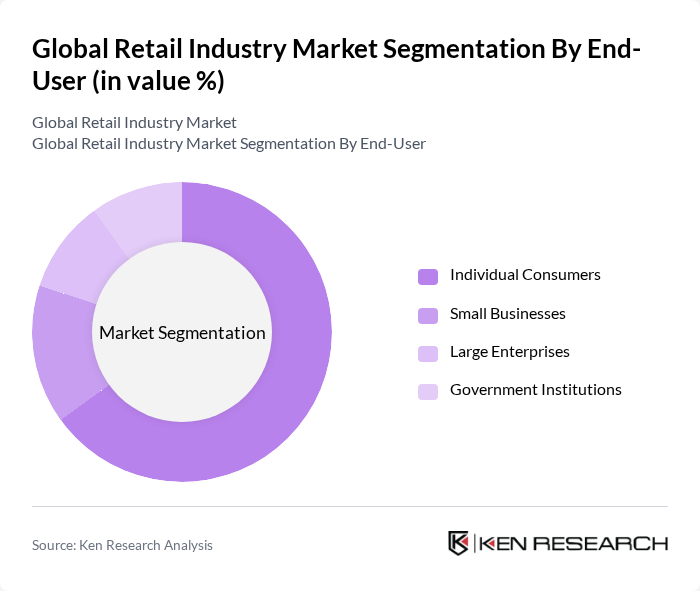

By End-User:The retail market is also segmented by end-users, which include Individual Consumers, Small Businesses, Large Enterprises, and Government Institutions. Individual Consumers dominate the market as they represent the largest segment of retail spending, driven by personal consumption patterns, urbanization, and evolving lifestyle choices. Small Businesses and Large Enterprises are significant contributors, particularly in the B2B retail segment, while Government Institutions account for a smaller but stable share .

The Global Retail Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Walmart Inc., Amazon.com, Inc., Alibaba Group Holding Limited, Costco Wholesale Corporation, The Home Depot, Inc., Target Corporation, Tesco PLC, Carrefour S.A., Aldi Einkauf GmbH & Co. oHG, Lidl Stiftung & Co. KG, Best Buy Co., Inc., Macy's, Inc., Walgreens Boots Alliance, Inc., eBay Inc., JD.com, Inc., Schwarz Group, Aeon Co., Ltd., Seven & i Holdings Co., Ltd., CVS Health Corporation, and Ahold Delhaize contribute to innovation, geographic expansion, and service delivery in this space .

The future of the retail industry is poised for transformation, driven by technological innovations and evolving consumer behaviors. As e-commerce continues to expand, retailers will increasingly adopt omnichannel strategies to enhance customer experiences. Sustainability will also play a pivotal role, with consumers demanding more ethical sourcing and eco-friendly practices. Retailers that leverage data analytics for personalized marketing and invest in advanced technologies will likely gain a competitive edge in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Grocery Retail Apparel and Footwear Electronics and Appliances Home Goods and Furnishings Health and Beauty Products Sports and Outdoor Equipment Pharmaceuticals & Health Others |

| By End-User | Individual Consumers Small Businesses Large Enterprises Government Institutions |

| By Sales Channel | Online & Mobile Commerce Supermarkets/Hypermarkets Brick-and-Mortar Stores Direct Sales Wholesale Distribution |

| By Product Category | Food and Beverages Clothing and Accessories Electronics Home and Garden Health and Wellness |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing |

| By Distribution Mode | Direct Shipping Third-Party Logistics Click and Collect |

| By Customer Demographics | Age Group Income Level Geographic Location Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Retail Market Insights | 120 | Retail Managers, Marketing Directors |

| Consumer Electronics Retail | 60 | Store Managers, Product Category Managers |

| Fashion and Apparel Sector | 50 | Brand Managers, Merchandising Directors |

| Grocery and Food Retail | 80 | Operations Managers, Supply Chain Analysts |

| E-commerce Retail Trends | 40 | eCommerce Managers, Digital Marketing Managers |

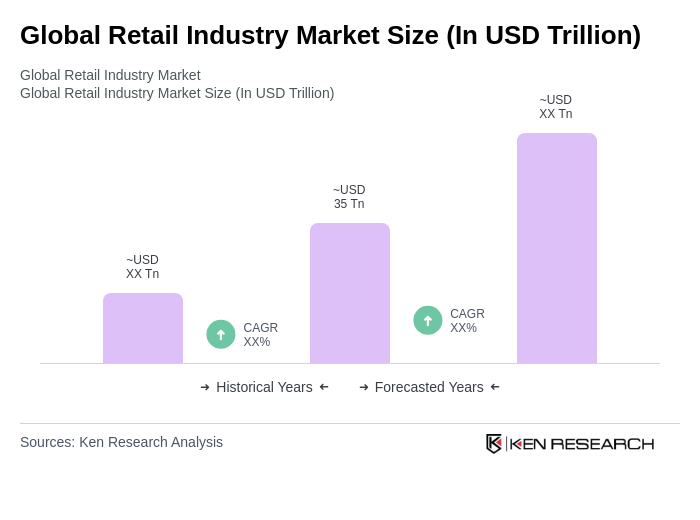

The Global Retail Industry Market is valued at approximately USD 35 trillion, reflecting significant growth driven by increasing consumer spending, the rise of e-commerce, and the adoption of digital payment systems.