Region:Global

Author(s):Shubham

Product Code:KRAA0960

Pages:84

Published On:August 2025

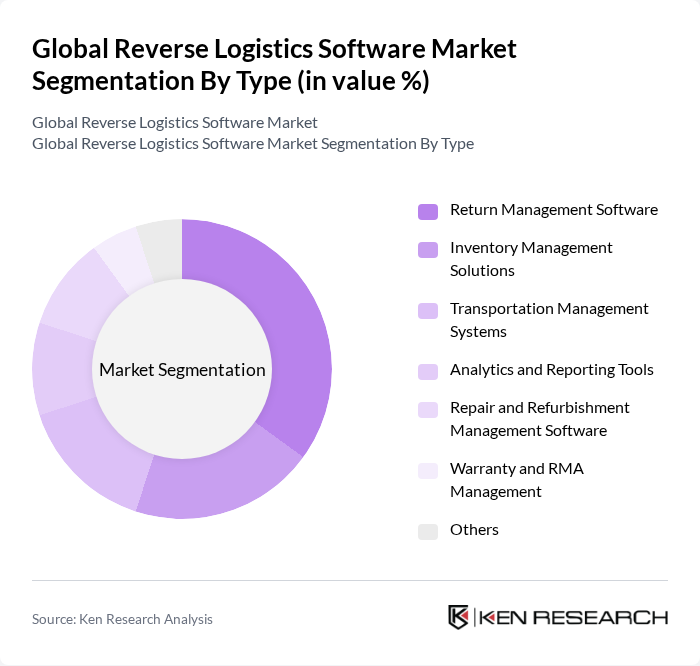

By Type:The market can be segmented into various types of software solutions that cater to different aspects of reverse logistics. The key subsegments include Return Management Software, Inventory Management Solutions, Transportation Management Systems, Analytics and Reporting Tools, Repair and Refurbishment Management Software, Warranty and RMA (Return Merchandise Authorization) Management, and Others. Among these, Return Management Software is currently dominating the market due to the increasing volume of product returns in e-commerce and retail sectors. This software helps businesses efficiently manage returns, track inventory, and improve customer satisfaction. The adoption of analytics and automation tools is also rising, driven by the need for real-time tracking and data-driven decision-making in reverse logistics operations .

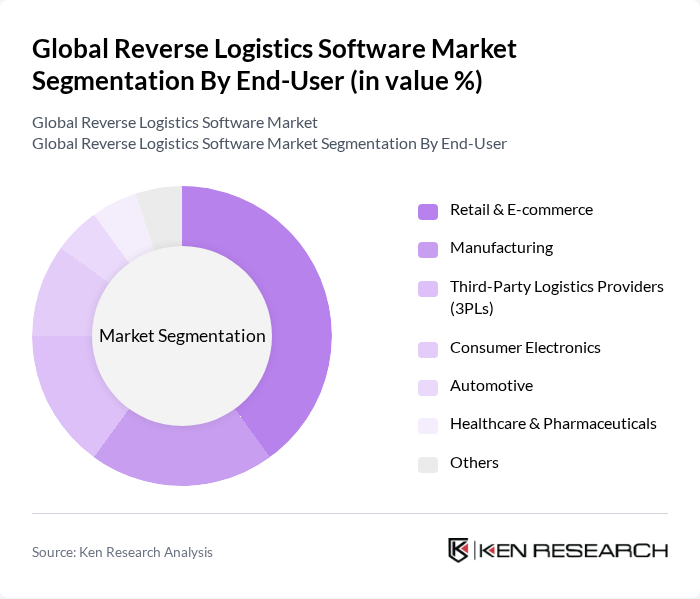

By End-User:The end-user segmentation includes various industries that utilize reverse logistics software, such as Retail & E-commerce, Manufacturing, Third-Party Logistics Providers (3PLs), Consumer Electronics, Automotive, Healthcare & Pharmaceuticals, and Others. The Retail & E-commerce sector is the leading end-user, driven by the exponential growth of online shopping and the need for efficient return processes. Companies in this sector are increasingly investing in reverse logistics solutions to enhance customer experience, streamline operations, and meet sustainability targets. The manufacturing and 3PL sectors are also significant adopters, leveraging software to optimize returns, repairs, and recycling processes .

The Global Reverse Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Blue Yonder (formerly JDA Software Group), Infor, IBM Corporation, Microsoft Corporation, Descartes Systems Group, Cerasis (now part of GlobalTranz), Returnly (an Affirm company), ShipBob, Happy Returns (a PayPal company), Optoro, Logiwa, Flexport, ReverseLogix, 3PL Central, ReBOUND Returns, Doddle, G2 Reverse Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of reverse logistics software in None is poised for significant transformation, driven by technological advancements and evolving consumer expectations. Companies are increasingly focusing on enhancing customer experience through streamlined return processes and transparent tracking systems. As sustainability becomes a core business strategy, organizations will invest in solutions that support eco-friendly practices. Furthermore, the integration of AI and machine learning will enable predictive analytics, optimizing reverse logistics operations and reducing costs, thereby fostering a more efficient supply chain ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Return Management Software Inventory Management Solutions Transportation Management Systems Analytics and Reporting Tools Repair and Refurbishment Management Software Warranty and RMA (Return Merchandise Authorization) Management Others |

| By End-User | Retail & E-commerce Manufacturing Third-Party Logistics Providers (3PLs) Consumer Electronics Automotive Healthcare & Pharmaceuticals Others |

| By Application | Product Returns Management Warranty & Service Management Repair, Refurbishment & Remanufacturing Recycling, Disposal & Sustainability Compliance Asset Recovery Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Online Sales Distributors Resellers |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Freemium/Trial Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 80 | Operations Managers, Customer Service Heads |

| Automotive Parts Recovery | 60 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 50 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 70 | eCommerce Managers, Fulfillment Center Supervisors |

The Global Reverse Logistics Software Market is valued at approximately USD 820 million, driven by the increasing demand for efficient return management processes, the rapid expansion of e-commerce, and the need for sustainable practices in supply chain management.