Region:Global

Author(s):Shubham

Product Code:KRAC0641

Pages:97

Published On:August 2025

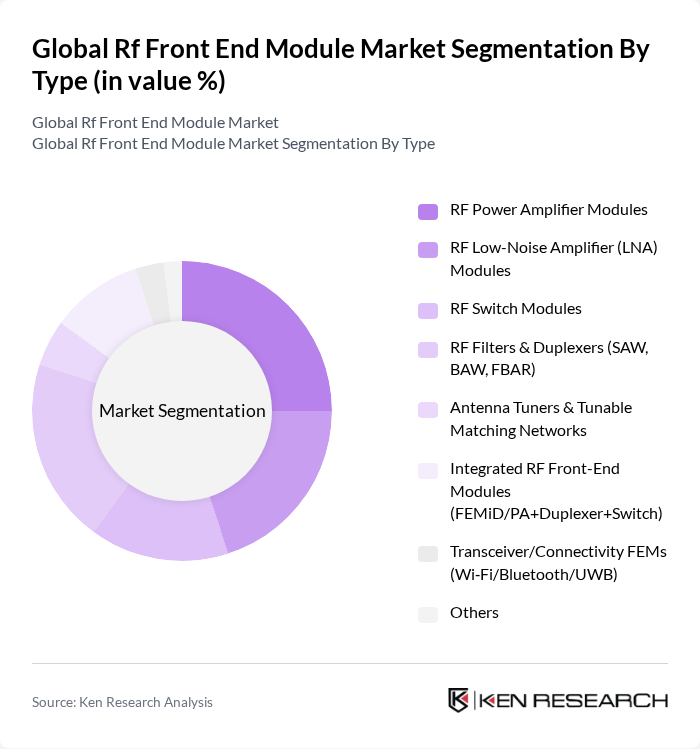

By Type:

The RF Power Amplifier Modules segment is currently dominating the market due to the increasing demand for high-efficiency amplifiers in mobile devices and telecommunications infrastructure. This segment benefits from advancements in semiconductor technology (GaAs, GaN, SOI) that enhance efficiency and thermal performance. The growing adoption of 5G, carrier aggregation, and MIMO architectures increases PA count and complexity per device, sustaining a significant share for RF Power Amplifier Modules.

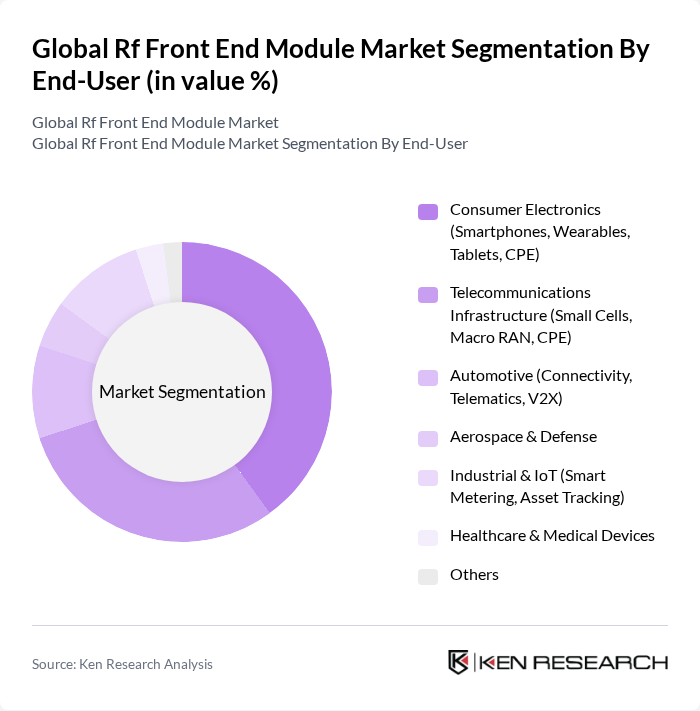

By End-User:

The Consumer Electronics segment is leading the market, underpinned by high smartphone volumes and richer RF content per premium device, along with growth in Wi?Fi 6/7, Bluetooth, and UWB in wearables and accessories. Rising IoT device penetration and home networking upgrades further support demand for integrated FEMs and filters in this segment.

The Global Rf Front End Module Market is characterized by a dynamic mix of regional and international players. Leading participants such as Broadcom Inc., Skyworks Solutions, Inc., Qorvo, Inc., Murata Manufacturing Co., Ltd., Qualcomm Technologies, Inc., Infineon Technologies AG, NXP Semiconductors N.V., Texas Instruments Incorporated, Analog Devices, Inc., STMicroelectronics N.V., Renesas Electronics Corporation, onsemi (ON Semiconductor Corporation), Microchip Technology Incorporated, MediaTek Inc., Skyworks/AVX (Kyocera AVX Components Corporation), TDK Corporation (including TDK InvenSense, RF components), Taiyo Yuden Co., Ltd., Wisol Co., Ltd. (RF filters & modules), Akoustis Technologies, Inc., Qorvo/Resonant LLC (XBAR/BAW technologies) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the RF front end module market appears promising, driven by the ongoing advancements in wireless communication technologies and the increasing adoption of 5G networks. As industries continue to embrace IoT and smart technologies, the demand for efficient RF solutions will likely escalate. Companies that prioritize innovation and sustainability in their manufacturing processes will be well-positioned to capitalize on emerging opportunities, ensuring their relevance in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | RF Power Amplifier Modules RF Low-Noise Amplifier (LNA) Modules RF Switch Modules RF Filters & Duplexers (SAW, BAW, FBAR) Antenna Tuners & Tunable Matching Networks Integrated RF Front-End Modules (FEMiD/PA+Duplexer+Switch) Transceiver/Connectivity FEMs (Wi?Fi/Bluetooth/UWB) Others |

| By End-User | Consumer Electronics (Smartphones, Wearables, Tablets, CPE) Telecommunications Infrastructure (Small Cells, Macro RAN, CPE) Automotive (Connectivity, Telematics, V2X) Aerospace & Defense Industrial & IoT (Smart Metering, Asset Tracking) Healthcare & Medical Devices Others |

| By Component | RF Power Amplifiers RF Filters (SAW/BAW/FBAR) and Duplexers RF Switches Low-Noise Amplifiers Tuners & Matching Networks Integrated Modules Others |

| By Application | Mobile Handsets & Wearables Wi?Fi/WLAN (Routers, PCs, IoT) Bluetooth/BLE & UWB Devices G/4G Infrastructure Automotive Connectivity & Telematics Satellite, GNSS & Radar Test & Measurement Others |

| By Connectivity/Frequency Band | Sub?6 GHz (FR1) mmWave (FR2) Wi?Fi (Wi?Fi 5/6/6E/7) Bluetooth/BLE UWB GNSS Others |

| By Technology/Material | GaAs GaN Silicon (CMOS/SOI/SiGe) Ceramic/Piezoelectric (SAW/BAW/FBAR) Others |

| By Sales Channel | Direct OEM Sales Authorized Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Device Manufacturers | 120 | Product Managers, R&D Engineers |

| IoT Device Developers | 90 | Technical Leads, System Architects |

| Automotive Electronics Suppliers | 70 | Procurement Managers, Design Engineers |

| Telecommunications Service Providers | 100 | Network Engineers, Operations Managers |

| Research Institutions and Universities | 60 | Academic Researchers, Industry Analysts |

The Global RF Front End Module Market is valued at approximately USD 25 billion, reflecting significant growth driven by the demand for high-speed data transmission and the expansion of smart devices, particularly with the rollout of 5G networks.