Region:Global

Author(s):Dev

Product Code:KRAD0407

Pages:90

Published On:August 2025

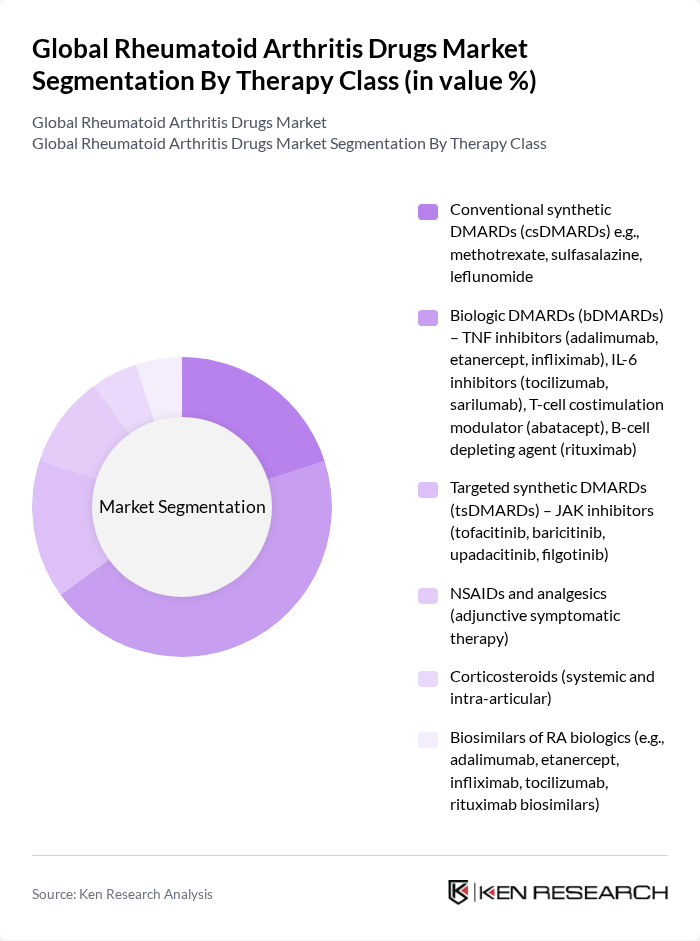

By Therapy Class:The therapy class segmentation includes various treatment options for rheumatoid arthritis, which are crucial for managing the disease effectively. The subsegments include Conventional synthetic DMARDs (csDMARDs), Biologic DMARDs (bDMARDs), Targeted synthetic DMARDs (tsDMARDs), NSAIDs and analgesics, Corticosteroids, and Biosimilars of RA biologics. Among these, biologic DMARDs have gained significant traction due to their targeted action and effectiveness in treating moderate to severe cases of rheumatoid arthritis. The increasing adoption of these therapies is driven by their ability to improve patient outcomes and quality of life.

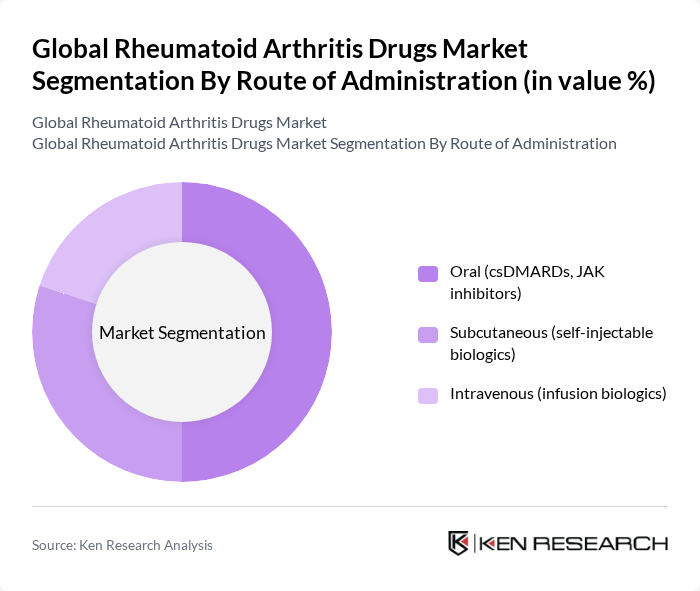

By Route of Administration:The route of administration for rheumatoid arthritis drugs is critical in determining patient compliance and treatment effectiveness. This segmentation includes Oral (csDMARDs, JAK inhibitors), Subcutaneous (self-injectable biologics), and Intravenous (infusion biologics). Oral administration remains the most preferred route due to its convenience and ease of use, particularly for patients who may be hesitant about injections. However, subcutaneous and intravenous routes are gaining popularity for biologics, as they often provide faster relief and are suitable for patients with more severe conditions.

The Global Rheumatoid Arthritis Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as AbbVie Inc., Amgen Inc., Johnson & Johnson (Janssen/Johnson & Johnson Innovative Medicine), Pfizer Inc., F. Hoffmann-La Roche Ltd, Novartis AG, Sanofi S.A., Merck & Co., Inc. (MSD), GSK plc, Eli Lilly and Company, Bristol Myers Squibb Company, Takeda Pharmaceutical Company Limited, Biogen Inc., UCB S.A., Astellas Pharma Inc., Galapagos NV, Organon & Co., Samsung Bioepis Co., Ltd., Celltrion Healthcare Co., Ltd., Sandoz Group AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the rheumatoid arthritis drug market appears promising, driven by ongoing advancements in biologics and personalized medicine. As the healthcare landscape evolves, there is a growing emphasis on patient-centric care, which is expected to enhance treatment adherence and outcomes. Additionally, the integration of digital health technologies will facilitate remote monitoring and management of RA, improving patient engagement and access to therapies. These trends indicate a dynamic market poised for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Therapy Class | Conventional synthetic DMARDs (csDMARDs) e.g., methotrexate, sulfasalazine, leflunomide Biologic DMARDs (bDMARDs) – TNF inhibitors (adalimumab, etanercept, infliximab), IL-6 inhibitors (tocilizumab, sarilumab), T-cell costimulation modulator (abatacept), B-cell depleting agent (rituximab) Targeted synthetic DMARDs (tsDMARDs) – JAK inhibitors (tofacitinib, baricitinib, upadacitinib, filgotinib) NSAIDs and analgesics (adjunctive symptomatic therapy) Corticosteroids (systemic and intra-articular) Biosimilars of RA biologics (e.g., adalimumab, etanercept, infliximab, tocilizumab, rituximab biosimilars) |

| By Route of Administration | Oral (csDMARDs, JAK inhibitors) Subcutaneous (self-injectable biologics) Intravenous (infusion biologics) |

| By Patient Profile | Treatment-naïve Inadequate responders to csDMARDs Inadequate responders to biologics/tsDMARDs |

| By Distribution Channel | Hospital/Infusion Center Pharmacies Retail Pharmacies Online/Specialty Pharmacies |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Treatment Line | First-line (csDMARD-led) Second-line (add/switch to bDMARD/tsDMARD) Third-line and refractory (multi-biologic/tsDMARD cycling) |

| By Payer Type | Public reimbursement Private/commercial insurance Out-of-pocket/self-pay |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Rheumatology Clinics | 140 | Rheumatologists, Nurse Practitioners |

| Patient Support Groups | 110 | Patients, Caregivers |

| Pharmaceutical Sales Representatives | 80 | Sales Managers, Product Specialists |

| Healthcare Payers | 70 | Insurance Analysts, Policy Makers |

| Clinical Research Organizations | 60 | Clinical Researchers, Trial Coordinators |

The Global Rheumatoid Arthritis Drugs Market is valued at approximately USD 60 billion, driven by the increasing prevalence of rheumatoid arthritis, advancements in drug development, and a growing aging population, alongside rising healthcare expenditures and improved access to treatments.