Region:Global

Author(s):Geetanshi

Product Code:KRAB0136

Pages:95

Published On:August 2025

By Type:The market is segmented into various types of end effectors, including Grippers, Suction Cups, Magnetic End Effectors, Welding Torches, Tool Changers, Force/Torque Sensors, and Others. Grippers are the most widely used, owing to their versatility and ability to handle a broad range of objects in applications such as material handling, assembly, and packaging. The demand for Grippers is driven by their essential role in automation processes across industries, particularly in manufacturing, logistics, and e-commerce fulfillment.

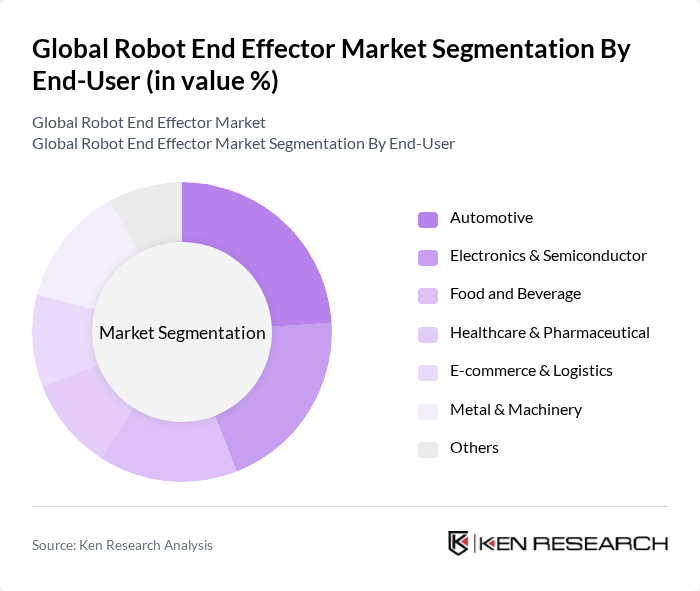

By End-User:The end-user segmentation includes Automotive, Electronics & Semiconductor, Food and Beverage, Healthcare & Pharmaceutical, E-commerce & Logistics, Metal & Machinery, and Others. The Automotive sector remains the leading end-user of robot end effectors, driven by the industry's push for automation to enhance production efficiency, quality, and flexibility. The electronics and semiconductor industries also show strong adoption, leveraging end effectors for precise assembly and handling of delicate components. Food and beverage, healthcare, and logistics sectors are rapidly increasing their use of robotic end effectors to improve throughput and ensure hygiene and safety standards.

The Global Robot End Effector Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, Universal Robots A/S, Schunk GmbH & Co. KG, Applied Robotics, Inc., Zimmer Group, Robot System Products AB, Piab AB, SMC Corporation, Denso Corporation, Mitsubishi Electric Corporation, Omron Corporation, AUBO Robotics, DESTACO (Dover Corporation), Robotiq Inc., OnRobot A/S, Festo SE & Co. KG, ATI Industrial Automation (Novanta Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the robot end effector market appears promising, driven by technological advancements and increasing automation across various sectors. As industries continue to embrace AI and IoT integration, the demand for sophisticated end effectors will rise. Furthermore, the shift towards sustainable practices will encourage the development of eco-friendly robotic solutions, enhancing market growth. Companies that adapt to these trends will likely gain a competitive edge in the evolving landscape of robotics.

| Segment | Sub-Segments |

|---|---|

| By Type | Grippers Suction Cups Magnetic End Effectors Welding Torches Tool Changers Force/Torque Sensors Others |

| By End-User | Automotive Electronics & Semiconductor Food and Beverage Healthcare & Pharmaceutical E-commerce & Logistics Metal & Machinery Others |

| By Application | Material Handling Assembly Packaging Welding Painting & Coating Quality Control & Inspection Others |

| By Component | Sensors Actuators Controllers Power Supply Mechanical Interface Others |

| By Sales Channel | Direct Sales Distributors Online Sales System Integrators Others |

| By Distribution Mode | Offline Distribution Online Distribution Hybrid Distribution |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Automation | 100 | Production Managers, Automation Engineers |

| Healthcare Robotics | 60 | Healthcare Administrators, Robotics Specialists |

| Logistics and Warehousing | 80 | Warehouse Managers, Supply Chain Analysts |

| Agricultural Robotics | 40 | Agronomists, Farm Equipment Managers |

| Consumer Electronics Assembly | 50 | Quality Control Managers, Production Supervisors |

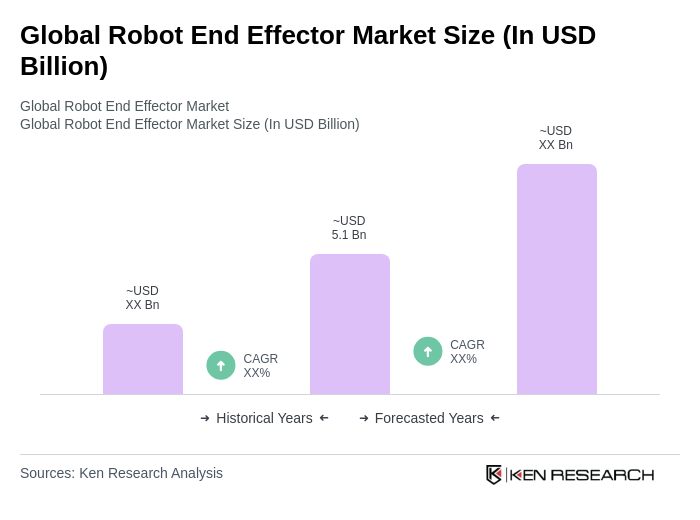

The Global Robot End Effector Market is valued at approximately USD 5.1 billion, reflecting significant growth driven by increased automation in various sectors, including manufacturing, logistics, and healthcare.