Region:Global

Author(s):Dev

Product Code:KRAD0364

Pages:97

Published On:August 2025

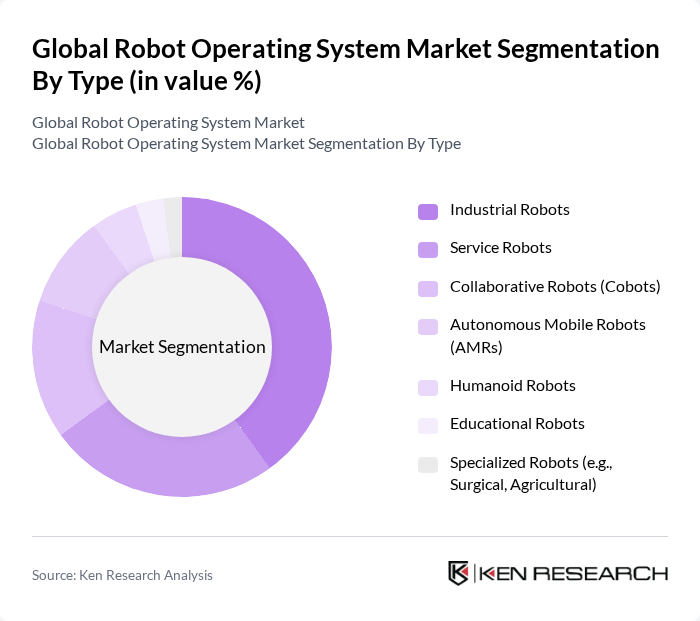

By Type:The market is segmented into various types of robots, including Industrial Robots, Service Robots, Collaborative Robots (Cobots), Autonomous Mobile Robots (AMRs), Humanoid Robots, Educational Robots, and Specialized Robots (e.g., Surgical, Agricultural). Among these, Industrial Robots hold the largest share due to their extensive use in manufacturing and assembly lines, driven by the need for automation, precision, and efficiency. Service Robots are gaining traction in healthcare, hospitality, and logistics, enhancing service delivery and operational efficiency. Collaborative Robots (Cobots) are increasingly adopted for safe human-robot interaction in shared workspaces, while Autonomous Mobile Robots (AMRs) are expanding in logistics and warehousing for material handling and inventory management. Specialized robots, including surgical and agricultural robots, are witnessing rising demand due to advancements in application-specific automation.

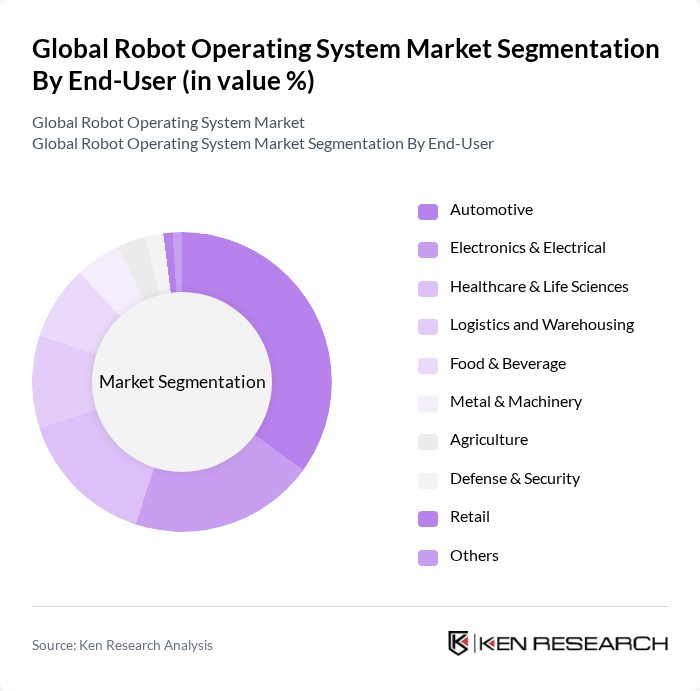

By End-User:The end-user segmentation includes Automotive, Electronics & Electrical, Healthcare & Life Sciences, Logistics and Warehousing, Food & Beverage, Metal & Machinery, Agriculture, Defense & Security, Retail, and Others. The Automotive sector leads adoption, driven by increasing automation in manufacturing and assembly processes. Electronics & Electrical and Healthcare & Life Sciences sectors are witnessing significant growth due to the rising demand for precision manufacturing, robotic surgeries, and patient care solutions. Logistics and Warehousing are rapidly adopting ROS-based robots for inventory management and material handling. Food & Beverage, Metal & Machinery, and Agriculture sectors are also integrating robotics to enhance productivity, safety, and operational efficiency.

The Global Robot Operating System Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Universal Robots A/S, Boston Dynamics, Inc., iRobot Corporation, Intuitive Surgical, Inc., Omron Corporation, Denso Corporation, Mitsubishi Electric Corporation, Epson Robots (Seiko Epson Corporation), Clearpath Robotics, Inc., Rethink Robotics GmbH, Fetch Robotics, Inc., Open Robotics (formerly OSRF), Staubli Robotics, Techman Robot Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the robot operating system market appears promising, driven by technological advancements and increasing automation across industries. As companies prioritize efficiency and cost reduction, the integration of IoT with robotics is expected to enhance operational capabilities. Furthermore, the shift towards open-source platforms will foster innovation, allowing for greater collaboration and customization in robotic applications, ultimately leading to more widespread adoption and improved functionalities in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Robots Service Robots Collaborative Robots (Cobots) Autonomous Mobile Robots (AMRs) Humanoid Robots Educational Robots Specialized Robots (e.g., Surgical, Agricultural) |

| By End-User | Automotive Electronics & Electrical Healthcare & Life Sciences Logistics and Warehousing Food & Beverage Metal & Machinery Agriculture Defense & Security Retail Others |

| By Application | Material Handling Assembly and Packaging Inspection and Quality Control Mapping and Navigation Cleaning and Maintenance Surgery and Rehabilitation Inventory & Warehouse Management Home Automation and Safety Others |

| By Component | Hardware Software Services |

| By Distribution Channel | Direct Sales Online Sales Distributors and Resellers |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Price Range | Low-End Robots Mid-Range Robots High-End Robots |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Robotics in Manufacturing | 150 | Manufacturing Engineers, Production Managers |

| Service Robots in Healthcare | 100 | Healthcare Administrators, Robotics Technicians |

| Logistics Automation Solutions | 80 | Logistics Coordinators, Supply Chain Analysts |

| Collaborative Robots in SMEs | 70 | Small Business Owners, Operations Managers |

| Robotics Research and Development | 40 | R&D Managers, Robotics Researchers |

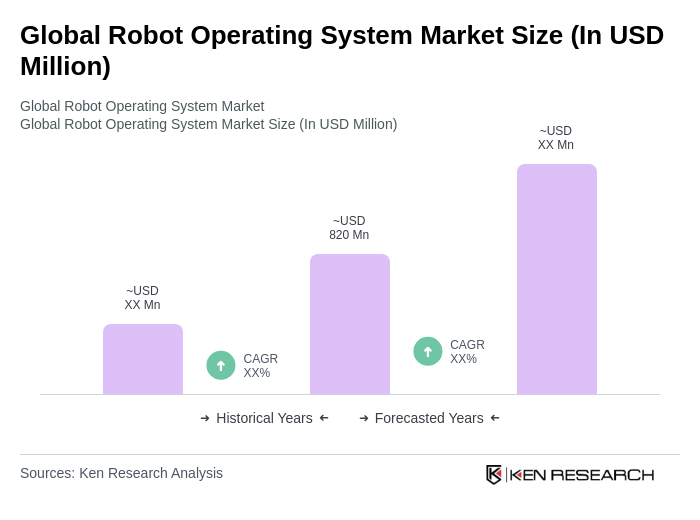

The Global Robot Operating System Market is valued at approximately USD 820 million, reflecting significant growth driven by advancements in automation technologies and increasing demand for robotics across various sectors, including manufacturing and healthcare.