Region:Global

Author(s):Dev

Product Code:KRAD0555

Pages:81

Published On:August 2025

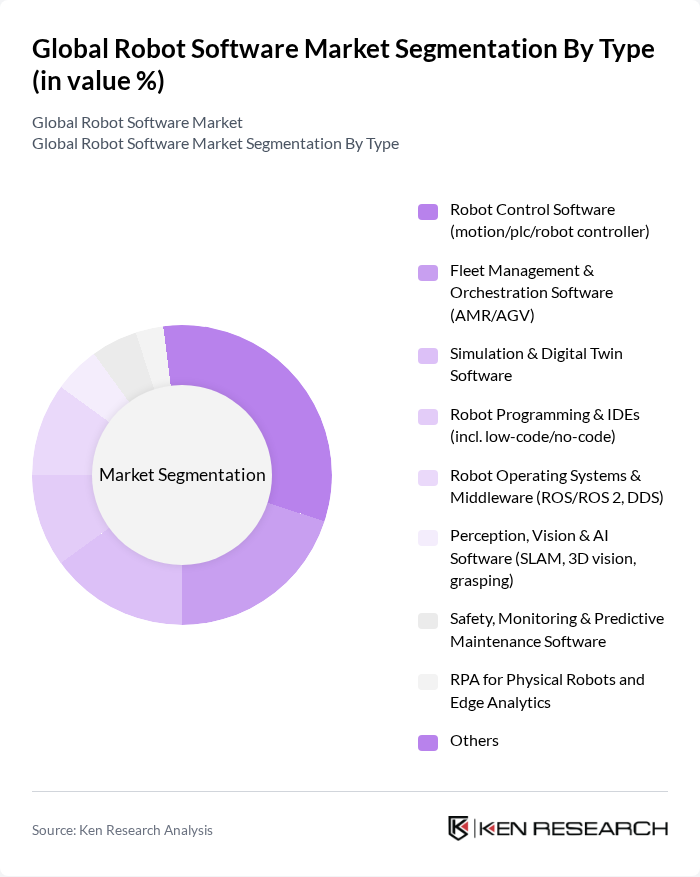

By Type:The market is segmented into various types of robot software, including Robot Control Software, Fleet Management & Orchestration Software, Simulation & Digital Twin Software, Robot Programming & IDEs, Robot Operating Systems & Middleware, Perception, Vision & AI Software, Safety, Monitoring & Predictive Maintenance Software, RPA for Physical Robots and Edge Analytics, and Others. Among these, Robot Control Software is currently the leading subsegment due to its critical role in the operation and management of robotic systems. The increasing complexity of robotic tasks and the need for precise control mechanisms have driven demand for advanced control software solutions.

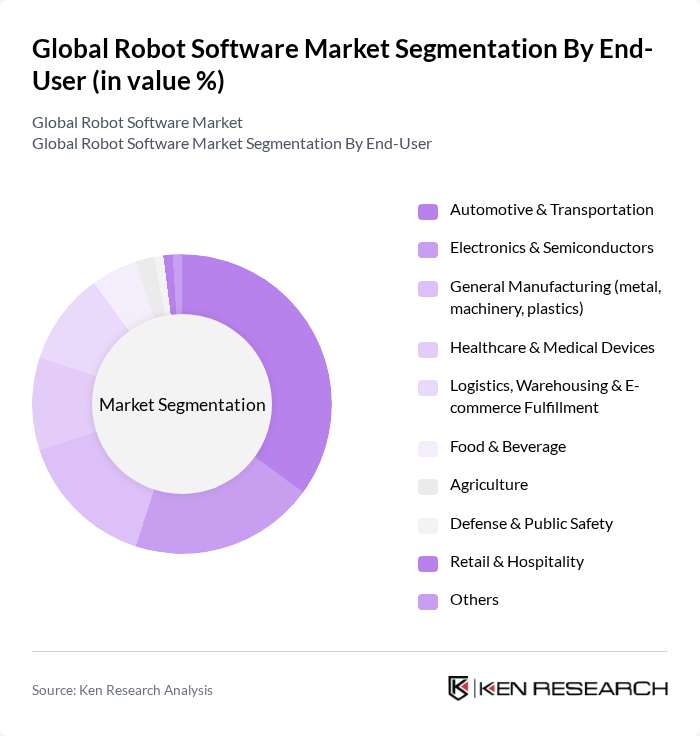

By End-User:The end-user segmentation includes Automotive & Transportation, Electronics & Semiconductors, General Manufacturing, Healthcare & Medical Devices, Logistics, Warehousing & E-commerce Fulfillment, Food & Beverage, Agriculture, Defense & Public Safety, Retail & Hospitality, and Others. The Automotive & Transportation sector is the dominant end-user, driven by the increasing adoption of automation in manufacturing processes and the need for enhanced operational efficiency. The demand for autonomous vehicles and smart manufacturing solutions has further propelled growth in this segment.

The Global Robot Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Siemens AG, Mitsubishi Electric Corporation, Universal Robots A/S (Teradyne), Intuitive Surgical, Inc., UiPath Inc., NVIDIA Corporation, Cognex Corporation, OMRON Corporation, Rockwell Automation, Inc., DENSO Corporation, Clearpath Robotics Inc. (OTTO Motors by Rockwell), Robot Operating System (ROS) by Open Robotics (Intrinsic), Intrinsic (Alphabet), Zebra Technologies (Fetch Robotics), Seegrid Corporation, Brain Corp, Locus Robotics, Mobile Industrial Robots A/S (MiR, Teradyne), Boston Dynamics AI Institute, SoftBank Robotics Group Corp., BlueBotics SA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the robot software market is poised for significant transformation, driven by technological advancements and evolving industry needs. As companies increasingly adopt cloud-based solutions, the integration of IoT with robotics will enhance operational capabilities. Furthermore, the focus on sustainable practices will lead to the development of eco-friendly robotic solutions. These trends indicate a robust growth trajectory, with businesses prioritizing efficiency and innovation in their robotic investments, ultimately reshaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Robot Control Software (motion/plc/robot controller) Fleet Management & Orchestration Software (AMR/AGV) Simulation & Digital Twin Software Robot Programming & IDEs (incl. low-code/no-code) Robot Operating Systems & Middleware (ROS/ROS 2, DDS) Perception, Vision & AI Software (SLAM, 3D vision, grasping) Safety, Monitoring & Predictive Maintenance Software RPA for Physical Robots and Edge Analytics Others |

| By End-User | Automotive & Transportation Electronics & Semiconductors General Manufacturing (metal, machinery, plastics) Healthcare & Medical Devices Logistics, Warehousing & E?commerce Fulfillment Food & Beverage Agriculture Defense & Public Safety Retail & Hospitality Others |

| By Application | Pick & Place, Palletizing/Depalletizing Welding, Cutting & Machining Assembly, Screwdriving & Dispensing Material Handling & Intralogistics (AMR/AGV routing) Inspection, Vision-Guided QA & Metrology Packaging & End-of-Line Automation Cleaning, Disinfection & Facilities Services Surgical & Rehabilitation Robotics Field Robotics (construction, mining, energy) Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based (SaaS/RaaS) One-Time License/Perpetual Usage-Based/Pay-Per-Use Enterprise Agreements & Bundled With Hardware |

| By Support Services | Technical Support Maintenance Services Training & Certification Services Consulting, Integration & Customization Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Robotics Software | 120 | Production Managers, Automation Engineers |

| Healthcare Robotics Solutions | 90 | Healthcare IT Directors, Robotic Surgeons |

| Logistics and Supply Chain Automation | 110 | Logistics Coordinators, Supply Chain Analysts |

| Consumer Robotics Applications | 70 | Product Managers, Marketing Directors |

| Robotics Software Development | 80 | Software Developers, Technical Project Managers |

The Global Robot Software Market is valued at approximately USD 11.1 billion, reflecting significant growth driven by advancements in artificial intelligence and increasing automation across various industries, particularly in manufacturing, healthcare, and logistics.