Region:Global

Author(s):Dev

Product Code:KRAA1638

Pages:81

Published On:August 2025

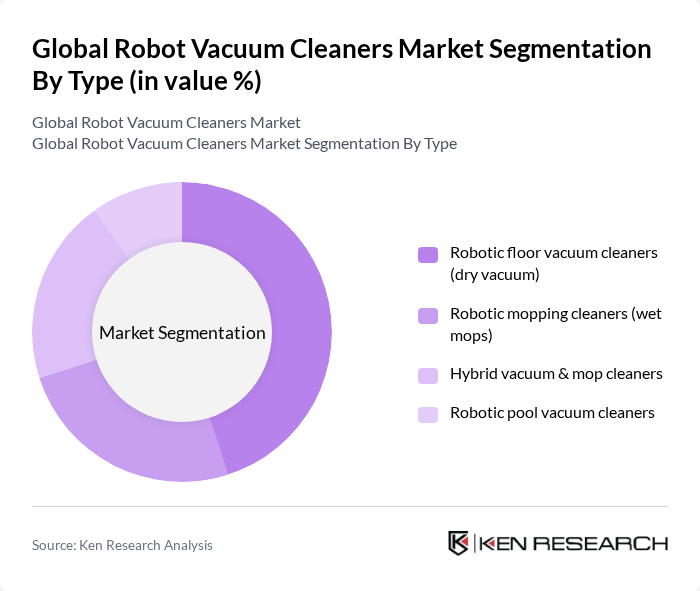

By Type:The market is segmented into robotic floor vacuum cleaners, robotic mopping cleaners, hybrid vacuum & mop cleaners, and robotic pool vacuum cleaners. Robotic floor vacuum cleaners remain the most widely adopted for residential use, supported by improvements in suction performance (Pa ratings), HEPA?grade filtration, auto?empty docks, and AI/SLAM?based navigation with LiDAR in many new models; hybrid vacuum?mop formats are growing rapidly as multi?function cleaning becomes a mainstream consumer preference .

The robotic floor vacuum cleaners segment dominates due to broad residential adoption, strong integration with smart assistants, and autonomous operation features such as room mapping and obstacle avoidance; LiDAR and AI mapping are increasingly common in new models, reinforcing performance and ease of use .

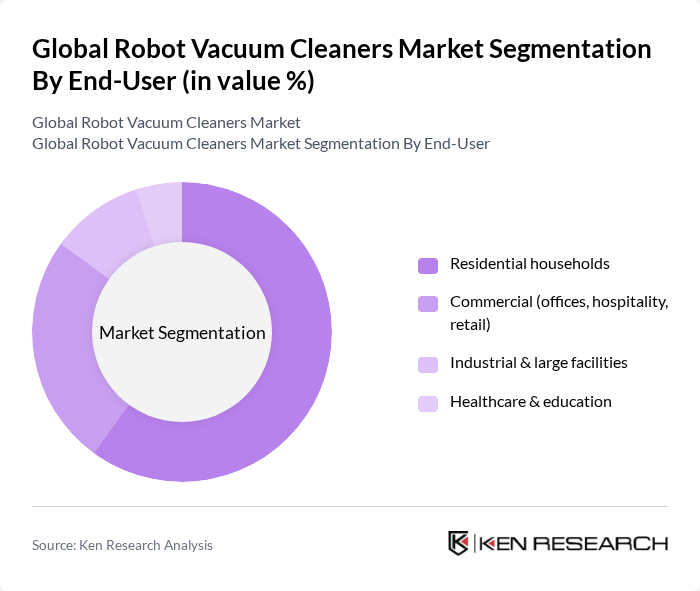

By End-User:The market is segmented into residential households, commercial establishments (offices, hospitality, retail), industrial & large facilities, and healthcare & education. Residential remains the largest end?user, while commercial use is expanding for after?hours cleaning and facility maintenance as autonomous navigation improves .

Residential households represent the largest end?user segment, propelled by smart home adoption, dual?income lifestyles, and feature advances such as auto?empty bases, object recognition, and app/voice control; consumer robots constitute a major share of global service robot sales by units, underpinning residential demand for robotic vacuums .

The Global Robot Vacuum Cleaners Market includes regional and international players. Leading participants such as iRobot Corporation, Ecovacs Robotics Co., Ltd., Roborock Technology Co., Ltd., Xiaomi Corporation (Mi Home/Smartmi/viomi ecosystem), SharkNinja, Inc., Samsung Electronics Co., Ltd., LG Electronics Inc., Anker Innovations (Eufy), Dyson Ltd., Panasonic Corporation, Cecotec Innovaciones S.L. (Conga), Midea Group (Midea/Proscenic), ILIFE Innovation Ltd., Dreame Technology, Neato Robotics (a Vorwerk brand) continue to drive innovation, AI/LiDAR navigation, auto?empty docking, and connected app ecosystems across price tiers .

The future of the robot vacuum cleaner market appears promising, driven by technological advancements and increasing consumer interest in smart home integration. As manufacturers focus on enhancing battery life and performance, the market is likely to see a rise in user satisfaction. Additionally, the trend towards eco-friendly products will encourage innovation in energy-efficient designs, aligning with consumer preferences for sustainability. Overall, the market is poised for significant growth as these trends continue to evolve.

| Segment | Sub-Segments |

|---|---|

| By Type | Robotic floor vacuum cleaners (dry vacuum) Robotic mopping cleaners (wet mops) Hybrid vacuum & mop cleaners Robotic pool vacuum cleaners |

| By End-User | Residential households Commercial (offices, hospitality, retail) Industrial & large facilities Healthcare & education |

| By Distribution Channel | Online retail (brand D2C, marketplaces) Offline retail (electronics/appliance stores) Specialty distributors & B2B channels OEM/white-label sales |

| By Price Range | Entry-level (? US$250) Mid-range (US$251–600) Premium (US$601–1,000) Ultra-premium (? US$1,001) |

| By Brand Positioning | Global established brands Challenger/emerging brands Retailer private labels |

| By Features/Technology | Smart connectivity (Wi?Fi/app, voice assistants) Self-emptying/self-washing docks Advanced navigation (LiDAR/visual SLAM) Pet hair & HEPA/allergen filtration |

| By Battery & Performance | Runtime ? 100 minutes Runtime 101–180 minutes Runtime ? 181 minutes Suction power tiers (Pa-based) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Robot Vacuums | 140 | Homeowners, Renters |

| Retailer Feedback on Sales Trends | 90 | Store Managers, Sales Associates |

| Expert Opinions on Technology Adoption | 80 | Industry Analysts, Technology Consultants |

| Market Trends in Home Automation | 70 | Product Managers, Marketing Managers |

| Consumer Preferences and Buying Behavior | 120 | Tech Enthusiasts, Early Adopters |

The Global Robot Vacuum Cleaners Market is valued at approximately USD 4.6 billion, reflecting a significant share of consumer robotics revenues, particularly in residential applications, driven by the increasing adoption of smart home devices and advanced cleaning technologies.