Region:Global

Author(s):Rebecca

Product Code:KRAA1383

Pages:84

Published On:August 2025

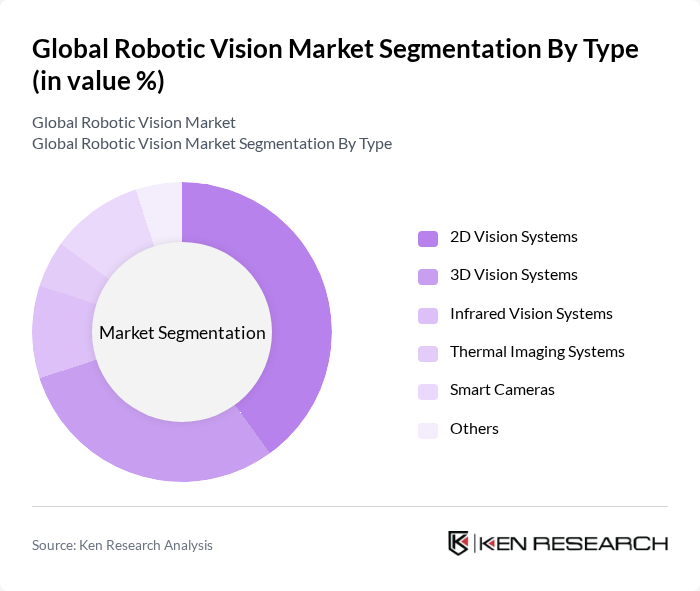

By Type:The robotic vision market is segmented into various types, including 2D Vision Systems, 3D Vision Systems, Infrared Vision Systems, Thermal Imaging Systems, Smart Cameras, and Others. Among these, 2D Vision Systems currently hold the largest share due to their widespread application in quality control and inspection processes across industries. The simplicity and cost-effectiveness of 2D systems make them a preferred choice for many manufacturers. However, 3D Vision Systems are rapidly gaining traction as they offer enhanced accuracy and depth perception, making them suitable for more complex applications such as bin picking and object orientation analysis in automotive and pharmaceuticals .

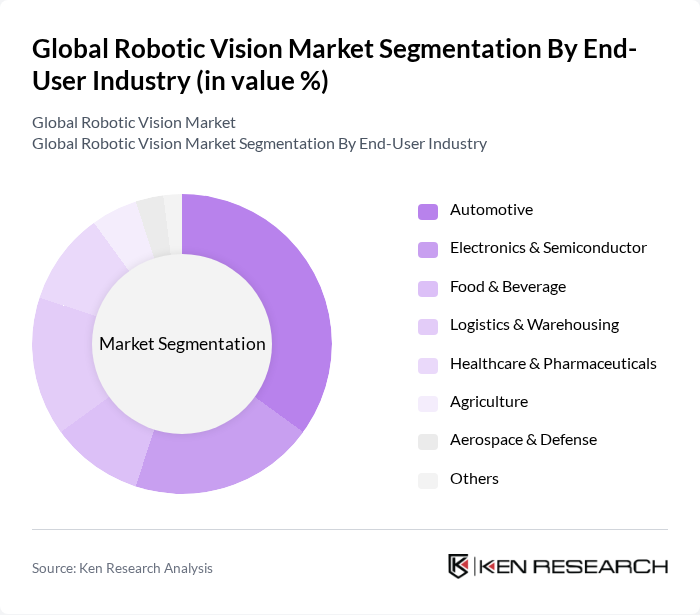

By End-User Industry:The end-user industries for robotic vision systems include Automotive, Electronics & Semiconductor, Food & Beverage, Logistics & Warehousing, Healthcare & Pharmaceuticals, Agriculture, Aerospace & Defense, and Others. The automotive industry remains the largest consumer of robotic vision systems, driven by the need for precision in manufacturing, welding, assembly, inspection, and quality assurance. The increasing adoption of automation in logistics and warehousing is also propelling demand, as companies seek to enhance operational efficiency and reduce labor costs. Electronics and semiconductor manufacturing also represent a significant segment due to the need for high-speed, high-precision inspection .

The Global Robotic Vision Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cognex Corporation, Omron Corporation, Basler AG, Teledyne Technologies Incorporated, Keyence Corporation, FLIR Systems, Inc., SICK AG, Intel Corporation, NVIDIA Corporation, ABB Ltd., Fanuc Corporation, Yaskawa Electric Corporation, Mitsubishi Electric Corporation, Universal Robots A/S, Denso Corporation, Epson Robotics (Seiko Epson Corporation), ISRA VISION AG, KUKA AG, Zebra Technologies Corporation, Allied Vision Technologies GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the robotic vision market appears promising, driven by continuous technological advancements and increasing automation across various sectors. As industries increasingly adopt smart manufacturing practices, the demand for sophisticated vision systems is expected to rise. Furthermore, the integration of AI and IoT technologies will enhance the capabilities of robotic vision systems, making them more efficient and versatile. This evolution will likely lead to broader applications, particularly in sectors like healthcare and logistics, where precision and reliability are critical.

| Segment | Sub-Segments |

|---|---|

| By Type | D Vision Systems D Vision Systems Infrared Vision Systems Thermal Imaging Systems Smart Cameras Others |

| By End-User Industry | Automotive Electronics & Semiconductor Food & Beverage Logistics & Warehousing Healthcare & Pharmaceuticals Agriculture Aerospace & Defense Others |

| By Application | Quality Control & Inspection Object Detection & Recognition Navigation & Guidance Pick & Place Operations Surveillance & Security Packaging & Sorting Others |

| By Component | Cameras & Sensors Processors & Controllers Software & Algorithms Lighting & Optics Others |

| By Sales Channel | Direct Sales Distributors Online Sales System Integrators Others |

| By Distribution Mode | Offline Distribution Online Distribution Hybrid Distribution |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Region | North America Europe Asia Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Automation | 100 | Production Managers, Automation Engineers |

| Healthcare Imaging Systems | 60 | Medical Device Engineers, Radiology Managers |

| Logistics and Warehousing | 80 | Warehouse Managers, Supply Chain Analysts |

| Research and Development | 40 | R&D Directors, Robotics Researchers |

| Consumer Electronics Integration | 50 | Product Managers, Technology Developers |

The Global Robotic Vision Market is valued at approximately USD 2.9 billion, driven by advancements in artificial intelligence and machine learning, as well as the increasing demand for automation across various industries such as manufacturing, automotive, and logistics.